Improved ingredient sales, particularly to Southeast Asia, helped U.S. dairy export volume post its fifth straight month of growth in January, and dairy replacement heifer sales also started the year strong.

Looking at dairy product exports, here’s the latest information from the U.S. Dairy Export Council (USDEC):

- Volume basis: U.S. suppliers shipped 184,033 tons of milk powders, cheese, whey products, lactose and butterfat during the month, 21% more than the same month a year earlier.

A 114% jump in nonfat dry milk/skim milk powder sales to Southeast Asia was led by increased purchasing from Indonesia, the Philippines and Vietnam, and regional sales of whey and lactose sales into Southeast Asia were up 17% and 19%, respectively. Overall year-over-year whey product sales were up 18% in January, and sales to China were the highest in more than a year.

U.S. lactose exports were up 16% in January, with Southeast Asia and New Zealand helping offset declines to China and Mexico. Cheese exports were up fractionally in January compared with a year ago. U.S. exports saw gains in Mexico and Southeast Asia but lost sales in Japan and South Korea.

-

Value basis: The value of all dairy exports In January was $554.8 million, up 29% from a year earlier and the highest figure in nearly five years. The value of exports to Southeast Asia more than doubled last year’s total, topping $100 million for the first time since May 2015.

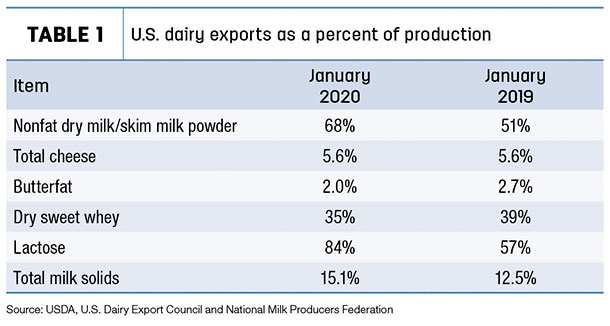

- Total milk solids basis: U.S. exports were equivalent to 15.1% of U.S. milk solids production in January 2020 (Table 1). That’s the highest percentage for the month of January on record and up from 12.5% in January 2019.

Dairy heifer exports strong

The U.S. isn’t just finding a market for dairy products. U.S. dairy heifer exports started 2020 strong, with more than 5,000 head finding new homes internationally. January exports totaled 5,019 head, the highest total for any month since March 2014. The heifers were valued at just over $12 million, the highest total since December 2017.

Egypt (2,738 head) and Vietnam (1,650 head) were the leading destinations for U.S. heifers in January, with Mexico (432), Thailand (147) and Canada (52) rounding out total shipments.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said the USDA numbers are still undercounting actual dairy heifer exports and forecasts February sales reports to reflect that. However, he expected sales will drop quickly until fears related to the coronavirus blow over.

Heifer health protocols remain unresolved under Phase I of the U.S.-China agreement, and Clayton said he believes that once resolved, heifer shipments there will be measured in smaller plane loads rather than larger ship loads of heifers.

Hay exports at 24-month low

After setting a new record high in 2019, U.S. alfalfa hay export volumes started the new year weaker, even before the full force of the coronavirus. January shipments totaled 177,977 metric tons (MT), the lowest monthly total in 24 months. Japan was the leading market for U.S. alfalfa hay at 54,397 MT. At 47,836 MT, sales to China were the lowest to that country in 11 months. Other leading destinations were Saudi Arabia, South Korea and United Arab Emirates.

Like alfalfa, January exports of other hay were a 24-month low at 105,386 MT. Japan continued to be the leading buyer at 61,679 MT, with South Korea taking 24,681 MT.

For more on hay exports and market conditions, check out Progressive Forage’s Forage Market Insights update.

Ag trade balance

Overall, January 2020 U.S. ag exports were valued at $11.44 billion, while ag imports were estimated at $11.67 billion, resulting in a $233.5 million ag trade deficit. In year-to-date fiscal year 2020 (October 2019 – January 2020), the ag trade surplus stands at about $4.4 billion.

Other dairy trade news

- How will Phase 1 of the U.S.-China trade agreement impact dairy exports? Dairy consultant John Geuss, a regular contributor to Progressive Dairy, discussed some of the issues in a recent blog post, "What will the China trade agreement do for milk producers?"

- Connecticut dairy farmer James “Cricket” Jacquier provided a dairy producer perspective on agricultural trade during a House Committee on Agriculture’s Subcommittee on Livestock and Foreign Agriculture hearing, March 10.

Jacquier, Agri-Mark cooperative board chair, operates LaurelBrook Farm, a fourth-generation, 1,500-cow dairy in East Canaan, Connecticut. The business involves his wife, Jennifer, and son Colby, along with his brother, father and two nephews.

In his testimony, Jacquier urged Congress to work with the Trump administration to use negotiating resources wisely to target important agricultural markets and create greater access for U.S. dairy products with key trading partners. He noted attention to the implementation and enforcement of negotiated trade agreements, such as U.S.-Mexico-Canada Agreement (USMCA), will be critical in the coming year.