Anyone who owns, operates or invests in farmland knows there are many factors that can drive farmland values. It primarily comes down to the potential financial returns per acre, but there can be many underlying attributes that drive those returns. Examples include productivity factors such as soil and water quality and their impact on suitable crops and yields; cost drivers such as water (cost, quality, security) and distance to markets (freight and basis price); and market drivers such as proximity to specialty crop processing and packaging facilities for potatoes, sugarbeets, fruits and vegetables. There are also potential soft factors such as the neighboring farmer who has always wanted to own the land next door and is willing to pay for the strategic advantage or emotional satisfaction it gives him or her.

If you are selling, you want to maximize the price of the land and not leave money on the table. If you are purchasing, whether as an operator or investor, you are worried about the lack of local knowledge or having boots on the ground and the risk of overpaying and thus not meeting required returns, but neither do you want to underestimate a property’s value and miss opportunities.

Traditional data sources, such as state- and county-level USDA reported values or even historical comparable sales are helpful but provide limited insight into differentiators within states, counties or sub regions. The problem is applicable everywhere but becomes magnified as we move into arid regions, such as Idaho, in which water source, quality, costs and rights can become the determining factors.

“Big data” or the accumulation, assimilation and sophisticated analysis of vast amounts of data from multiple and disparate sources, is radically changing our ability to gain actionable insight into sustainable land values, identify the drivers that really matter and provide the ability to quantify those drivers’ impacts to individual tract values, especially when combined with geospatial mapping and advanced mathematics. As an example, let’s look at an analysis we recently conducted of the Magic Valley in Idaho.

Utilizing big data acquired from the past 10 years, representing individual farmland sales in the Magic Valley in concert with geospatial mapping and analysis software, we were able to derive, with high statistical significance and confidence, differences in farmland value due to drivers such as irrigation type, geographic information system (GIS) coordinates within a region, water source, irrigation districts and time.

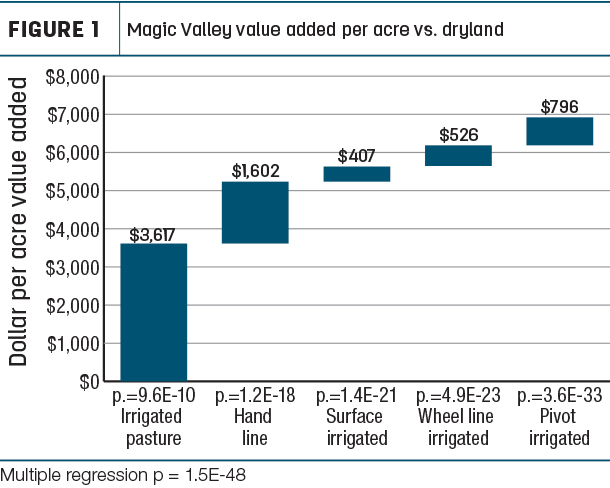

Figure 1, for example, is a stair-step chart derived from multiple regression of the average additional value per acre for each irrigation type over a baseline of dryland in the Magic Valley, starting with irrigated pasture at $3,617 and stepping through to pivot irrigated on the far right, adding a final $796 per acre for an accumulated total of $6,974 over dryland. Now that doesn’t mean the average pivot-irrigated acre is worth $6,974; rather, it means with all else equal, pivot-irrigated ground is on average worth $6,974 more than dryland.

