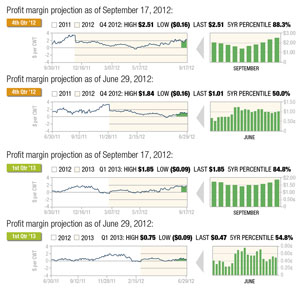

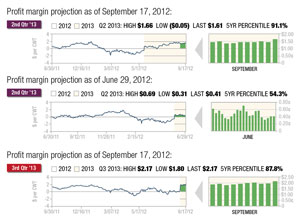

Contrary to what many may have believed to be the case given the circumstances, projected forward profit margins for dairy producers actually improved over the summer as the increasing value of milk has more than offset surging feed prices due to this year’s historic drought. This puts dairies in an enviable position relative to their counterparts in the swine and beef cattle industries, where profitability at relatively high historical percentiles can presently be secured through the second half of 2013. In fact, forward profit margins currently exist at or above the 80th percentile of the past 10 years from Q4 2012 through Q4 2013 based upon our model dairy analysis.

By contrast, a model hog operation is projected to incur significant losses through Q1 2013, with only average profit margins expected through the second half of the year.

( Click here or on the image at right to view it at full size in a new window.)

The following graphs reflect both the current outlook for dairy margins through the third quarter of 2013 as well as comparison graphs to these same forward profit margin projections back in June.

Milk prices have generally been supported by strong product prices as both cheese and butter have trended higher over the summer.

In addition, poor spot margins recently have accelerated the pace of dairy cow culling, which has impacted milk production.

July milk production at 16.6 billion pounds was down 3.6 percent from June and only 0.7 percent higher than the previous year. The dairy cow herd in that milk production report was reported at 9.227 million head, down 12,000 from June and 44,000 below a high of 9.271 million head in April prior to a culling campaign that began in the late spring and ensued through the summer.

As of the week ending August 18, the dairy cow slaughter pace was running 5.1 percent above 2011; and since July, dairy producers have culled 11.7 percent more cows than they had during the same period last year. Poor spot margins have been cited for the increase in dairy cow slaughter, with the impact disproportionate to the western states where margins have been worse due to a combination of higher costs and lower prices received for milk.

So far this year, dairy cow slaughter in the western states is running 14.8 percent higher than 2011 while dairy producers in eastern states have culled 7.3 percent more cows than last year.

Meanwhile, dairy product prices remain quite firm, helping to support milk. Both cheese and butter have recently hit new highs for 2012, and there has generally been optimism that these higher values will hold.

The aforementioned culling campaign in western dairy-producing states should be supportive for butter as more production in that region goes to powder, while we are moving into a stronger demand period seasonally for both cheese and butter with school beginning and the approaching holiday period. ( Click here or on the image at right to view it at full size in a new window.)

The latest USDA Cold Storage report showed American cheese stocks July 31 totaled 634 million pounds, up 4.7 million versus June but down 14.9 million from last year. Butter stocks totaled 234 million pounds, down 11.2 million from June but up 44.2 million from July, 2011.

Despite the year-over-year gain though, analysts noted that the data reflected an earlier start to the seasonal drawdown period which was supportive.

Demand for cheese remains very strong as the annual USDA Milk: Supply and Utilization of Dairy Products report showed record U.S. consumption in 2011 for cheese varieties other than American. Recent demand for Jack cheese in particular has reportedly been robust, but Americaâs ongoing love of pizza obviously has been quite supportive for mozzarella, with pizzerias now representing 17 percent of all restaurants in the country.

Feed costs have moderated somewhat as both corn and soybeans succumb to harvest pressure and technical exhaustion after a blistering rally that lifted prices sharply over the summer. The USDAâs recent September WASDE report further reduced yield and production forecasts for both crops, although corn ending stocks increased following cuts to demand projections carried over from the previous marketing year.

While supply may fall further as more harvest results come in, it is clear that high corn prices are already accomplishing their task of rationing demand. This realization may keep a lid on further price strength for the time being, although there should be strong support as the market corrects.

Contrary to the wishes of the livestock industry, it does not appear that petitions to roll back Renewable Fuel Standards mandates will be granted, and high gasoline prices should make ethanol margins more profitable as corn costs decline. Moreover, the USDA is forecasting corn used for ethanol to contract for the first time in the new crop year, and lower DDG production that will result from the reduced ethanol grind will support prices of that co-product moving forward.

Comparatively, soybeans have a more bullish balance sheet relative to corn, but here too, the market is suffering from a certain degree of exhaustion. Early yield reports have been promising with around 10 percent of the crop harvested, and demand from China has slowed considerably as they process their own harvest and release more of their state reserve stocks into the domestic marketplace.

In addition, recent rainfall in Brazil has been quite favorable for early planting, with record production expected from South America during the upcoming season in response to historically high prices. There is a significant discount on deferred soybean and soy product prices compared to spot values because of this expectation, and that in part is why projected profit margins in 2013 are revealed currently at attractive levels.

Like corn, soybean production may fall further as more yield results come in from advancing harvest progress, and strong support should be revealed on corrections.

All told, corn production for 2012/2013 is projected down 13.2 percent from last year while ethanol production is forecast down 10 percent, which will lower DDG production as previously discussed. Soybean meal production in the new crop year is currently projected down 13 percent, and dairy producers will also have to deal with lower hay production this season.

Hay production is forecast to be down 20 percent for alfalfa and down 12 percent for all other hays. In addition to the higher price levels already reflected in the marketplace, the impact of these figures also implies that feed availability will also be a struggle for dairies moving forward into next year. This should also disproportionately affect western dairy states that do not produce their own feed and present further challenges for dairies to manage their profitability.

Fortunately, projected forward margins present an opportunity right now for dairies to protect their profitability at historically attractive levels. With margins at or above the 80th percentile of the past 10 years through 2013, it would be prudent for a dairy to help assure their profitability by securing both their feed costs and milk revenue simultaneously.

There are a variety of ways this can be accomplished both through the cash market and with exchange-traded derivatives. Regardless of the medium and the strategies employed, it is important to keep in mind that the best profit margin opportunities often present themselves well ahead of the marketing periods they will actually be realized in.

Dairies will have many challenges to manage over the next several months, but dealing with the uncertainty associated with forward profitability should not be one of them given what the market is currently offering. PD

Chip Whalen

Senior Risk Manager and Director of Education

CIH â Commodity & Ingredient Hedging LLC