Federal Milk Marketing Order (FMMO) regional uniform milk prices were mixed in November, with prices continuing to slip from September peaks in many marketing areas.

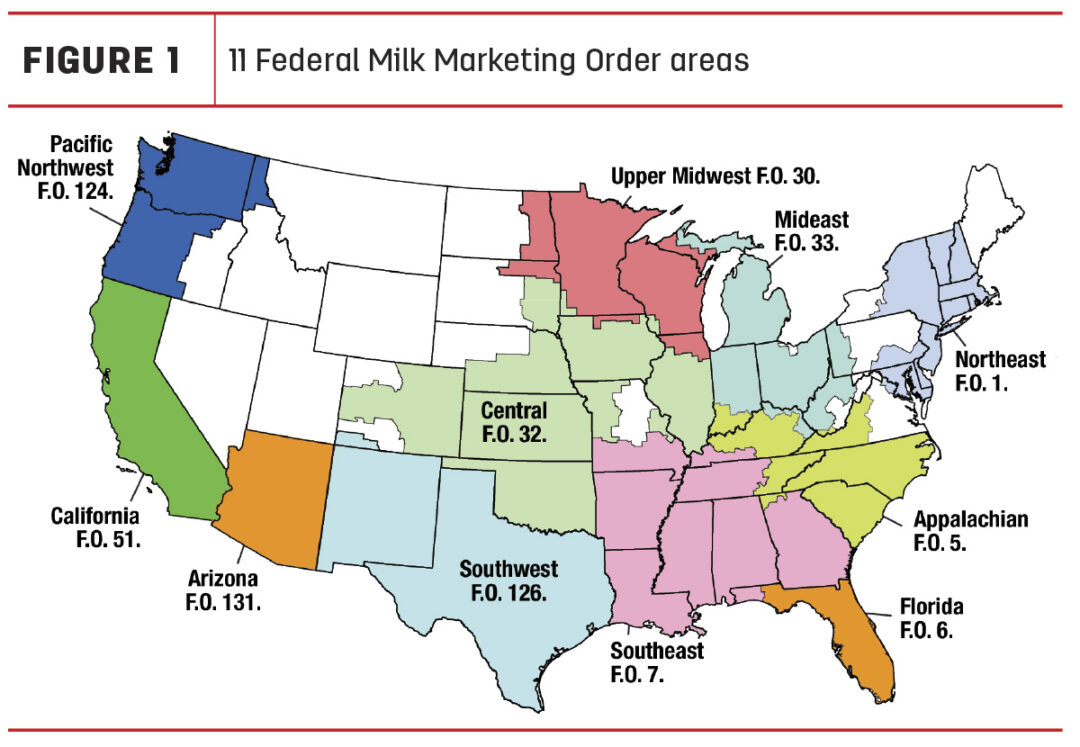

Administrators of the 11 FMMOs reported November prices and pooling data, Dec. 11-14. Here’s Progressive Dairy’s monthly review of the numbers to provide some additional transparency to your milk check.

Uniform prices, PPDs

Compared with October, November 2024 statistically uniform milk prices declined again in eight of 11 FMMOs, while those with highest fluid Class I milk utilization posted small increases (Table 1). Among individual orders, the top average was $26.79 per hundredweight (cwt) in Florida, up 17 cents from October and the highest since December 2022. The low average was in the Upper Midwest FMMO at $20.33 per cwt, down $2.05 from October and a four-month low.

Compared to October, November base producer price differentials (PPDs) were up in all applicable FMMOs (Table 1), in most cases by more than $2 per cwt. PPDs have zone differentials, and milk handlers may also apply PPDs and other “market adjustment factors” differently on your milk check.

Class prices for November

Milk class prices were mixed in November, with declines in Class I and Class III milk prices partially offset by higher prices for Class II and Class IV milk.

- Class I base price: After hitting a two-year high in October, the advanced Class I base price dipped to $22.53 per cwt, down 64 cents from October but still $2.78 more than November 2023.

- Class I base with zone differentials: Class I zone differentials are added to the base price at principal pricing points to determine the actual Class I price in each FMMO. With those additions, November Class I prices averaged approximately $25.35 per cwt across all FMMOs, ranging from a high of $27.93 per cwt in the Florida FMMO to a low of $24.33 per cwt in the Upper Midwest FMMO.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($12.66 per cwt) and advanced Class IV skim milk pricing factor ($10.47 per cwt) widened for November to $2.19 per cwt. That means that the current Class I mover formula negatively impacted Class I prices.

Based on Progressive Dairy calculations, using the Class I mover calculated under the “higher-of” formula would have resulted in a Class I base price about 34 cents more than the actual price determined using the “average-of plus 74 cents” formula.

- At $21.52 per cwt, the November Class II milk price was up 51 cents from October and 31 cents more than November 2023.

- The November Class III milk price fell $2.90 from October to $19.95 per cwt. That is still up $2.80 from November 2023 but the lowest since July 2024.

