On July 21, the USDA National Agricultural Statistics Service (NASS) released its biannual Cattle report. According to the report, on July 1, 2023, all cattle and calves were estimated at 95.9 million head, down 2.7 million head, or nearly 3%, from July 2022. The largest decline by class was beef cows, which were down 800,000 head from a year earlier. The dairy cow herd size remained unchanged.

The total number of heifers decreased 600,000 head, or 3.8%. The largest percentage decline by heifer class was in the number of “other heifers” over 500 pounds not retained for replacement. The number of steers weighing more than 500 pounds dropped by 500,000 head. The inventory of bulls weighing 500 pounds and over fell by just 100,000 head.

The 2023 calf crop is estimated at 33.8 million head, a decline of nearly 2% from last year and larger than expected. However, the year-over-year calf crop decline implies a small pool of calves for either retention or placement in feedlots in 2024. Based on the current pace of placements and the larger-than-expected size of the 2023 calf crop, the projections for feedlot placements for late 2023 and early 2024 are raised.

Fed cattle slaughter pace slows, lowering 2023 production

The outlook for 2023 beef production is lowered from last month by 180 million pounds to 27 billion pounds. This reflects a slower-than-expected pace of fed cattle slaughter that is projected through the end of the year. Average carcass weights were slightly lowered on recent slaughter data. The downward pressure on the forecast was partially offset by higher anticipated cow slaughter in the second half.

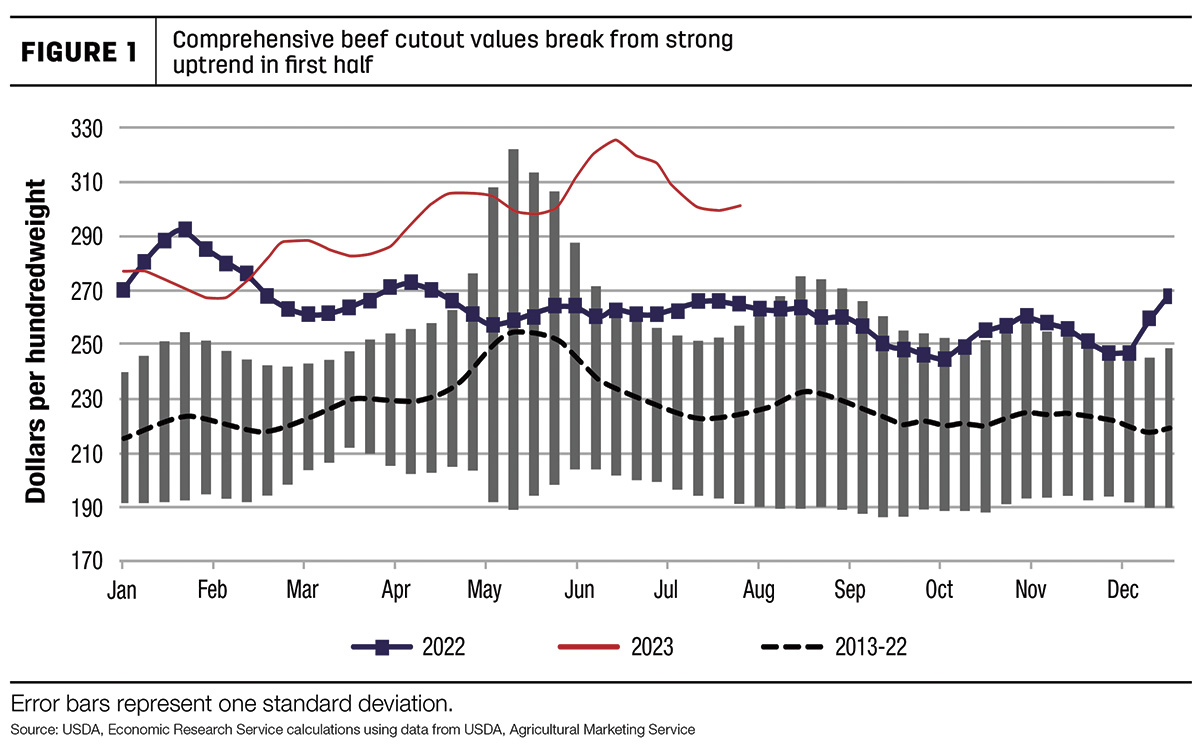

Figure 1 shows that wholesale beef values have retrenched from their strong upward trend in the first half of the year.

During that time, fed steer prices showed similar strength, but did not pull back to the same degree as wholesale prices in the third quarter. This move for beef prices is not atypical, but fed steer prices historically decline through September, the time of year when most fed cattle are marketed for slaughter. Steady cattle prices but lower wholesale prices have the effect of lowering packer margins. In turn, packers appear to be slowing the pace of slaughter to bolster wholesale beef prices.

Packers’ initiative to slow the pace of slaughter coincides with two of the three largest cattle-feeding states, Texas and Nebraska, holding 14% and 19% fewer cattle on feed over 150 days as of July 1 than a year ago – that is, these feedlots have fewer market-ready cattle available than at the same time last year. Further, the historically high Choice-Select spread in July and August suggests a potential incentive to keep cattle on feed longer.

