The calendar has turned to autumn and with it brought some seasonal changes in milk production, components and prices. Something that hasn’t changed much are Class IV milk volumes in Federal Milk Marketing Order (FMMO) pools, a situation that might last for years to come.

Administrators of the 11 FMMOs reported September 2023 prices and pooling data, Oct. 11-14. Here’s Progressive Dairy’s monthly review of the numbers to provide some additional transparency to your milk check.

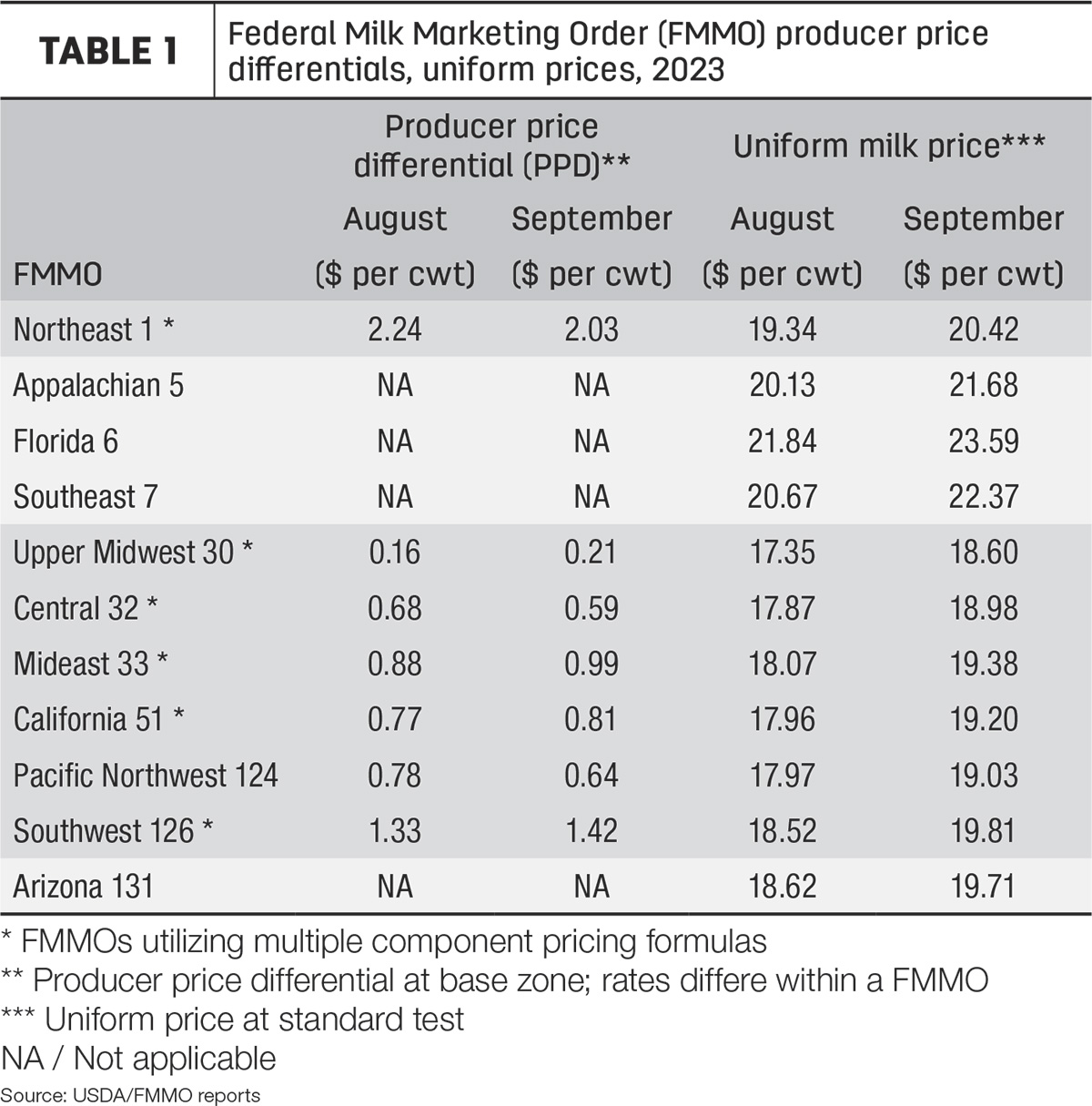

Uniform prices, PPDs

Compared with August, September 2023 statistically uniform milk prices were higher in all 11 FMMOs (Table 1). Those FMMOs with highest Class I milk utilization rates showed the greatest increases.

The highest uniform price for the month was in Florida at $23.59 per hundredweight (cwt), with the low in the Upper Midwest at $18.60 per cwt. In a majority of FMMOs, September uniform prices were the highest since February.

