The summer is in full swing and so is the next season of alfalfa. With corn in the ground and emerging, producers are chomping at the bit to get last year's crop sold and out of the barns to make room for this year's crop. Take a closer look at prices and conditions in each region in the Progressive Forage Forage Market Insights column as of June 10, 2024.

Moisture conditions see continued improvement

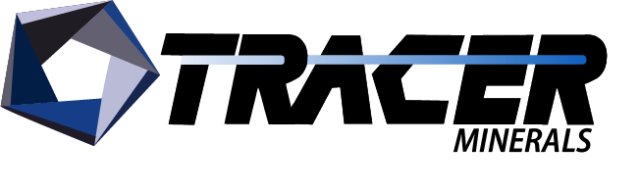

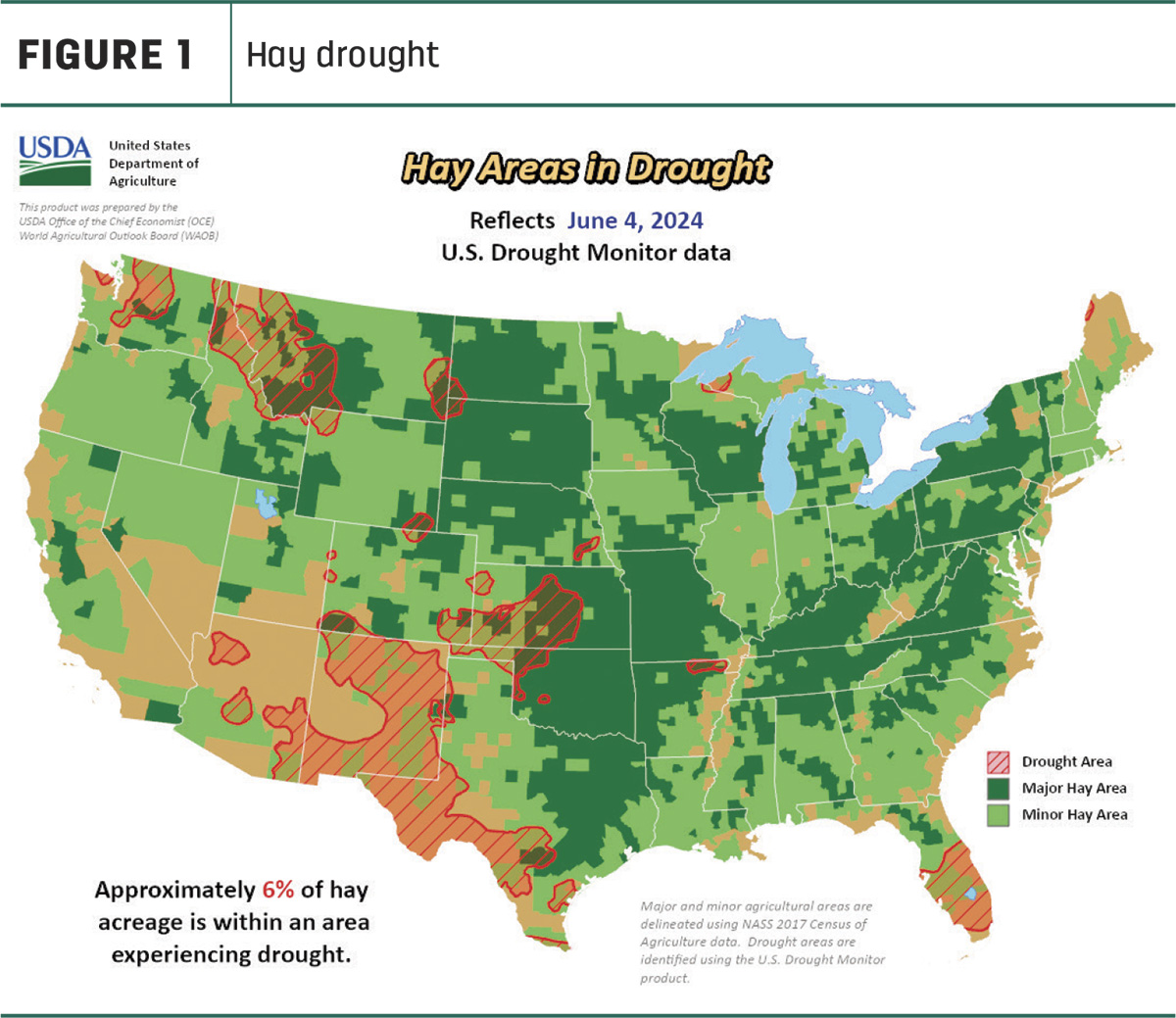

Summer showers have improved the moisture conditions. Overall U.S. Drought Monitor maps indicate drought areas that are continuing along the trend of decreasing. As of June 4, approximately 6% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 10% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions was reported to be 9%, with 14% the month prior.