Beef production for 2024 is projected higher than last month by 465 million pounds to 25.2 billion pounds. The large increase over last month’s forecast is largely based on an increase in projected fed cattle marketings, for which there is a twofold explanation. First, a higher-than-expected calf crop estimate raised anticipated placements in late 2023 and early 2024. Second, a slower anticipated pace of marketings in second-half 2023 shifted more marketings into 2024. There was also a slight upward adjustment to cow slaughter in the first half of 2024.

Cattle prices projected higher from last month

In July, the weighted-average price for feeder steers weighing 750-800 pounds at the Oklahoma National Stockyards was $244.22 per hundredweight (cwt). This was a $13 increase from June and nearly $75 higher than July 2022. In the sale on July 31, feeder steers set a record at $248.14 per cwt, and prices remained steady into the first week of August. Accounting for recent price strength, the third-quarter price forecast for feeder steers is raised $9 to $250 per cwt, and fourth quarter is raised $9 to $255 per cwt. Further, the 2024 forecast is raised $3 to $253 per cwt. In first-half 2023, weekly boxed beef values and fed steer prices in the 5-area marketing region followed a similarly strong trajectory over the period. However, as noted, boxed beef values retracted further than fed steer prices from the highs established in mid-June. Consequently, packer margins tightened and likely encouraged slowing production.

The July average price for fed steers in the 5-area marketing region was $184.25 per cwt, nearly flat from the record set in June and $42 higher year over year. Based on recent price data and expectations that market-ready supplies will continue to tighten despite a slower slaughter pace, the third-quarter 2023 fed steer price forecast is raised $6 to $184 per cwt, and the fourth quarter is raised $7 to $190 per cwt. The forecast for 2024 is raised $2 to $186 per cwt.

Beef exports down in the first half of the year

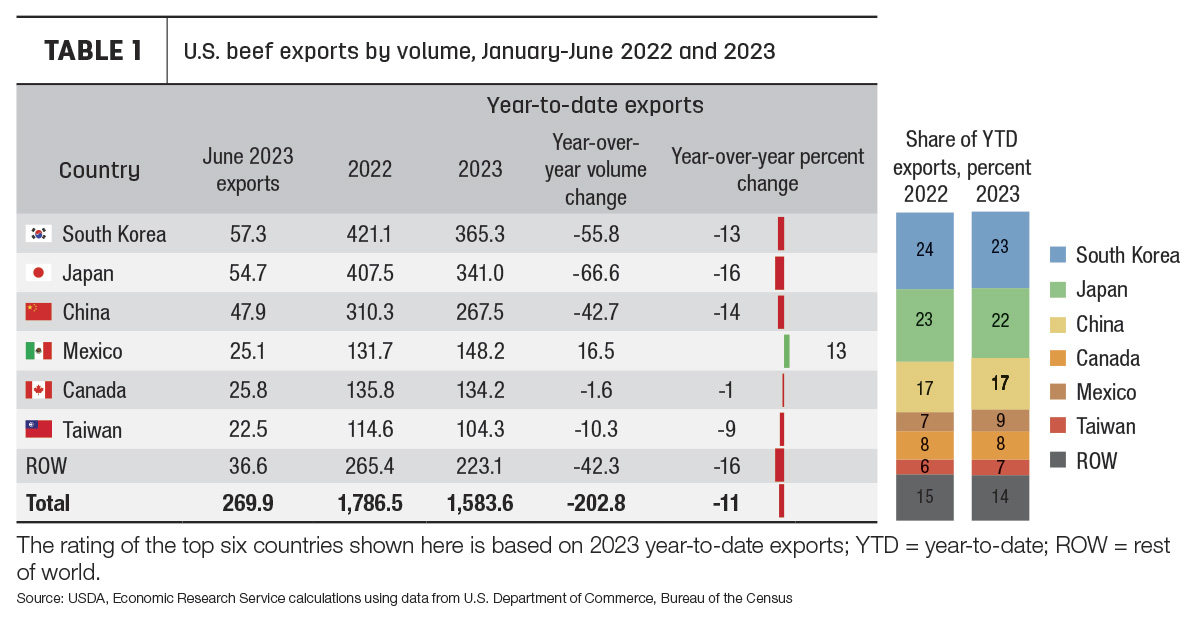

U.S. beef exports in June totaled 270 million pounds, 14% lower year over year but 2% higher than the five-year average. Exports to Mexico and Taiwan were particularly strong, nearly 25% and 26% higher year over year, respectively. Monthly exports to Canada and Hong Kong were also higher than a year ago. However, exports to the top three markets (South Korea, Japan and China) were down by a combined 42 million pounds, pulling total monthly exports lower than a year ago.

June exports brought the second-quarter total to 805 million pounds. This was a year-over-year decrease of 15% compared to last year’s record second quarter. Exports to Taiwan were the highest on record for the quarter, about 1% up year over year. Quarterly exports to Canada were up nearly 9%, and exports to Mexico were up 7% year over year. Exports to Japan were down nearly 31% year over year for the second quarter.

