I’m a child of the 1980s farm crisis and my parents were children of the Great Depression. The ethic born of those two experiences was that debt was evil, and if you must use debt, then pay it off quickly. Sacrifice, do without, fix it, jerry-rig it if you must, but don’t use debt!

That ethic is not wrong when debt is used to purchase cars, boats, vacations or other reasons that return zero profits. However, using debt to build more efficient infrastructure, upgrade technology or increase profitable activities is a different story. If used for the right purposes and managed well, debt can be a great tool for increasing profits. However, tools can be misused. Just like using pliers to pound in a nail usually doesn’t work so well, debt can be a double-edged sword that is a drag on profitability. This article dives into the math of debt to show its value or its curse on profitability.

Math of debt

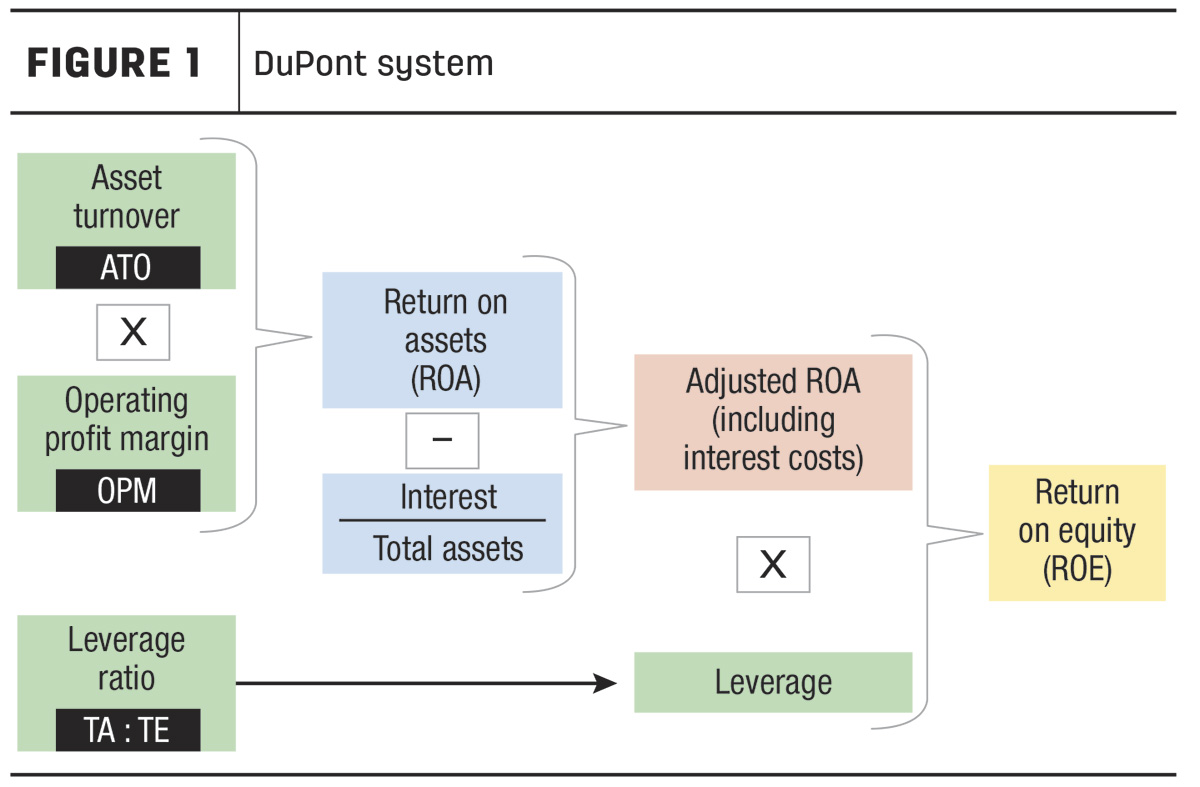

The DuPont system for financial analysis (Figure 1) shows the components and math of the profit metric, return on equity (ROE), which is the profit return to the owner’s equity investment in the business. The DuPont system begins on the left side of Figure 1 with the three primary levers of profitability, each of which can be measured using a financial ratio.