September baseline producer price differentials (PPDs) were mixed in a narrow range across all applicable FMMOs (Table 1), with a high of $2.03 per cwt in the Northeast to a low of 21 cents in the Upper Midwest. PPDs have zone differentials, so actual amounts will vary within each FMMO. And milk handlers may apply “market adjustment factors” differently on your milk check.

Class prices for September

- Class I base price: At $18.90 per cwt, it was up $2.28 from August but still $4.72 less than September 2022.

- Class I base with zone differentials: Class I prices averaged approximately $21.72 per cwt across all FMMOs, ranging from a high of $24.30 per cwt in Florida to a low of $20.70 per cwt in the Upper Midwest.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($7.15 per cwt) and advanced Class IV skim milk pricing factor ($8.64 per cwt) was $1.49 per cwt, the narrowest spread since May. Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would also have resulted in a Class I base price of $18.90 per cwt, equal to the actual price determined using the average-of plus 74 cents formula.

- Class II milk price: At $19.98 per cwt, the September Class II milk price was up 7 cents from August and the highest since February, but $6.53 less than September 2022.

- Class III milk price: At $18.39 per cwt, the Class III milk price rose $1.20 from August and is the highest since January. It was still $1.43 less than September 2022.

- Class IV milk price: At $19.09 per cwt, the September 2023 Class IV milk price was up 18 cents from August and is also the highest since January but is $5.54 less than September 2022.

- Class III-IV milk price spread: Affecting FMMO pooling, the September 2023 Class IV milk price was 70 cents more than the month’s Class III milk price. While the narrowest spread since April, it didn’t eliminate the incentives for Class IV depooling.

Component values, tests

Contributing to the September milk class price calculations in the seven FMMOs utilizing component pricing (Northeast, Upper Midwest, Central, Mideast, California, Pacific Northwest and Southwest), values of both protein and butterfat value increased again. The value of milk protein jumped nearly 22 cents from August to about $2.30 per pound, the highest since April. The value of butterfat rose about 10.5 cents to $3.13 per pound, the highest since December 2022 and the second straight month above $3 per pound.

The value of nonfat solids dipped slightly to about 94 cents per pound, while the value of other solids increased 0.3 cent, to 9.9 cents per pound.

Butterfat and skim values also rose in the four FMMOs utilizing skim-fat pricing: Appalachian, Florida, Southeast and Arizona.

Affecting statistical uniform prices “at test,” September average butterfat and protein tests in pooled milk were up substantially in FMMOs providing preliminary data.

Pooling totals

September Class I pooling was down about 38 million pounds from August. At 3.38 billion pounds, it represented about 26% of total milk pooled. Class II pooling was up 70 million pounds, to 1.35 billion pounds, representing about 10.3% of the total pooled.