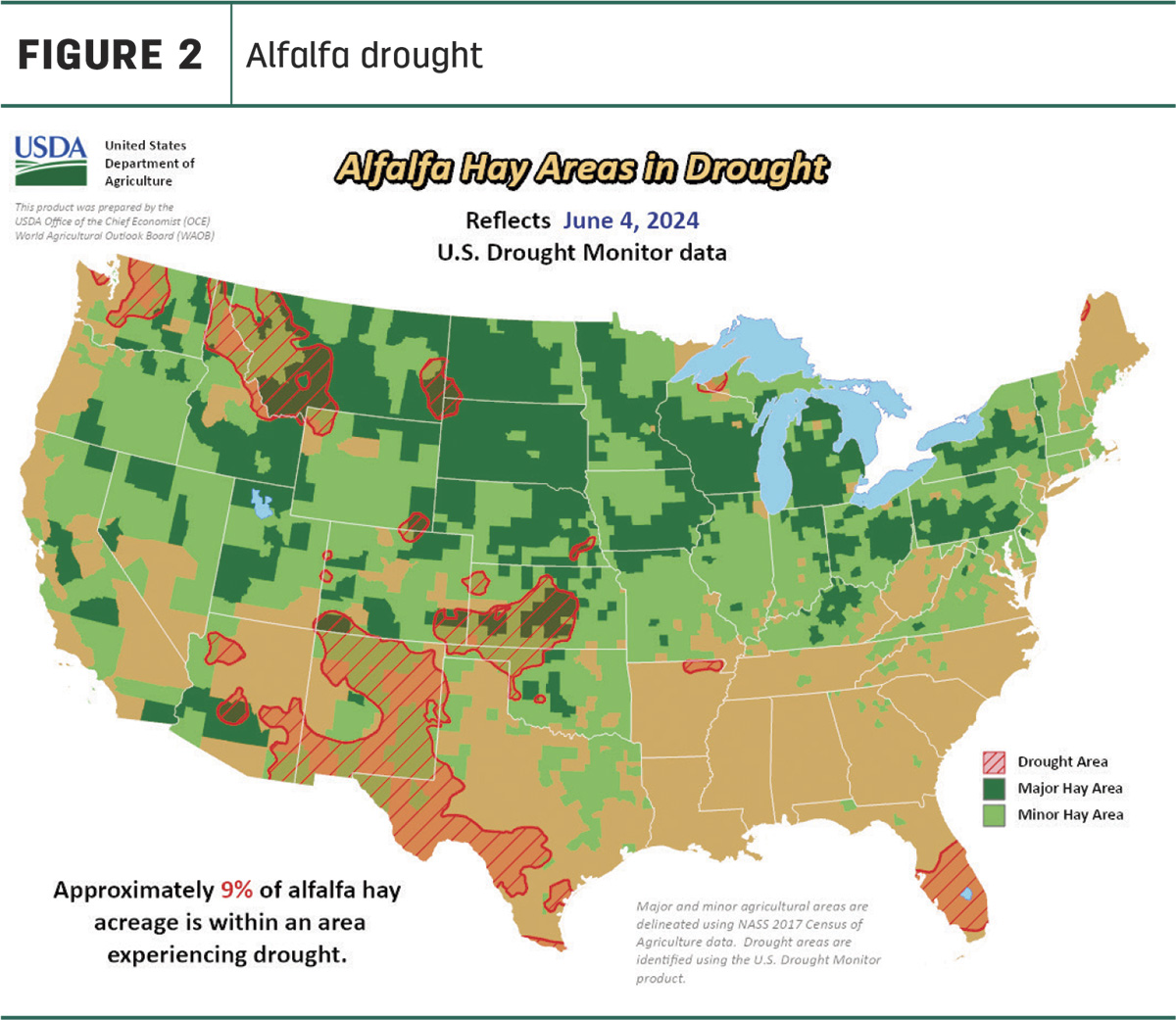

A snapshot of hay prices

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

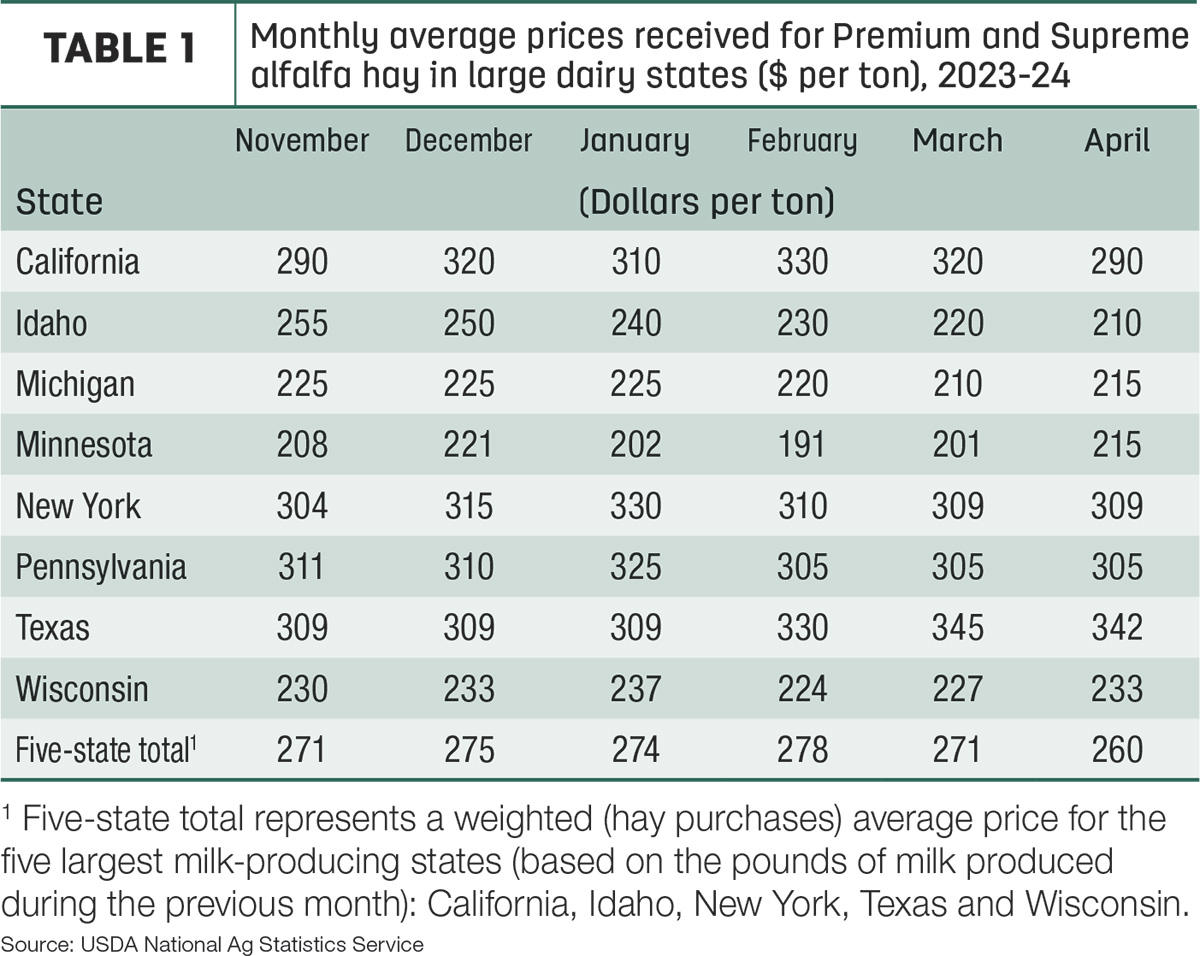

Dairy hay

The top milk-producing states reported a price of $260 per ton of Premium and Supreme alfalfa hay in the month of April, an $11 decrease from March. The price is $55 lower than what was reported in April 2023 (Table 1).