- Asset turnover ratio (ATO) measures how well assets are put to work to create gross revenues.

- Operating profit margin (OPM) ratio measures how well inputs are managed to create efficiency – that is, how much of the gross revenues are kept after expenses are paid.

- Leverage ratio measures the level of debt versus equity financing – the greater the debt, the greater the leverage ratio.

The third lever, leverage, is often called an equity multiplier and Figure 1 shows the reason why. Multiplication of the first two profit levers, asset turnover and operating profit margin, result in return on assets, a common “operating” profit measure. However, interest is not an operating expense and thus not included in return on assets. Therefore, an adjustment is made by subtracting interest from return on assets to give an adjusted return on assets (Figure 1) where interest costs are included.

The final step brings in the leverage ratio. When the adjusted return on assets is multiplied by the leverage ratio, the result is return on equity. The mathematical operation of multiplying these two ratios is where the term “equity multiplier” comes from.

Implications of debt use

Some readers may be scratching their head right about now wondering if what they read is correct. The math shows that the more percent debt an operation has, the higher the leverage ratio, and the higher the leverage ratio, the higher the return on equity. Said another way, if an operation wants to increase profitability, then they only need to have more debt. Is that really true?

Well, yes, sort of, sometimes, but not sometimes, definitely no other times, actually it depends. Sounds like an economist’s answer! The math is correct, but remember another math fact: Multiplication of a negative number with a positive one results in a greater negative answer.

There are two problems. The first is: If return on assets is negative to start with, which it surely can be at times, then the adjusted return on assets will be negative and, when multiplied by a positive leverage ratio, results in a greater negative return on equity. The second problem is: If interest expenses are too high relative to return on assets, then even if return on assets is positive, the adjusted return on assets can still be negative when interest is subtracted. The result is, again, an even greater negative return on equity.