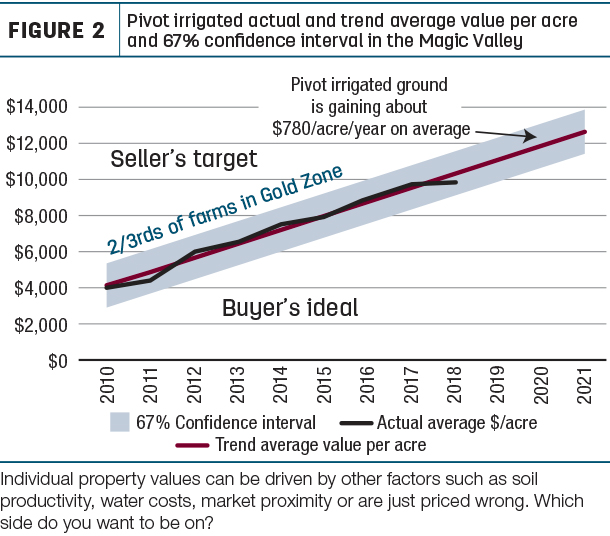

Returning to the same data set and applying regression analysis, we see in Figure 2 the trendline and 67% confidence interval (the range + or – around the average where we’d expect to see two-thirds of the values) for pivot-irrigated farmland values over the 10 years of data, as well as projecting forward into 2020 and 2021.

Individual farmland values above and below the red trendline are driven both by measurable attributes we can adjust for – such as soil productivity, water costs, market proximity, etc. – and things we may not be able to account for mathematically, such as competing buyer interests, additional real property or condition of irrigation equipment and pumps.

We aren’t saying robust data sets and analytics can precisely price farmland or any other asset; but it is an excellent and strategically advantageous tool to evaluate a property’s relative value before a “go or no-go” decision is made. After adjusting for all the value drivers, is a property’s asking price above or below the predicted value? Can that difference be justified by intangible bits or changes in market dynamics? If you are selling, how does your property measure up against others?

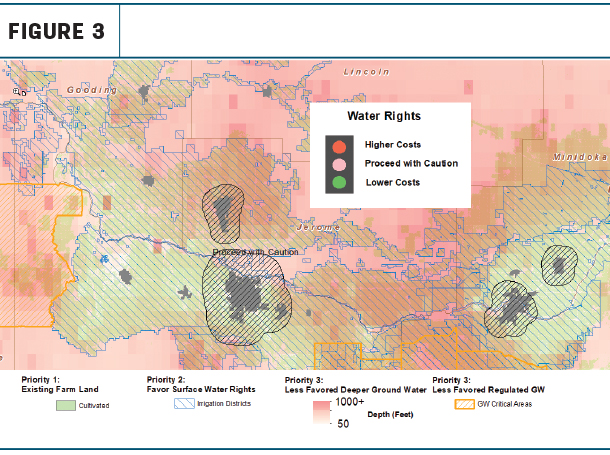

Additional insight can be gained by layering these historical databases geospatially with information such as irrigation districts, groundwater depth, critical groundwater areas and pressure from urban development. Figure 3 is an illustration compiling disparate information from numerous sources into a single visual tool to aid strategic investment decisions of not only where to target, but just as critically, where to avoid (or for current owners, where to divest, due for example to factors such as more costly farming inputs, lower yields, distance to markets or depth of the tenant pool).

As another example, irrigation districts indicate availability of low-cost groundwater and can contrast cost differences between those districts. Groundwater depth directly affects well depth and pumping costs, and areas designated “groundwater critical” are likely areas to avoid entirely. Alternatively, the contrarian investor can utilize the same tools to identify properties uniquely undervalued within an overlooked region or because of a local reputation no longer deserved due to improved irrigation equipment or other arbitrage opportunities and factors.

In addition to the data sets listed above, consider the potential to incorporate the ability to spatially capture individual farm crop, yield and production cost histories; current ownership, irrigation pump and well locations and history; as well as other items, not just in Idaho but across all major U.S. agricultural regions, for greater comparisons of performance and risk.

Big data, inexpensive storage and computing capacity, geospatial mapping capabilities, sophisticated analysis, and visionary application of it are enabling the exponential expansion of our ability to transform data previously residing in unconnected places, or even nonexistent, into knowledge capable of maximizing returns and preventing mistakes.

Gregg Ruddell is the owner of Advanced Valuation & Consulting.