The USDA’s latest Crop Production report, released Oct. 12, indicates 2021 hay supplies will be lower than a year ago. Production of alfalfa and alfalfa-mixture hay, at 48.2 million tons, is up 1% from the August forecast but down 9% from 2020. Based on conditions as of Oct. 1, yields were expected to average 2.99 tons per acre, down 0.28 ton from last year. Harvested area was forecast at 16.1 million acres, down 1% from 2020.

Production of other hay is forecast at 72.3 million tons, up 2% from the August forecast but down 2% from 2020. Yield is expected to average 2.04 tons per acre, down 0.01 ton from last year. Harvested area was forecast at 35.4 million acres, down 2% from 2020.

Drought conditions carry into fall

Major forage production areas continue to face moisture challenges heading into the final quarter of 2021.

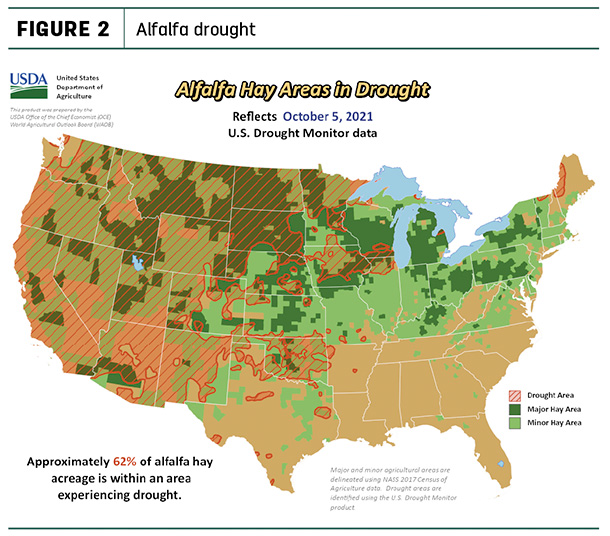

As of Oct. 5, U.S. Drought Monitor maps estimated about 39% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, up 3% from early September. The area of drought-impacted alfalfa acreage (Figure 2) declined 1% over the past month to 62%. Improving conditions in southwestern Minnesota, Virginia and West Virginia were offset by worsening drought in Oklahoma, northern Texas and portions of Colorado.

August prices hit multiyear highs

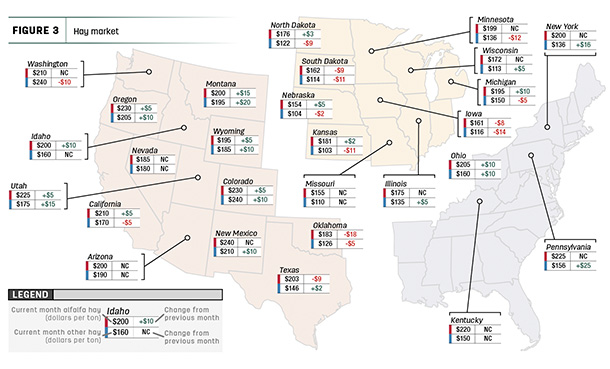

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

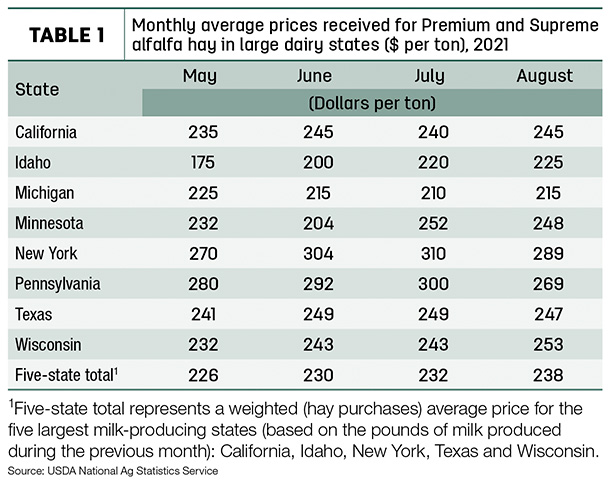

The average price for Premium and Supreme alfalfa hay in the top milk-producing states jumped $6 to $238 per ton in August (Table 1), the highest average recorded since the USDA began compiling dairy-quality hay prices in 2019. Compared to July, average prices were down in New York and Pennsylvania, mostly steady in Minnesota and Texas and somewhat higher in California, Idaho, Michigan and Wisconsin.

Alfalfa

The national average price for all alfalfa hay rose for a ninth consecutive month in August 2021, up $5 per ton from July to $206 per ton. It’s the highest monthly U.S. average dating back seven years to August 2014. Monthly prices increased in 13 of 27 major forage states, led by Montana, Ohio, Michigan and Idaho. Average prices declined in just four states: Oklahoma, South Dakota, Texas and Iowa.

Other hay

The U.S. average price for other hay rose $1 in August to $152 per ton, the highest since May 2019. Compared to a month earlier, average prices moved higher in 12 of 27 major hay-producing states. Largest increases were in Pennsylvania, Montana, New York and Utah. Prices were lower in nine states, led by Iowa, Minnesota, Kansas, South Dakota and Washington, all down $10 of more.

Alfalfa hay exports surge higher

After recording low numbers in July, August hay exports posted a strong rebound.

