At present, the Southern Oscillation phenomenon that generates La Niña and El Niño effects is in a neutral state. However, some weather models are predicting an El Niño event, which could bring some drought relief to California and the Southwest beginning in the fall of 2014.

Weekly federally inspected cow slaughter appears to be declining rapidly after remaining high relative to Jan. 1 inventories for many months.

While also a seasonal pattern, the decline is likely exacerbated by both low cow inventories and the desire to maintain or increase cow inventories. In response, weekly cow prices have moved sharply higher since the beginning of 2014.

The most recent cattle on feed report showed placements of feeder cattle in 1,000-plus-head feedlots much higher than analysts expected.

January saw the largest share of 800-plus-pound placements during any January since the series began in December 1995.

Despite the large share of heavy placements, a calculated “average” placement weight was only slightly larger than other recent January placement weights.

The Jan. 1, 2014 inventory of heifers on feed in 1,000-plus-head feedlots constituted the third-smallest proportion of total Jan. 1 heifers on feed since the series began in December 1995.

This is likely an indirect result of low total cattle inventories and a direct result of the effect that retention of heifers for breeding and adding to the cow inventory has on placements in feedlots.

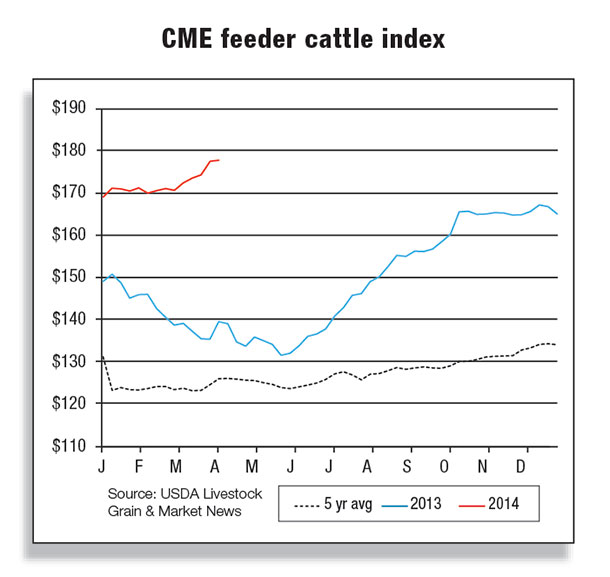

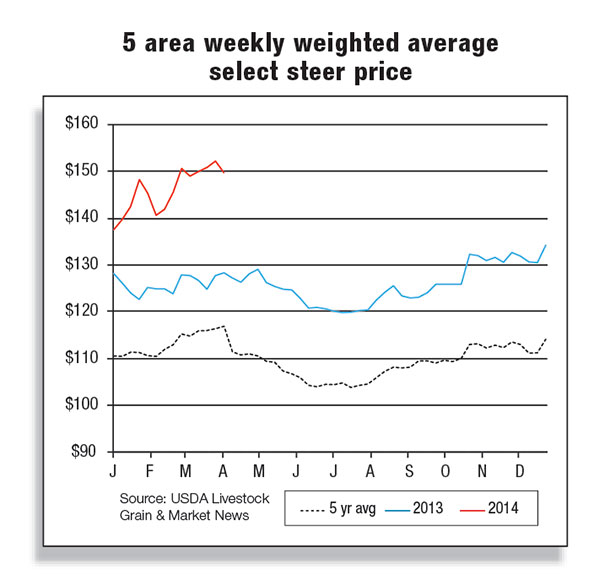

While feeder cattle prices have increased at a relatively modest rate, recent fed cattle prices have proven extremely volatile.

Indications are that meat packers are again deep into negative profit margins and could begin to reduce slaughter, although that strategy may be only partially effective in the current environment of limited supplies of market-ready fed cattle.

