Flooding and an extremely slow pace of crop progress (especially in the Eastern Corn Belt) brought support back to the grain markets, but cattle futures continued under pressure - despite both fed and feeder cattle cash markets trading at a sizeable premium to the Board. Cattle feeders gladly pocketed their $3 to $4 basis premium on hedged cattle but ultimately lost over $12 of market position through the month. Feeder and stocker cattle lost $4 to $8 during the first three weeks of May, then lost another $4 to $8 during the final week of trading in response to the grizzly of a bearish cattle-on-feed report.

May 1st feedlot inventories actually came in quite a bit lower than expectations at 104.9 percent of the same period a year ago. However, placements of new arrivals into feeding facilities far exceeded industry analysts’ predictions with headcounts totaling 109.8 percent of 2010, which was well over 5 percent larger than the average guess. Where did all these cattle come from when we know we’re working with the smallest cow herd in over 60 years? Perhaps the best explanation is that few can completely fathom just how dry the Southwest has become and the reality that there has been a huge displacement of cattle from pastures to confinement operations. Despite historic flooding along the Mississippi River Valley, the bulk of the western United States is drought ridden. Texas recently marked the driest seven-month span since recordkeeping began with major grazing areas in New Mexico, Colorado, Kansas and western Oklahoma also hurting. Cattle weighing under 600 pounds made up 52 percent of the placements and very few of these lightweights are expected to leave the lots and return to pasture. Cost of gains will be expensive on these cattle but they will gain 1 to 2 pounds more per day than the average yearling on grass. These cattle will pressure the finished market late this year, but will be noticeably absent from the normal green yearling supplies from August through October.

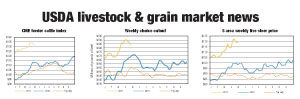

Producers with calves to sell this fall and backgrounders with enough pasture to maintain their stockers through the summer will be reluctant to contract their cattle off the significantly lower CME Feeder Cattle futures. Despite currently heavy inventories, feedlots will have needs to fill as their cattle on hand move through the channels. The U.S. cattle industry has seen all-time record prices at every level of production in recent months, but the full extent of tight supplies has yet to be realized (only expected). Packers will try to stretch current on-feed numbers in an effort to avoid market-ready shortages early next year. There has been some increase in imports from Mexico, but cattle populations in the U.S. have not spontaneously combusted. Some herd rebuilding signs have been noted in the Northern Plains, but for every heifer retained in Nebraska an extra cow has been sold-off for slaughter in Texas (both of which lowers production over at least the next two years). This trend along with high feedcosts has moved the concentrated median of cattle production and feeding farther to the north, where it faces lopsided competition from high-tech row crop farming operations. Feedlots are currently full, but they may very well be holding the highest percentage of available feeder cattle ever. ![]()

Corbitt Wall is the officer in charge and the Missouri federal-state supervisor at the USDA-Missouri Livestock and Grain Market News Service.