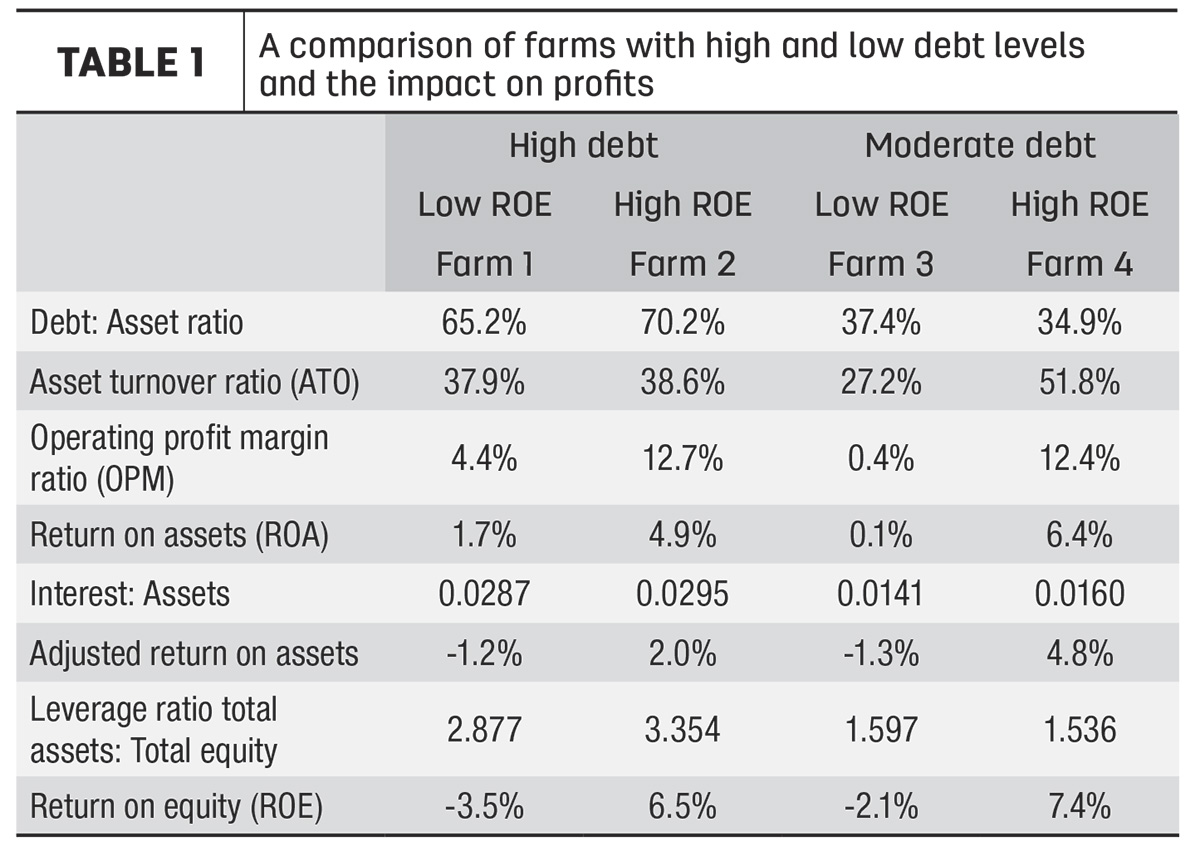

So the math is correct, the equity multiplier indeed multiplies profits, but it can be multiplied either more positively or negatively. Table 1 includes four farms from a year that was not friendly for dairy profits.

Farms 1 and 2 both had high debt as shown by the debt-to-asset ratio being in the 65% to 70% range (30% to 35% equity for those who think better in percent equity terms). Farm 1 had a return on assets of 1.7%, but the interest deduction was greater and thus the adjusted return on assets was negative. When multiplied by the leverage ratio, it resulted in a greater negative return on equity. Farm 2 had high debt as well (70.2% debt-to-asset), but it was able to manage its way to a higher return on assets that, even when interest was deducted, still resulted in a positive adjusted return on assets. When multiplied by the leverage ratio, the result was an even greater and positive return on equity. Both farms were high-debt, the difference was that Farm 2 managed its debt-financed capital in a way that returned greater profitability than the interest paid for that debt.

Farms 3 and 4 show a similar comparison, but in this case both farms had relatively low debt (35% to 37% debt-to-asset). While both had relatively low debt, Farm 4 used its debt-financed capital to create greater profitability than interest paid, while Farm 3 did not. The results of each set of farms show the double-edged sword of using debt.

Final food for thought

The key that most farmers intuitively know is: If the debt-financed capital is managed in a way that results in a higher profit return than the interest paid on the debt, then the leftover is additional profits. In this situation, debt supported greater profitability. However, if the profit return is less than interest paid, then the portion of interest not covered must be subsidized from somewhere else in the operation. In this situation, debt further eroded profitability.

So it is not a question of whether debt is good or bad; it is a question of how it is used and managed. Is it for assets, technologies, automation or better infrastructure that increases productivity, decreases costs or both to result in more profits than interest paid? Or is the debt for covering losses, restructuring of old loans or assets that have not resulted in profitable returns?

Like many decisions in the dairy business, using debt comes with opportunity and risk. Profitable farms take risks, but they are calculated risks and steps are taken to mitigate the risk.

- Has due diligence and sensitivity analysis been done to better understand best- and worst-case scenarios?

- Have efforts been taken to mitigate worst-case scenarios, such as employee training, standard operating procedures, maintenance protocols, marketing, monitoring and contingency planning?

- Have estimated revenues and expenses been stress tested?

- Has maintenance and replacement costs and timing been appropriately estimated?

- Is debt service self-liquidating? Do profits from the debt financed activities cover the debt service?

When your management mind turns on tomorrow morning after your first cup of coffee, don’t be afraid of using the tool of debt financing. Each of us has different levels of comfort. However, if we recognize that its opportunity also includes risk and manage the risk accordingly, then we will have increased the probability of a good outcome. Even Mom and Dad utilized debt financing now and then.

This article is provided for information purposes only. Readers should consult their own professional advisers for specific advice tailored to their needs. Information contained in this article may be subject to change without notice.