Regional markets

- Midwest: In Nebraska, ground and delivered hay and new crop alfalfa pellets both sold steady. Demand is light for both old and new crop hay. The new crop sales are currently at a standstill according to reports, but haying conditions are good and the quality of the new crop is dairy quality.

In Kansas, demand is overall low for grinding hay specifically. Trade activity is gaining momentum and many sellers are willing to let go of old crop hay to clean out barns. Second cutting has already begun in some parts of the state, but yields are less than expected as well.

In South Dakota, demand is lower than normal for this time of year and prices are still unsettled. Producers are doing their best to put up hay to avoid rainfall.

In Missouri, hay is moving at a decent rate and price. Rain and weather interruptions have caused some complications, but the state is still ahead of the five-year average with around 54% of the first cutting being completed at the time of report release.

- East: In Alabama, hay prices are reported as steady with moderate supply and demand.

In Pennsylvania, alfalfa and grass mix are both selling steady with no comparison available on orchardgrass. Orchard and timothy sold steady while prairie and meadowgrass sold steady with a weak undertone. Wheat straw also sold steady.

- Southwest: In California, demand and trade activity were both reported as moderate. Dairy quality and hay to be exported were moderate to good while retail hay demand was steady. Corn silage fields are growing well and alfalfa was cut, raked and baled.

In New Mexico, although some parts of the state did receive some moisture, much of the state still remains dry. The state is reporting 80% done with first cutting and 14% done with second cutting. Supplies are still short and water supplies are even shorter.

In Oklahoma, hay trade has slowed to a standstill. As rain continues to fall across the state, the first cutting is still getting baled and put in the barn when possible.

In Texas, hay prices are mainly steady to firm and demand is also picking up. Excess old-crop hay is beginning to move along with the new crop, but the majority of delivered hay is from older contracts. Areas of the state have received significant rainfall, and the percentage of the state in drought is decreasing.

- Northwest: In the Columbia Basin, demand and movement are low because of the dispute of unsettled prices as producers continue to hold out.

In Montana, hay was too lightly tested to detect a market trend and hay sales were at an almost complete standstill.

In Idaho, demand for hay is lower than normal with an unsettled market and price disparity. Producers are optimistic the demand will pick back up when more new crop is out of the fields and ready to be sold.

In Colorado, trade activity was light and demand was also light. Triticale haylage harvest has begun and alfalfa production is underway statewide. Large amounts of rainfall improved drought conditions in many parts of the state.

In Wyoming, demand was light and hay prices were steady on a thin test of the market. One-third of the state is still reported to be abnormally dry.

Other things we are seeing

- Dairy: Potentially affecting Federal Milk Marketing Order (FMMO) pooling, the May 2024 Class IV milk price is $1.95 more than the month’s Class III milk price, down from $4.61 in April and the narrowest spread since September 2023. One setback in May, the advanced Class I base price was previously announced at $18.46 per cwt, down 72 cents from April 2024 and $1.11 less than a year ago, and the lowest since February. Based on FMMO advanced prices and current futures prices, the outlook for June milk prices will improve. Already announced, the June 2024 advanced Class I base price is $20.08 per hundredweight (cwt), up $1.62 from May 2024 and $2.07 more than a year ago. It’s the highest Class I base price since February 2023.

- Cattle: The USDA’s latest Cattle on Feed report, published May 24, showed that 1.87 million head of fed cattle were marketed in April, a more than 10% increase from the same period last year and higher than the 9% to 9.5% increase many analysts had expected. Feedlot placements in April were 1.66 million head, 6% lower than 2023. The total number of U.S. cattle on feed for the slaughter market in feedlots with a capacity of more than 1,000 head totaled 11.6 million on May 1, only about 1% below the 2023 level. With the national cow herd population still near a 50-year nadir, it comes as little surprise that feeder cattle supplies remain limited and placements lower than a year ago. These factors should lead to continued high cattle prices.

- Fuel: Fuel prices are declining slightly according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.43 per gallon. The average U.S. retail diesel price was around $3.67 per gallon.

- Trucking: Spot flatbed prices increased slightly in most regions with average prices falling slightly, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.70, South-central – $2.55, Midwest – $2.62, Northeast – $2.46 and West – $2.26.