While the rest of the world may be getting ready to start getting into the swing of things, the hay market is savoring the last of summer. Producers are holding on to good pastures and the hay market is still on summer break. Take a closer look at what prices and conditions are in each region in the Progressive Forage Forage Market Insights column as of July 15, 2024.

Moisture conditions fall short

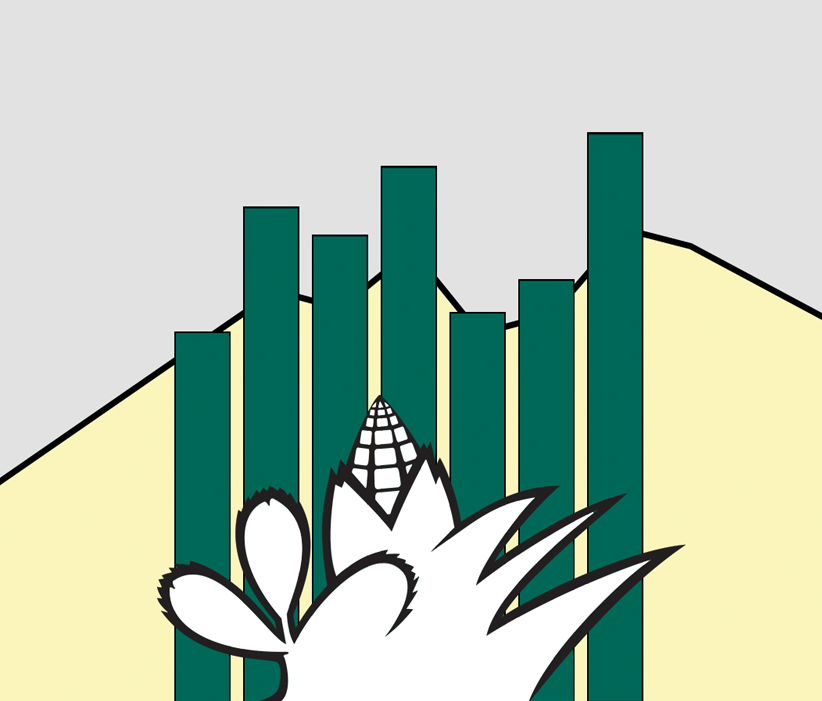

Summer showers have improved the moisture conditions. Overall U.S. Drought Monitor maps indicate drought areas that are continuing along the trend of decreasing. As of July 9, approximately 17% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 6% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions was reported to be 14%, with 9% the month prior.

A snapshot of hay prices

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

The top milk-producing states reported a price of $276 per ton of Premium and Supreme alfalfa hay in the month of May, a $16 increase from April. The price is $41 lower than what was reported in May 2023 (Table 1).

Exports

For the second month in a row, hay exports slipped. The total of purchased U.S. alfalfa hay in May was down 12% at 198,993 metric tons; year-to-date sales are at 1,013,054 metric tons. China and Saudi Arabia continued to lead in purchases (79,313 and 42,374 metric tons, respectively), although May’s purchases were down in both countries (China 13% and Saudi Arabia 8%). Japan saw a 2% increase in purchases at 35,442 metric tons of alfalfa hay.

Other hay exports were also down, but the difference was not quite as stark. May posted a 1% change in other hay purchases. The leader of those purchases was Japan at 55,178 (up 11% from April) and South Korea at 25,466 (down 13% from April). In total, the U.S. exported 96,303 metric tons of other hay in May, and since January, the U.S. has exported 464,352 metric tons of other hay.

Regional markets

- Midwest: In Nebraska, baled hay sold steady to weak while delivered hay and alfalfa pellets sold steady. Overall demand appeared to be a bit light while tonnage of grass and meadow hay had been good. Hail has played a factor in getting an established corn crop and has caused an uptick in plant cane or millet.

In Kansas, low overall demand for all hay products. Prices are continuing to drop as new hay is hitting the market. Feedyards are also slowing their buying with lower cattle numbers and many other feed options present.

In South Dakota, demand is lower than normal for this time of year and prices are still unsettled.

In Missouri, plentiful pastures and abundant moisture have increased pressure on the hay market. More than 80% of pastures in the state are rated as good to excellent, so buying of hay has been slow. This is a sharp contrast from a year ago, when over 70% of pastures were rated as poor.

- East: In Alabama, hay prices are reported as steady with moderate supply and demand.

In Pennsylvania, alfalfa and grass mix are both selling steady with no comparison available from last report.

- Southwest: In California, demand and trade activity were both reported as good. Dairy quality and hay to be exported were moderate and slowing down steadily while retail hay demand was steady. Herbicide applications are continuing.

In New Mexico, hay is being sold steady, while much of it is being put in barns. Blister beetles are causing some increased herbicide applications. Some areas of the state are dealing with flooding while moisture is still desperately needed in other areas.

In Oklahoma, hay trade has slowed to a standstill. As rain continues to fall across the state and the excess supply from 2023 stands in barns, pricing is predicted to remain low.

In Texas, hay prices are mainly weak across all regions. Increased rainfall is allowing cattle to stay turned out longer and be supplemented less.

- Northwest: In the Columbia Basin, not enough reported sales to detect a trend.

In Montana, hay sold stray to weak on old crop and too few new hay sales have been reported to develop a trend.

In Idaho, not enough reported sales were reported for accurate trend.

In Colorado, trade activity was light and demand was also light while stable hay sold mostly steady.

In Wyoming, bales of hay sold fully steady with limited dew creating a challenge to keep leaves on, but the quality has remained high.

Other things we are seeing

- Dairy: July uniform prices and pooling totals will be announced on Aug. 11-14. Based on FMMO advanced prices and current futures prices, the outlook for July milk prices is brighter.

Class I base price: Already announced, the July 2024 advanced Class I base price is $21.11 per hundredweight (cwt), up $1.03 from June 2024 and $3.79 more than a year ago. It’s the highest Class I base price since January 2023.

Class I base with zone differentials: Class I zone differentials are added to the base price at principal pricing points to determine the actual Class I price in each FMMO. With those additions, July Class I prices will average approximately $23.93 per cwt across all FMMOs, ranging from a high of $26.51 per cwt in the Florida FMMO to a low of $22.91 per cwt in the Upper Midwest FMMO.

Class I mover formula: For the first month since last October, the 2018 Farm Bill change to the Class I pricing formula paid a small dividend for producers. The spread in the monthly advanced Class III skim milk pricing factor ($7.72 per cwt) and advanced Class IV skim milk pricing factor ($8.93 per cwt) narrowed for July to $1.21 per cwt, the smallest gap since October 2023.

Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would also have resulted in a Class I base price of $20.97 per cwt, about 14 cents less than the actual price determined using the average-of plus 74 cents formula.

- Cattle: The USDA’s June 2024 Cattle on Feed report showed 11.6 million cattle and calves on feed for the slaughter market in the country on feedlots with capacity of 1,000 or more head, slightly below the June 2023 report.

After a relatively slow April, May feedlot placements totaled 2.05 million head, 4% above 2023. Net placements were 1.98 million head.