Alfalfa hay exports totaled 290,072 metric tons (MT) in August, the highest monthly total since April 2020. The surge was powered by sales to China. At 191,267 MT, it’s likely the largest monthly shipment of alfalfa hay to any country in history. Sales to China represented two-thirds of all alfalfa hay exports for the month. August sales to Japan hit a three-month high at 50,031 MT. January-August 2021 alfalfa hay exports now stand at more than 1.89 million MT, the highest total on record for the first eight months of the year. The USDA estimated the value of August alfalfa hay exports averaged about $353 per MT, down about $4 from July’s average.

At 107,618 MT, August exports of other hay also improved from July but were the third-lowest total for the year. Shipments to the top five exports markets, Japan, South Korea, Taiwan, China and the United Arab Emirates were all up from July. Despite the somewhat ho-hum totals, 2021 year-to-date exports of other hay are still the most for the January-August period since 2017. The USDA estimated the value of August other hay exports averaged about $345 per MT, down about $6 from July’s average.

Latest news surrounding West Coast ports was better but hardly something to get overly enthused about. According to a summary of August shipping data from the U.S. Dairy Export Council (USDEC), a few more outbound containers leaving major California ports (Los Angeles, Long Beach and Oakland) were filled with U.S. goods during the month. However, filled containers still lagged prior-year levels by 12%. Consistent with July’s shipping woes, 70% of outbound containers from California’s major ports lacked cargo. The Pacific Northwest wasn’t much better, with 57% of outbound containers leaving Seattle-Tacoma empty.

Looking ahead, with the holiday import rush already upon us, delays, high freight rates and difficulties securing cargo space will persist at least into the new year, USDEC reported.

Regional markets

Here’s a snapshot of local markets and conditions during the first week of October:

- Southwest: In Texas, the price spread between high- and low-quality hay was widening as livestock producers began to stock up for winter. Supplies of off-grade hay are large due to excessive moisture during the growing season. Although the summer was cooler and wetter than normal, the majority of the state was now in need of a rain.

In Oklahoma, many hay producers were wrapping up last cuttings. This year’s growing conditions have resulted in limited supplies of feeder-quality hay, and the tight supplies were keeping prices firm, as many producers made decisions on buying hay or selling cattle.

In New Mexico, alfalfa prices were steady to $20 higher, with fifth and sixth cuttings moving into storage. A substantial supply of low-quality hay was reported at discount.

In California, demand remained good for short supplies. In Tulare County, corn for silage needed less irrigation with the cooler temperatures. In the northern regions, growers were expecting one more alfalfa cutting for the year.

- Northwest: In Montana, demand remained good as ranchers sought to cover winter needs, with many buying hay from out of state or Canada. Cow culling is heavy as the value of hay will eclipse the value of cows by the end of winter. Higher prices were providing incentives for some growers to try for a fourth cutting.

In Idaho, demand remained good for all grades and types of forage crops as the growing season was coming to an end. Trade remained active especially for supplies going out of state. Supplies of high-testing hay were limited.

In Colorado, drought challenged pasture and rangeland conditions as hay stockpiles continue to decline and grow more expensive. Dairy-quality hay was moving out of state and horse hay sold steady on good demand, but other markets were less active.

In the Columbia Basin, all grades of domestic, export and retail forages and straw sold firm as the growing season came to an end. High-testing dairy hay remained scarce. Exporters had a difficult time getting overseas orders loaded.

In Wyoming, demand was good for all types and classes of hay. There were many reports that buyers were picking up hay as soon as it was baled. Some growers had lists of buyers waiting for third cuttings and were not taking any new customers.

-

East: In Pennsylvania, overall demand was steady.

- Midwest: In Nebraska, the bulk of forages sold steady, with ground and delivered hay selling higher. Some producers were finishing up on fourth cutting alfalfa with a few talking about a fifth cutting. Anything that can be baled will be, and it will be blended back into a feed ration for livestock.

In Kansas, hay prices were steady for alfalfa and grass hay; movement was slow. Demand for grinder hay was down at feedyards.

In South Dakota, there was good demand for all types and qualities of hay as the drought has increased the need for supplemental feeding. Fourth cutting of alfalfa finished up in areas lucky enough to get late summer rains. Cattle producers in the west were selling calves early, and some were liquidating cows due to short forage supplies. Calves arriving in feedyards supported demand for high-quality grass hay.

In Missouri, hay demand and movement were light, with mixed reports on supplies.

In Wisconsin, dairy-quality hay was in demand, and overall prices were steady, with slight downward pressure. Lower-quality hay was losing some ground with a wide range of prices. There was a large supply of hay in the central part of the state.

Other things we’re seeing

-

Dairy: Monthly average U.S. dairy farmer income over feed cost margins shrunk again in August, based on factors included in the Dairy Margin Coverage (DMC) program. At $5.25 per hundredweight (cwt) of milk sold, the margin is the slimmest since the DMC program and its predecessor, the Margin Protection Program for Dairy (MPP-Dairy) began in 2014. The tight margins are affecting the size of the U.S. dairy herd, with more cows going to slaughter. The USDA estimated cow numbers declined by about 29,000 between May-August 2021.

-

Fuel and trucking: The U.S. Energy Information Administration noted U.S. average retail diesel fuel prices increased during the first week of October and were about $1.10 per gallon higher than a year ago. Smallest increases were in the East. Price increases were less notable for gasoline, which averaged about $1.02 more than a year ago. Despite increased fuel costs, national average flatbed hauling rates declined slightly to start October.

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke