Further, Oklahoma’s “mild winter has produced wheat that looks to be in great condition” (Crop Progress – State Stories).

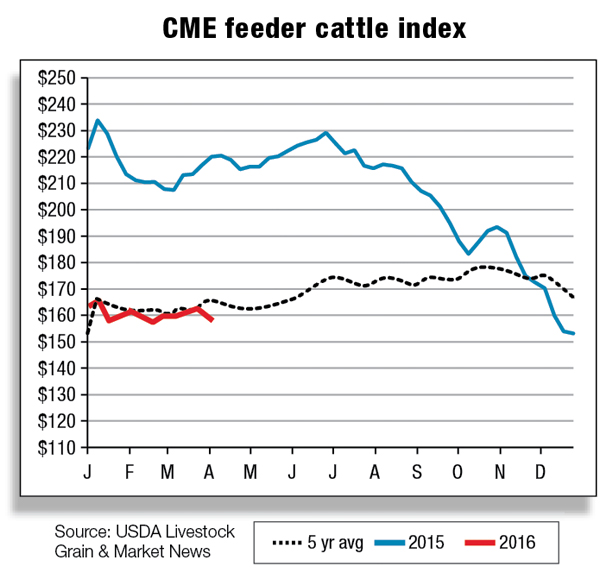

Recent auction receipts indicate year-over-year larger feeder cattle sale runs in many areas which, in the Southern Plains, could indicate that feeder cattle are coming off wheat pasture in significant numbers.

However, given that feeder cattle supplies outside feedlots on Jan. 1 were 5 percent higher year-over-year and forage supplies in much of the country were adequate for overwintering cattle, these large runs could reflect sales of more than just wheat cattle.

At any rate, the heavy end of these feeder cattle have to be moved off wheat relatively soon, having little potential for further economically efficient weight gains on pasture; this could boost year-over-year cattle-on-feed inventories over the near term, exerting downward pressure on feeder cattle prices.

The current mid-$150s prices for 750- to 800-pound feeder steers – down significantly year-over-year and from last fall, when many of these cattle were placed on wheat pasture at 500 to 600 pounds – combined with current feed prices, imply breakevens near or below current fed-cattle prices, with some profit potential for cattle feeders over the next several months.

Recent year-over-year lower net placements of cattle on feed may reflect that stocker operators were able to keep cattle on pasture longer and that cattle feeders dealt with very volatile prices and a disappointing fed-cattle market by feeding cattle longer and to heavier weights.

In addition to lush pastures and adequate supplies of hay, which have allowed stockers to continue gaining weight on pasture, first-quarter 2016 fed-steer and heifer weights continue to be heavier year-over-year and are likely to continue above 2015 levels for the next few months.

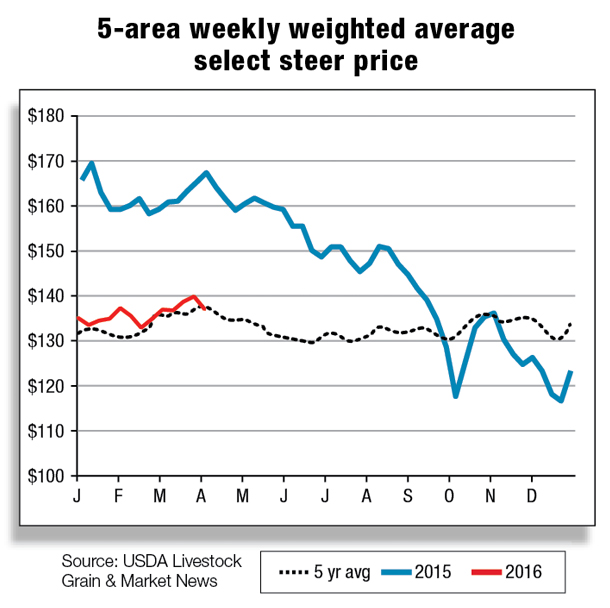

For the week ending March 6, 5-area all-grade fed steers were $135.53 per hundredweight (cwt), roughly $25 lower than year-earlier fed-steer prices (5 area weekly weighted average direct slaughter cattle). For first-quarter 2016, the 5-area direct total all grades steer prices are projected to be $131 to $135 per cwt, down about $29 compared with first-quarter 2015.

Packer resistance and herd expansion reduce slaughter

Cumulative weekly federally inspected cow slaughter and estimated monthly commercial cow slaughter through February appear close to 2015 levels, with dairy cow slaughter slightly ahead of year-earlier slaughter and beef cow slaughter about even with a year earlier.

The share of Jan. 1 beef cow inventories represented by current cow slaughter levels implies ongoing expansion, based on year-over-year larger cow herds, implying a slower rate of cow slaughter.

Combined with year-over-year larger Jan. 1 inventories of heifers expected to calve in 2016, the U.S. beef cow herd could have another year of expansion during 2016.

With more heifers expected to calve during the year and because retained heifers are generally not placed on feed, inventories of heifers available for placement on feed will likely be relatively lower than they would be in the absence of expansionary activities.

Although the relative paucity of heifers available for cattle feeding this year may dampen the expansion of inventories of cattle on feed over the next several months, on-feed inventories are expected to increase later in the year.

In addition to the higher number of cattle outside feedlots, the length of time cattle are kept on feed before being marketed is a factor in determining feedlot inventories. This has led to higher inventories of cattle on feed during much of the last year, despite lower year-over-year net placements of cattle on feed.

Thus far, since November 2014, cattle on feed numbers have been relatively inflated, in part because cattle were kept on feed for longer periods. The inflation occurred even as cattle continued to be placed on feed at lower year-over-year rates, which resulted in the large inventories of overfinished, extremely large cattle in much of 2015.

Keeping cattle on feed for longer periods has been a rational decision up to this point because of relatively inexpensive feed, high prices for feeder cattle to replace marketed fed cattle and inconsequential discounts for large carcasses or excess fat.

To some extent, the backlog of overfinished cattle has been reduced, aided somewhat by the impact of cold winter weather on weight gains and the greatly reduced calf crops of recent years (a result of ongoing drought and resulting reductions in U.S. cow inventories).

Cattle slaughter continues at somewhat reduced levels, implying that packers are reluctant to pay recent asking prices for fed cattle in the upper $130s to $140s. Packer margins typically are weak in the winter before beef demand moves seasonally higher ahead of “grilling season.”

Beef complex at a standstill

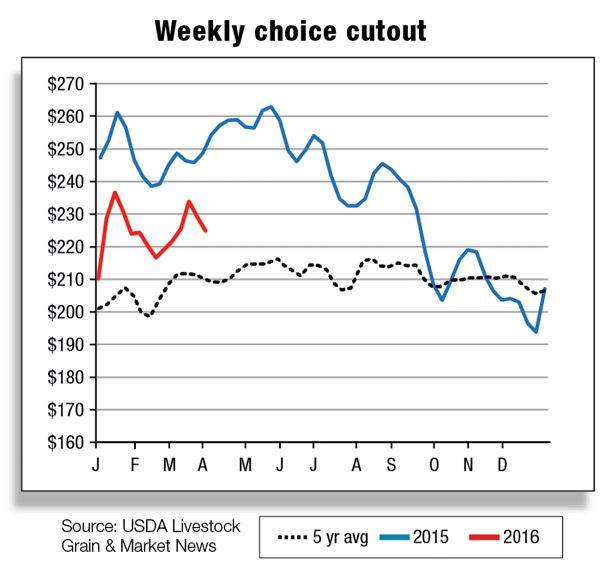

Wholesale boxed beef prices have moved lower since the beginning of the year and, in the first week of March, choice-grade boxes were $7.02 per cwt lower than the first week of January, while select boxes were $7.56 per cwt lower. Typically, there is a slight rebound in prices during February, but this year’s price movements have been small. Wholesale prices are likely under pressure from large supplies of beef and competition from large supplies of other meats.

On the retail side, choice beef prices have fallen, but it appears beef products are continuing to experience some resistance from consumers, especially in demand for ground beef products. Beef prices remain relatively high compared with competing meats, creating a bit of a conundrum for retailers in determining feature selections.

With beef processing margins being squeezed between firm asking prices for live cattle and limited upside movement in wholesale beef prices, packers have opted to reduce weekly kill schedules – a strategy that supported higher cutout values while alleviating margin pressures due to high cattle prices in 2015.

Live cattle trade forecast lower in 2016

Cattle inventory data released by StatsCanada depict a scenario of tight slaughter supplies in Canada this year. As of Jan. 1, the number of Canadian beef cows were reported lower, as was the number of heifers available for slaughter.

The survey also showed the number of steers (1 year and greater) on operations as of Jan. 1 slightly lower. Further supportive of the notion that Canadian supplies of live cattle crossing the border will be limited in 2016 is the weekly AMS Canadian Live Animal Imports report that shows live imports down 35 percent year-to-date as of the week ending Feb. 20, 2016.

With regard to Mexico, the steep decline in U.S. cattle prices relative to prices in the first half of 2015, coupled with tight domestic supplies in Mexico, has created a disincentive for producers to ship feeder cattle to the U.S. According to AMS data (Mexico to U.S. Imports), feeder cattle imports from Mexico are down 19 percent year-to-date.

Total U.S. cattle imports are expected to decline further in 2016 due to smaller exportable supplies of cattle in Mexico and Canada, and the current 2016 forecast has been lowered an additional 75,000 head to 1.825 million head.

Beef exports higher in January, imports decline

U.S. beef exports were reported around 174.8 million pounds in January, 7 percent higher than January 2015. U.S. beef prices have declined significantly since reaching very high levels in 2015, and this will be a supportive factor for exports this year.

In addition, expectations of higher U.S. domestic beef production should increase interest in U.S. beef exports, especially since Australian beef production and export shipments are expected to be constrained by smaller supplies and reduced slaughter. The 2016 export forecast remains unchanged at 2.48 billion pounds.

U.S. beef imports declined approximately 3 percent year-over-year in January. Imports from Australia fell by the largest volume, down 12 percent in January. Annual U.S. beef imports from Australia skyrocketed 16 percent in 2015 as a result of strong demand for lean processing beef.

Prolonged drought in Australia led to significant increases in slaughter last year, but weather conditions have improved and cattle slaughter rates have decreased relative to the pace of slaughter in 2015. This could be an indication that herd rebuilding is taking place, limiting the amount of beef available for export in 2016.

The forecast for U.S. beef imports in 2016 is 2.85 billion pounds, 16 percent lower than in 2015. Imports are expected to decline due to increased U.S. domestic beef production and decreased demand for lean processing beef. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.