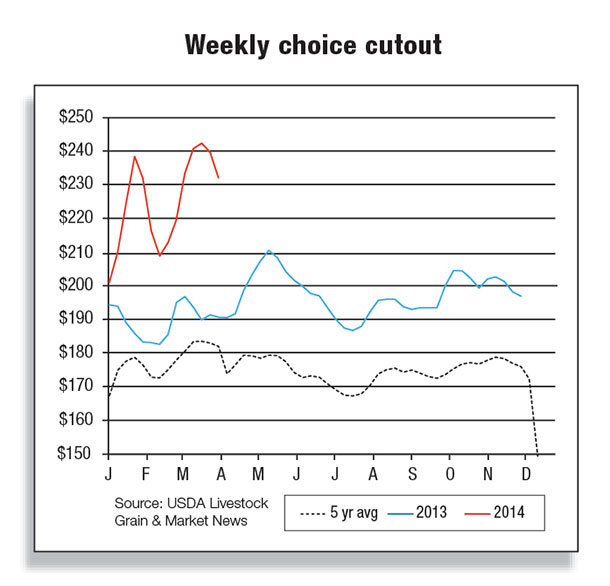

Wholesale cutout values, while moving higher, have not responded to the extent necessary for fed cattle prices to generate positive meat packer margins despite prices for some components, like 50 percent lean trim, moving into record territory.

Further, while choice retail beef has faltered from its November 2013 high ($5.41 per pound), all-fresh beef prices continue to set higher records each month ($5.04 per pound in January), in part sustained by the current popularity of ground beef products.

Cattle trade forecast 2 percent lower in 2014

U.S. cattle imports totaled 157,299 head in January 2014, nearly unchanged from a year earlier. Imports are expected to fall 2 percent in 2014 to 1.95 million head.

Inventories remain tight in Mexico after several years of drought resulted in substantial herd liquidation. Inventories have also declined in Canada. Thus, shipments are not expected to strengthen in 2014.

Beef exports rise in January, imports decline

U.S. beef exports rose 5 percent in January 2014 from the previous year. Shipments increased to Hong Kong (+69 percent), Japan (+44 percent) and Mexico (+24 percent).

Exports to Japan have gained steadily over the past year since a restriction was relaxed in February 2013 to allow for imports of U.S. beef from cattle aged 30 months or younger. Japanese beef imports increased 3 percent overall in 2013, while U.S. exports to Japan rose 49 percent.

Australia remained Japan’s top beef supplier in 2013 but lost market share to the U.S. after shipments declined 10 percent.

This trend is likely to continue as strong demand for U.S. beef endures and higher Australian exports to China divert beef products from Japan.

U.S. beef exports in January fell to Canada (-25 percent), Egypt (-81 percent) and Taiwan (-33 percent). Prices of U.S. beef have risen in the past year, while the Canadian dollar has depreciated against the U.S. dollar.

Higher prices and a weaker Canadian dollar are likely to dampen demand for U.S. beef in Canada. The forecast for U.S. exports in 2014 was increased 100 million pounds to 2.435 billion pounds due to strong beef demand in Asia.

However, lower production will result in an expected decline in exports of 6 percent year over year.

U.S. beef imports declined 9 percent in January from a year earlier. Imports fell by the greatest volume from New Zealand (-15 percent).

Imports from New Zealand rose 6 percent in 2013 after severe drought during the rainy season led to a significant uptick in cattle slaughter. Australian beef production rose for the same reason, but higher exports to Asia led to a decline in shipments to the U.S.

Rains have accelerated this year in Oceania, but pastures have not fully recovered from last year’s drought, creating uncertainty in this year’s expected cattle slaughter.

However, with reduced cattle numbers, beef production is likely to decline this year in both Australia and New Zealand. Imports in January also fell from Uruguay (-45 percent) and Mexico (-14 percent).

The forecast for U.S. beef imports in 2014 is 2.285 billion pounds, 2 percent higher than in 2013.

Imports are expected to rise due to tighter domestic beef supplies. U.S. beef production is forecast to decline 5 percent in 2014 due to lower cattle inventories and a likely uptick in heifer retention as herd rebuilding begins.

Although import demand is expected to rise, the magnitude of the increase will be constrained by tight supplies in Oceania and strong competition from Asia. ![]()

Kenneth Mathews

USDA – Economic Research Service