You may recall the fortune tellers who made headlines this past spring for admitting fortune telling was just a scam. Perhaps now we can definitively say that, when it comes to predicting the future, you just never know.

Back in spring of this year, we saw lots of confident predictions about future feed prices. Again, the truth is: You just never know.

So what should you do when trying to build a profitable business that relies in part on the markets, and you just never know what the market is going to do?

Try scenario planning. It’s a process for thinking through all feed and milk price possibilities and planning strategies accordingly. It’s especially helpful when:

1. There’s a great deal of uncertainty in a market.

2. There is a history of costly surprises in the market preceding the current trend.

3. There is significant and ongoing change present that could result in any number of future scenarios.

How to scenario plan

There are four basic steps to scenario planning – and a lot of hard work.

Step 1

Analyze possible price scenarios based on fundamental and technical analysis. Add in what-if scenarios that could also happen.

Step 2

Develop marketing strategies for each possible price scenario. Set trigger points, or signals, for a particular scenario unfolding.

Step 3

Do the math. What will the impact of those strategies be on your overall price?

Step 4

Repeat. What you’re doing is looking for any holes in your planning and plugging them. Scenario planning involves constant updating.

Applying scenario planning – May 2015

To help illustrate why it is often the smartest approach to take for price risk management, let’s look back at feed prices in 2015 through a scenario planning lens.

In May of this year, dairy producers in general did not have feed price worries. Crop condition reports were positive. Low feed prices seemed destined to go lower.

It was time to ask, “What if?” What if the weather turned and became hot and dry over summer? What if the price in May was the season low?

As a scenario planner, you would first consider that, just maybe, corn prices were at their low right then. True, the season low typically arrives near harvest. However, years which produced the biggest price rallies in corn have been when a price low was hit in the May-June time frame.

We saw this in 2002, 2010 and 2012. The average corn price ended up rallying about 35 percent above the Jan. 1 high.

By May of 2015, the market was trending in a pattern that made it possible again.

There were reasons for those past rallies. We saw a gradual building of bearish expectations from January through May. Prices were sensitive because all risk premium had been eroded. Weather forecasts indicated possible hot or dry conditions for key crop development time frames. This year, we saw all of that, plus hedge funds were bearishly positioned on corn.

All we needed for a dramatic price rally was the first sign of a weather event.

This is where scenario planners pulled out their calculators. The corn price was hovering around $3.70. The lowest price in recent years was $3.02 in 2009. If prices were to fall that low, you would have had a $0.70-per- bushel downside risk. Conversely, if they rallied 35 percent like the three years mentioned earlier, your upside risk was much more significant.

It was a compelling risk-reward ratio that suggested May was a good time to purchase feed.

June 15 – enter the USDA

Things can change fast. A scenario for higher prices at harvest due to less-than-favorable weather and crop conditions began unfolding when the USDA released its weekly crop progress report on June 15.

Subsequent reports added fuel for higher prices. The June 30 USDA reports indicated lower-than-expected stocks as well as fewer planted acres than anticipated. We saw a sharp rise in price from $3.62 at the beginning of June to $4.36 by July 1.

You also had to consider a scenario with rapid price acceleration. A weather-driven run-up in prices could have gained steam fast if end users panicked and started buying a lot of feed.

Of course, you still had to keep in mind the prevailing scenario for low prices at harvest. This was what was on the minds of most.

No one could predict whether any of these scenarios would come to pass. However, a look at history would have shown you what was possible:

- In 1993, growers experienced a wet spring. The low in corn arrived in June. Prices spiked on weather fears in July, then rose dramatically once the crop yield was well understood.

- In 2010, the weather was both hot and wet. We got the low in corn during June. Prices climbed into harvest.

During mid-summer this year, uncertain crop conditions and tight stocks suggested we had achieved the price low during the May-June time frame.

August USDA corn yield estimate

After the USDA’s August corn yield estimate was released at 168.8 bushels per acre, corn prices dropped $0.19. It would have been easy to believe prices would continue to drop and, as a feed buyer, assume things would only get better.

A scenario planner would have questioned whether 168.8 bushels per acre was too high. To that point, the growing season wasn’t great across all of the U.S. You had to wonder if states with ideal crop conditions could make up for states that were lagging.

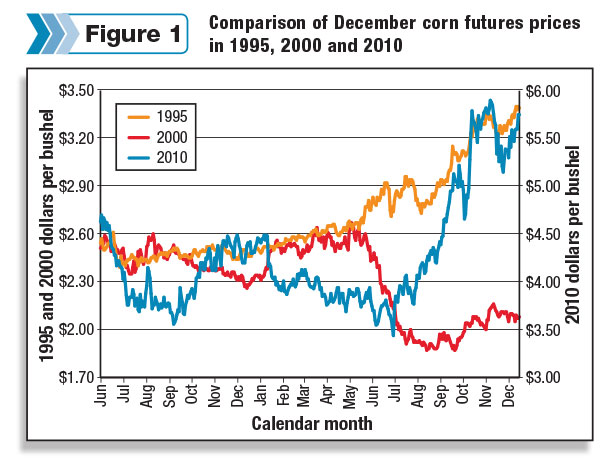

Additionally, the USDA had backpedaled before on its August yield estimate, mostly notable in 1995, 2000 and 2010. Figure 1 shows these years and how the December corn futures contract price increased as the end of the year approached.

As it turned out, the USDA lowered its September corn yield estimate for 2015-2016 to 167.5 bushels per acre. As of this writing, we still have to wait and see where the actual yield ends up.

Scenario planning offers flexibility

Market ups and downs can be unnerving. They cause producers to make decisions in the heat of a market move, based on emotion, without any forethought as to how that decision will play out. Or they cause people to freeze, hoping more information will provide greater clarity. The problem is this: By the time more information arrives, price opportunities have passed.

With scenario planning, you avoid both of those situations.

It is true that, as a scenario planner, you will put in a lot of work. Many of your action plans will sit on a shelf until needed or never be implemented. That’s OK. It’s better to be prepared and ready to take decisive action than to be caught off-guard and make poor decisions in the heat of a market move. PD

-

Matt Mattke

- Commodity Analyst

- Stewart-Peterson Inc.

- Email Matt Mattke