Risk management is a necessary but sometimes frustrating activity. Good risk management decisions can result in bad outcomes due to the uncertainty involved. For this reason, it is important to judge the quality of a risk management decision based on the information available at the time the decision is made and not solely on the final result.

Results are obviously important, but even high-quality risk management choices don’t come with guarantees in the face of significant uncertainty. However, better decisions should lead to good results more consistently.

For example, a producer developing a solid plan to manage market risk is more likely to achieve their goals in a given year than a neighbor who simply sells everything on the cash market at harvest. However, in some years, that neighbor may do better because markets just happened to work out that way.

That should not deter the producer from continuing to develop and implement sound marketing plans each year to manage market risk.

Most individuals would prefer certainty to uncertainty (risk) in many aspects of life. However, almost nothing is certain and, instead, uncertainty should be expected as we look to the future.

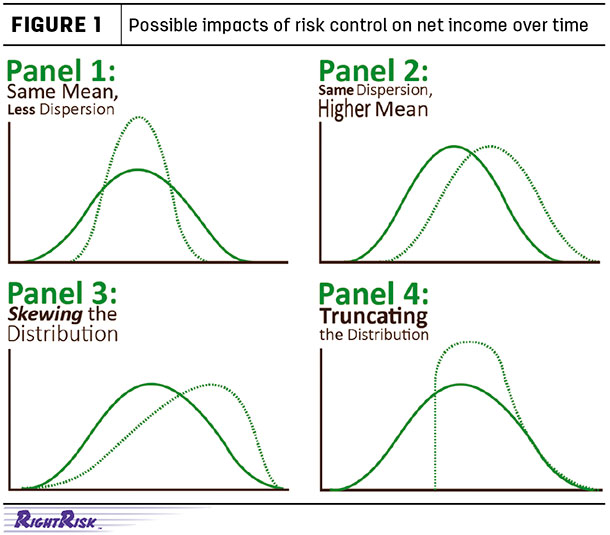

Risk management can be thought of as one or more strategies created with the goal of reducing the consequences of negative outcomes or increasing the likelihood of positive outcomes. Several different risk controls might be considered for a particular situation. However, in general, these approaches are limited to just a few results when considering their impact on net returns over time.

Some of those impacts are demonstrated in Figure 1, where the solid curve represents the beginning situation and the dotted line represents the changed or improved situation.

In each case, the risk control results in expected revenue that is more consistent, results in higher average return, has improved upside potential or is protected from downward forces. The challenge to risk decision-makers is to decide what risk management goal they might have in mind when considering the controls available.

It may seem elementary, but it is worth repeating: Good decisions don’t always result in good outcomes. It is OK to consider past results in making management decisions, but don’t let that past experience persuade you that you should have made a different decision without good cause.

Risk management decisions are focused on the future. Too much focus on the past can lead to biased decisions and fatal results.

A focus on decision quality involves evaluating the seven characteristics of good risk management decisions:

1. Appropriate decision frame

An appropriate decision frame captures the context in which you are making the decision, including both the internal and the external environment. It should also incorporate the objectives you are trying to accomplish through the decision, as well as the uncertainties that could influence your ability to reach them.

2. Clear values to adhere to

Identifying the objectives you are trying to accomplish is part of properly framing a decision. These objectives need to be clear and align with your values. Why is this so important? When you look back on a decision, you want to clearly see how the choice you made helped you fulfill key objectives and adhere to your values better than the other alternatives available at the time.

3. Creative alternatives to choose from

The choice you make can never be better than the best of the alternatives you have to choose from. And, let’s face it, it is impossible to choose an alternative you haven’t considered. Think outside the box and evolve some of your original alternatives into better alternatives.

At the end of the day, it is much easier to make a good decision if you are trying to decide between several good choices.

4. Good information

There are no future facts. At best, factual information can only describe the present or the past. Risk management decisions are made for the future, and the future is full of uncertainties. We live in the information age, but determining which information is important and reliable can sometimes be a challenge.

Use experts wisely to help gather relevant information about what the future could look like. You want to be able to say you incorporated the relevant facts known at the time and the best information about what the future could be when making your decision. A laser focus on your objectives as you gather information can help you achieve this result.

5. Clear trade-offs and sound reasoning

One of the most difficult challenges in making risk management decisions is grappling with trade-offs involving multiple objectives. This is one of the reasons people often try to monetize everything and treat decisions as profit-maximizing choices.

However, seldom can this be done without some difficult discussions about what something is worth. In other words, grappling with trade-offs between objectives can be difficult and requires sound reasoning.

For example, is it more important to have the capacity to harvest your crop within 10 days to reduce production risk than it is to save $2,000 in annual interest expense by operating smaller equipment?

Sound reasoning and evaluating trade-offs also extends to consideration of downstream decisions. A decision made today usually influences future decision opportunities. You want to be able to look back and say your reasoning was sound in evaluating the alternatives and the choice you made best accomplished your objectives.

6. Choice alignment with values and objectives

If you make a good risk management decision, you should be able to look back and say the choice you made aligned well with your values and the objectives you were trying to accomplish. It is important to reflect on this before making the final selection.

Too often, we focus on one piece of information and let it dominate the selection process. A quick reflection on choice alignment with your values can help prevent the decision from improperly reflecting an imbalance among your priorities.

7. Committed implementation

Finally, a good risk management decision must be accompanied by a commitment to implement it. When you evaluate your decision, reflect on how committed you are to fully implementing your choice. If it is a marketing plan, are you willing to stick with it?

A fully implemented strategy with committed effort offers the best chance for consistent success. ![]()

The authors are part of the Right Risk team: Jay Parsons is an associate professor with the University of Nebraska – Lincoln; John Hewlett is a ranch/farm management specialist with the University of Wyoming; Jeff Tranel is a business management economist with Colorado State University.

Jay Parsons is an associate Professor with the University of Nebraska – Lincoln. Email Jay Parsons.

PHOTO: Hay stacks. Staff photo.