- At $21.12 per cwt, the November 2024 Class IV milk price was up 22 cents from October and was 25 cents more than November 2023.

Affecting FMMO pooling, the November 2024 Class IV milk price jumped to $1.17 per cwt more than the Class III milk price, again providing incentives for depooling Class IV milk.

Component values, tests

Contributing to the November milk class price calculations, value changes for butterfat and protein were both down from a month earlier.

The value of butterfat fell 2.25 cents per pound from October, to about $3.06 per pound. It’s the lowest since January.

Meanwhile, the value of milk protein plummeted more than $1 per pound from October, to less than $2.32 per pound, the lowest since August 2024.

The value of nonfat solids was up about 3.5 cents at $1.20 per pound, while the value of other solids rose more than 3 cents, to 40 cents per pound.

Affecting statistical uniform prices “at test,” November average butterfat and protein tests in pooled milk were higher compared to October in many FMMOs providing preliminary data. Somatic cell counts were also down slightly, providing additional price support. Butterfat, protein and somatic cell count premiums will help offset some of the declines in uniform prices.

Pooling totals

The USDA releases preliminary November milk production estimates on Dec. 19. Despite one less marketing day compared with October, the total milk volume pooled through FMMOs in November was estimated at 11.75 billion pounds, about 880 million pounds more than the prior month. All of that increase – and more – was powered by Class III milk volume. With the Class III-IV milk price gap, November brought more Class III milk to the pool, but Class IV milk volume was again lower (Table 2).

November Class I pooling was down about 166 million pounds from the previous month. At 3.43 billion pounds, it represented about 29% of total milk pooled. Class II pooling was down about 439 million pounds, to 1.44 billion pounds, representing about 12.2% of the total pooled.

At 5.52 billion pounds, Class III pooling was up 2.7 billion pounds from October and represented about 46.9% of the total pool. Both volume and percentage were highest since August.

In contrast, November 2024 Class IV pooling decreased about 1.23 billion pounds from October, to about 1.37 billion pounds, and represented 11.6% of the total milk pooled. Both volume and percentage were the lowest since August.

Looking ahead

December uniform prices and pooling totals will be announced on Jan. 11-14. Based on FMMO advanced prices and current futures prices, monthly uniform prices are headed lower to close out the year.

- Class I base price: Already announced at $21.43 per cwt, the December 2024 advanced Class I base price is down $1.10 from November 2024. Despite the decline, the December price is still $1.67 per cwt above December 2023.

With the December price, the 2024 average Class I base price was $20.35 per cwt, up $1.15 from a year ago and the third-highest annual average in the past decade. Previous high annual averages were $23.66 per cwt in 2022 and $23.29 per cwt in 2014.

- Class I base with zone differentials: Class I zone differentials are added to the base price at principal pricing points to determine the actual Class I price in each FMMO. With those additions, December Class I prices will average approximately $24.25 per cwt across all FMMOs, ranging from a high of $26.83 per cwt in the Florida FMMO to a low of $23.23 per cwt in the Upper Midwest FMMO.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($9.70 per cwt) and advanced Class IV skim milk pricing factor ($10.77 per cwt) narrowed to $1.07 per cwt for December. That means that the current Class I mover formula positively impacted Class I prices slightly, and for the fourth time in the second half of the year.

Based on Progressive Dairy calculations, using the Class I mover calculated under the higher-of formula would have resulted in a Class I base price about 21 cents less than the actual price determined using the average-of plus 74 cents formula.

For the year, the preliminary Class I price under the average-of formula was about 55 cents less than the price calculated under the higher-of formula. A change in the formula back to higher-of calculations is included in the FMMO modernization proposal.

- Other class prices: December Class II, III and IV milk prices will be announced on Jan. 2. As of trading on Dec. 13, the Chicago Mercantile Exchange (CME) Class III milk futures price closed at $18.76 per cwt for December, down $1.19 from the November price. The December Class IV milk futures price closed at $20.75 per cwt, down 37 cents from November.

If Class III-IV futures prices hold, the December Class III-IV milk price gap will climb to $1.99 per cwt, offering a growing incentive for Class IV depooling.

Finally, with December estimates, the 2024 Class III milk price will average $18.91 per cwt, up $1.89 from the 2023 average. The 2024 Class IV milk price will average $20.75 per cwt, up $1.63 from the 2023 average. The 2024 Class I milk base price averaged $20.35 per cwt, up $1.15 from the 2023 average.

Other information

- The USDA Agricultural Marketing Service (AMS) released their FMMO final decision on Nov. 12, which will be voted on by dairy producers in a referendum before the end of the year. Ballots must be postmarked by Dec. 31. Read: FMMO modernization: USDA releases final decision, goes to producer referendum

- The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report was released on Dec. 10. The milk production forecasts for both 2024 and 2025 were raised from last month. As a result, annual average milk price projections for both years were lowered slightly. Read: USDA projections highlight increased milk production

Check the Progressive Dairy website later this month for milk production, cull cow marketing, risk management and Dairy Margin Coverage (DMC) program margin updates.