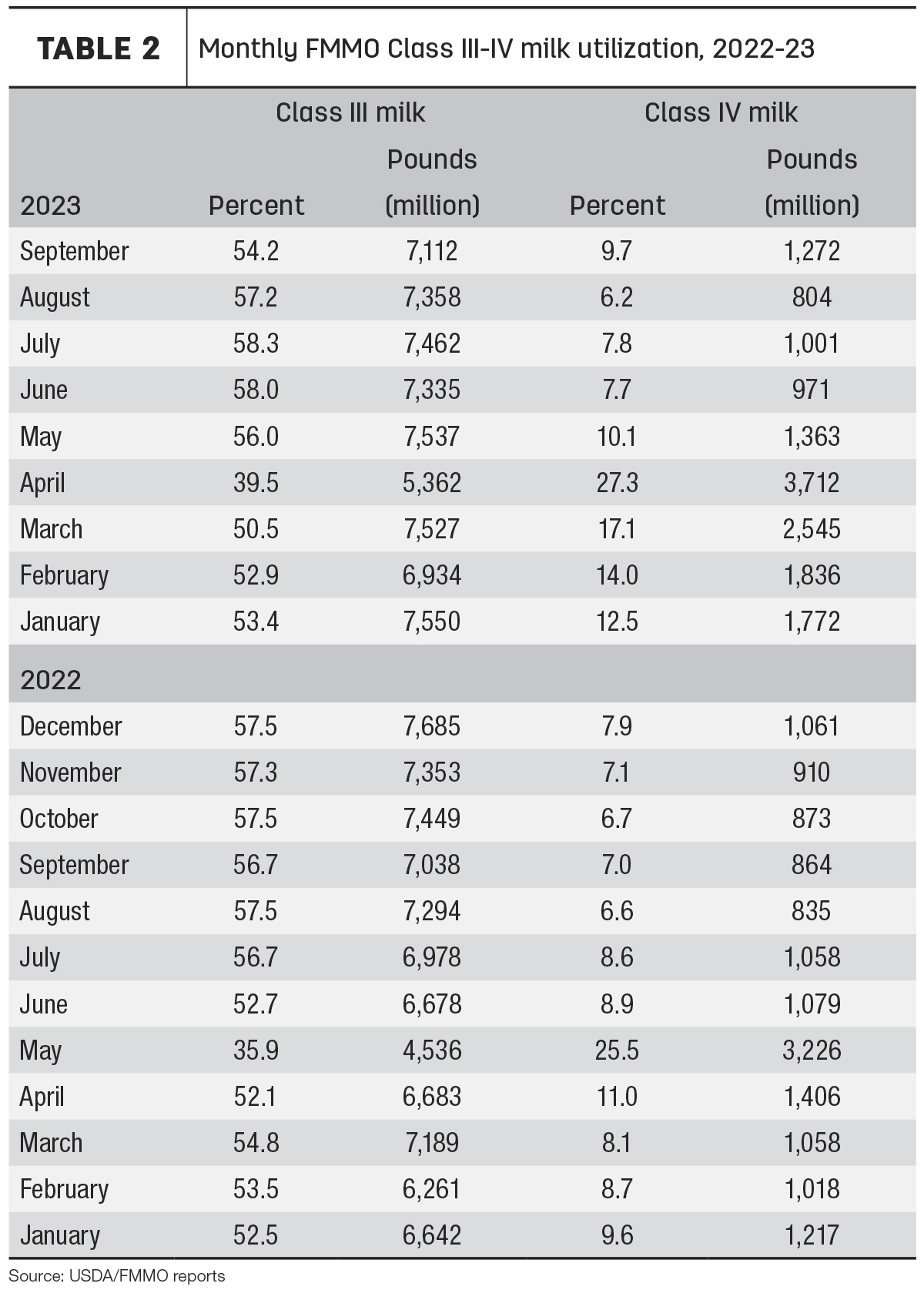

Compared to a month earlier, September brought a little less Class III milk to the pool, while pooling of higher-value Class IV milk increased slightly. At 7.11 billion pounds, Class III pooling represented about 54.2% of the total pool (Table 2). Class IV pooling increased from August to 1.27 billion pounds and represented 9.7% of the total milk pooled (Table 2), both four-month highs.

The USDA releases September milk production estimates on Oct. 19. Based on the FMMO data, the volume of milk pooled during the month was 13.11 billion pounds, up about 254 million pounds from August.

The percentage of monthly U.S. milk production marketed through FMMOs has slumped since peaking at more than 75% in March. That percentage slipped to about 67% to 68% in May through August.

Looking ahead

Milk price relationships are changing again as butter and cheese prices diverge. October 2023 uniform prices and pooling totals will be announced around Nov. 11-14. Based on FMMO advanced prices and current futures prices, milk prices could be mixed:

- Class I base price: Already announced, the October advanced Class I base price is $19.47 per cwt, up 57 cents from September but is still $3.24 less than October 2022.

- Class I base with zone differentials: Adding zone differentials, October Class I prices will average approximately $22.29 per cwt across all FMMOs, ranging from a high of $24.87 per cwt in the Florida FMMO 6 to a low of $21.27 per cwt in the Upper Midwest FMMO 30.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($8.20 per cwt) and advanced Class IV skim milk pricing factor ($8.55 per cwt) is 35 cents per cwt, the narrowest spread since June 2022. Based on Progressive Dairy calculations, the Class I mover calculated under the “higher-of” formula would also have resulted in a Class I base price of $18.92 per cwt, about 55 cents less than the actual price determined using the average-of plus 74 cents formula.

- Other class prices: October Class II, III and IV milk prices will be announced on Nov. 1. As of the close of trading on Oct. 13, the October Chicago Mercantile Exchange (CME) Class III milk futures price closed at $16.84 per cwt, a $1.55 drop from September and the lowest since July. In contrast, the October Class IV milk futures price closed at $21.59 per cwt, up 2.50 from September.

- Class III-IV milk price spread: If those futures prices hold, the October Class III-IV spread grows to $4.75, the widest spread since mid-2022 and supplying even greater incentives for Class IV depooling.

Long-term relationship?

Based on current Class III-IV milk futures prices, that spread narrows to about $1 per cwt in 2024, still enough to create incentives for Class IV depooling. And with more large-scale commodity cheese plants coming online in 2024-25, total cheese production has the potential to dampen cheese prices, continuing the cheese/butter and Class III/IV milk price relationships further.

Read: Could FMMO protein price become negative?, featured in the September National All-Jersey Equity Newsletter.