Inventory management is an important part of any ranching operation. It helps producers track livestock purchases and sales for income tax purposes and allows them to develop accurate financial statements. While it is necessary for operators to monitor the number of cows, calves, stockers, fed cattle, etc., on hand, finding a good inventory software program can be challenging. Many producers choose QuickBooks for this job, especially if they are already using the program to meet other financial accounting needs, such as paying bills, making deposits and creating invoices. However, keeping accurate inventory records in this program is difficult.

According to Mark Wilsdorf, author of the QuickBooks Farm Accounting Cookbook, three primary problems exist when accounting for agriculture inventories in QuickBooks. The first relates to inventory feature confusion. Program users often find that inventory management capabilities are buried under layers of menus, small business accounting jargon and reports with unfamiliar names. For example, livestock purchases are entered under the Items tab of a check instead of the more common Categories tab, and livestock sales work best when recorded as a sales receipt instead of a typical deposit. Also, to see if inventory flows correctly, the user must run an Inventory Valuation Detail Report, which is hard to find in the report center. Simply put, knowing where to go and how to properly enter farm and ranch inventory can be challenging.

The second program issue is a lack of manufacturing inventory features. Farmers and ranchers are similar to manufacturers because they buy raw materials, supplies and labor, and then use them to make (raise or produce) a finished product. However, the QuickBooks inventory system was designed for retail businesses that simply purchase merchandise wholesale and then sell it at retail. As a result, the basic design of QuickBooks assumes all inventory is purchased and does not provide an easy way to account for raised crops and livestock. While manufacturers can work around this problem by creating Work in Progress and Finished Goods inventories, this approach does not work well for agricultural operations that use cash-based accounting systems.

The final problem with QuickBooks inventory is the program makes automatic postings that are inaccurate for agricultural cash accounting. In other words, it simplifies inventory transactions by posting certain accounts “behind the scenes” without the user’s input. Since QuickBooks was designed for accrual accounting, these automatic entries produce incorrect results for cash-based operations. The poor design of inventory features causes many ranchers to use a different program, such as Excel, to manage day-to-day cattle tracking and only enter inventory values in QuickBooks when they need to create financial reports for bankers, accountants, etc.

While QuickBooks doesn’t work well for raised inventories, it can be effective under other circumstances. For example, if a rancher’s primary business is to purchase stocker cattle for resale, this type of business structure is similar enough to a retail business that the program’s inventory system operates quite effectively. To demonstrate this concept, let’s work a stocker inventory example in the QuickBooks Online Practice Company.

Before we begin, keep in mind that inventory tracking is only available in QuickBooks Online Plus or higher versions. Ranchers with QuickBooks Simple Start or QuickBooks Essentials subscriptions cannot take advantage of this feature.

QuickBooks stocker cattle inventory example

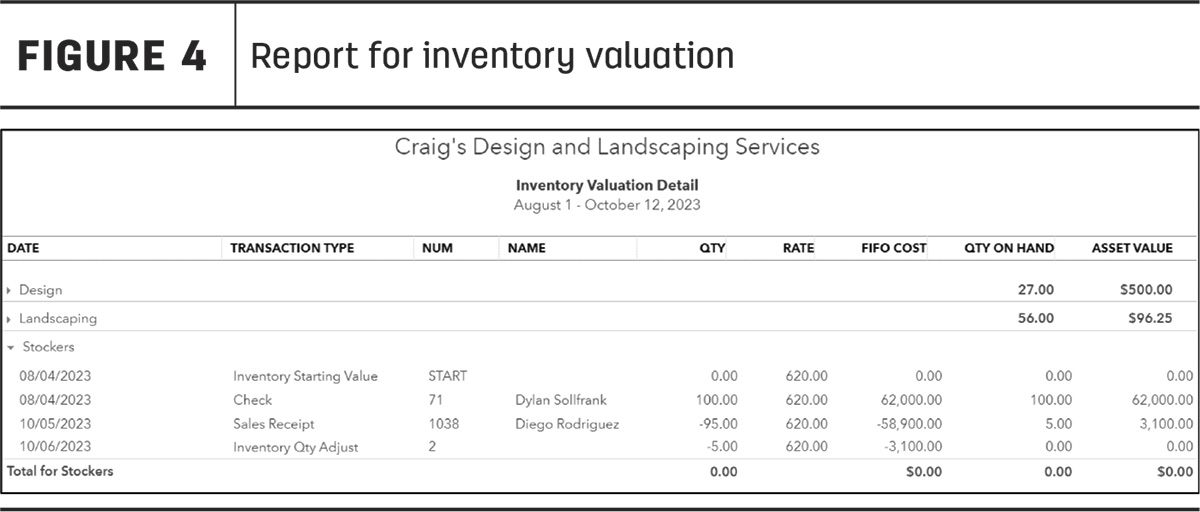

Assume a rancher purchases 100 light stocker cattle for $620 per head from Dylan Sollfrank (a preset vendor). Three months later, he sells 95 heavy stocker cattle for $875 per head to Diego Rodriguez and makes an inventory adjustment of five head for death loss.

Steps to inventory management

- Make sure the inventory feature is turned on by clicking the top gear icon and choosing Your Company: Account and Setting. Then, under the Sales menu, scroll to Products and Services and click on the pencil icon to activate inventory tracking.

- Set up a stocker inventory item by choosing Sales: Products and Services on the left navigation bar. Select New, then enter an inventory item called Stockers.

- Purchase light stocker cattle by writing a check. Select +New, then Vendors: Check on the left navigation bar. Be sure to choose the Item Details instead of Category Details in the voucher section at the bottom.

- Sell heavy stocker inventory a few months later by creating a sales receipt. Select +New, then choose Customer: Sales Receipt on the left navigation bar.

- Account for death loss by making an inventory adjustment in the Sales: Products and Services list on the left navigation bar. Scroll down to the Stockers item and select Edit: Adjust Quantity. Make sure the adjustment date is after the sale date, then enter “0” as the new quantity on hand.

- Lastly, check if everything worked correctly by running an Inventory Valuation Detail Report in the QuickBooks report center.

In conclusion, while QuickBooks is a useful accounting program that helps ranchers perform multiple bookkeeping transactions, the inventory management system has major shortcomings when dealing with raised crops and livestock. Whether or not this feature is worth the more expensive subscription level depends on the type of cattle operation and management preferences. Many ranchers find it faster and easier to keep track of livestock numbers outside of the program in an Excel spreadsheet and only enter inventory values in QuickBooks when they want to run financial reports.

For producers wanting to learn more about financial accounting, Texas A&M AgriLife Extension offers Beginning QuickBooks Online for Farmers and Ranchers. This self-paced, three-hour class teaches the financial concepts and features most important to agricultural operations.