Table 1 shows the exports to the top six markets for the first half of the year. Cumulative exports were down 11% so far this year, with lower year-over-year exports to all major markets except Mexico. The largest declines have been to the top three Asian markets, with Japan down 16%, China down 14% and South Korea down 13%. Exports to smaller markets not in the top six were down a combined 16%.

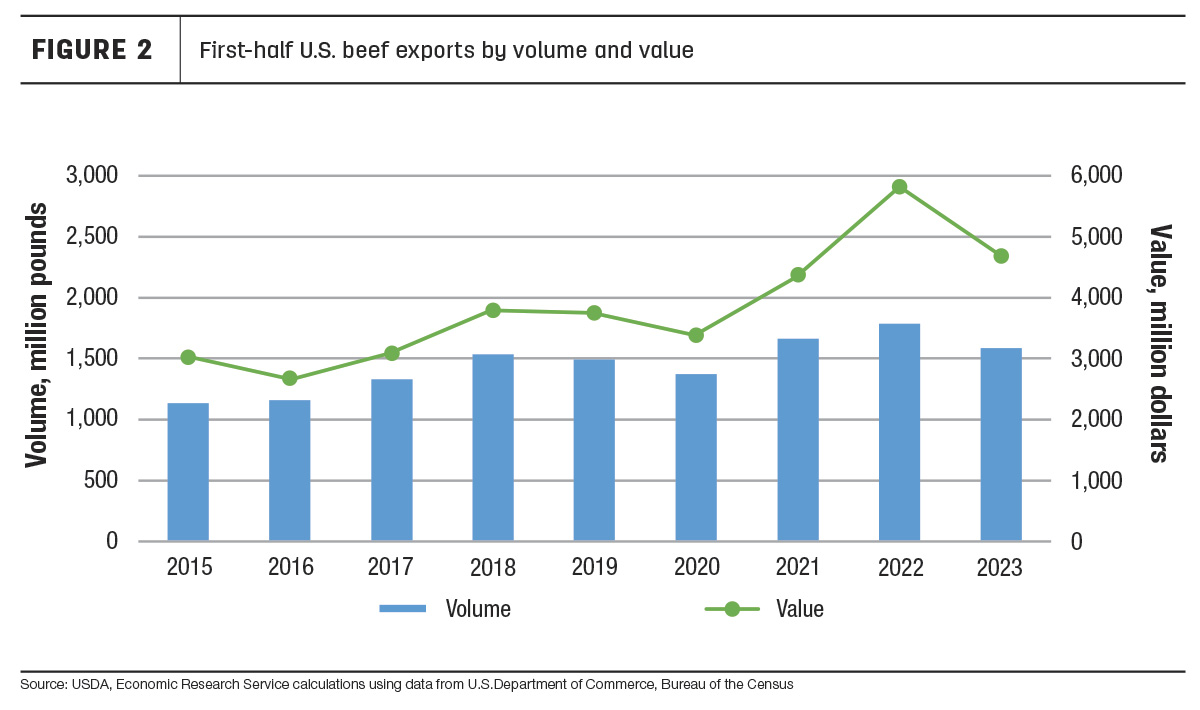

The total value of trade for the first half of the year was almost $4.7 billion. This was a 19% decrease from the same period last year. Figure 2 shows how first-half exports compare to previous years by volume and value.

The total value of exports in the first half of the year was still the second-highest on record. The average unit value of exports was down about 30 cents from last year. Exchange rates have tempered slightly from last year; the nominal broad dollar index has come down from the peak in October 2022 and remained relatively flat through the first six months of 2023. Wholesale beef prices in the U.S. remain strong, and foreign buyers will be looking at higher prices and lower availability of U.S. beef going forward.

The forecasts for 2023 third and fourth quarters remain unchanged from last month at 840 and 790 million pounds, respectively. The annual forecast for 2023 is 3.21 billion pounds. Following an increase in expected beef production next year, the annual export forecast for 2024 is raised 20 million pounds to 2.97 billion.

Beef import forecasts unchanged from last month

U.S. beef imports in June totaled 295 million pounds, bringing the second-quarter total to 901 million. Second-quarter imports were about 5% higher than the same period last year, aided by increased imports from Australia (up 38%) and New Zealand (up 34%). These higher imports from Oceania more than offset lower imports from North America and Brazil.

Imports in the first half of 2023 totaled nearly 1.9 billion pounds. First-half imports were about 1% above a year ago. Cumulative imports from Australia have increased 26% from the same period last year. Australia’s exports to the world are up 20% year over year as higher production has provided more exportable supplies.

Imports as a percent of total disappearance (production + net trade + net stocks) for the first half of the year were about 13.3%, slightly higher than the same period last year. Imports for the full year are expected to be 12.8% of total disappearance, compared to an average of 11.7% from 2018-22. That percentage is expected to increase to about 13.8% in 2024 as domestic production declines and imports increase. The forecasts for third and fourth quarter 2023 remain unchanged from last month at 890 and 765 million pounds, respectively. The annual forecast for 2023 is 3.51 billion pounds, and the forecast for 2024 is 3.56 billion pounds.