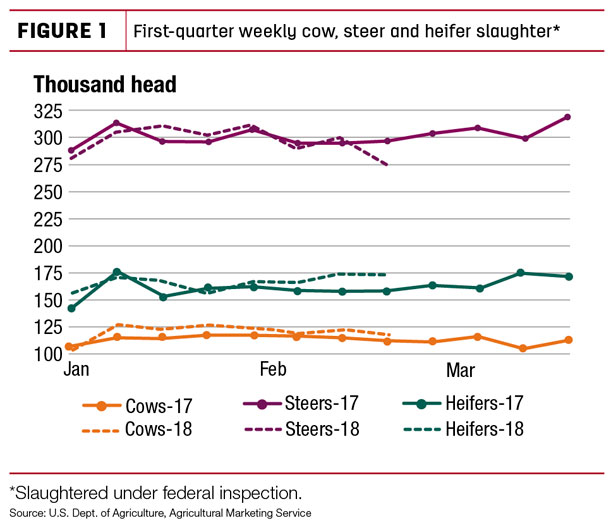

Based on USDA Agricultural Marketing Service (AMS) reporting of 2018 federally inspected slaughter through the week of Feb. 24, weekly cow and heifer slaughter was well above 2017 levels (see Figure 1). In contrast, the pace of steer slaughter remained close to last year’s levels.

As a result, year-to-date cow and heifer slaughter is up roughly 5.6 percent, but steer slaughter is 0.3 percent above the same period last year. The proportion of heifers and cows slaughtered relative to total slaughter has increased from last year, and heifers and cows are typically smaller and yield lower carcass weights than steers.

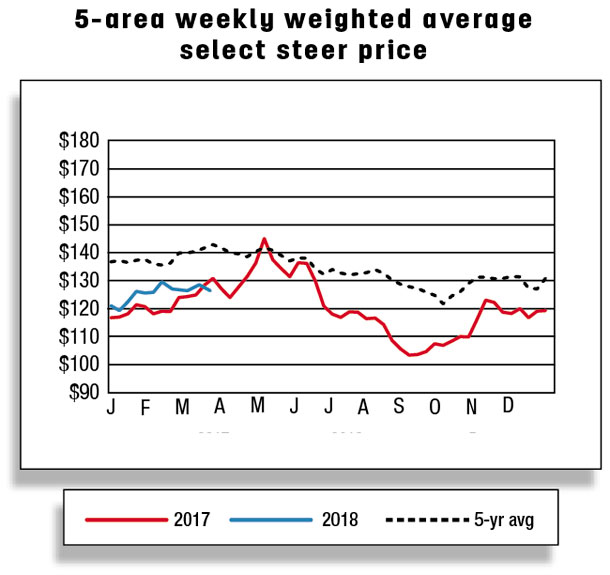

In addition, through late February, steer dressed weights were at the same level, and falling at a similar pace, to 2017 (see Figure 2).

This mix of higher cow and heifer slaughter and lighter steer dressed weights combined to push cattle dressed weights during the first quarter below expectations.

Production was also revised downward on a slower-than-expected pace of fed cattle slaughter in first-quarter 2018. To the extent that this implies a slower pace of marketing, some of those animals that might have been slaughtered in the first quarter are likely to be slaughtered in the second quarter.

For much of last year and through January 2018, the level of marketings maintained a rapid pace, with the percent of cattle on feed over 120 days below year-earlier levels. However, the pace of slaughter began to slow, and the percentage of cattle on feed over 120 days moved above year-earlier at the beginning of February.

Prices offered for fed steers in the 5-area marketing region fell nearly $4 from a mid-February daily high of $130 per hundredweight (cwt), compounding already weak margins. To the extent that these cattle are not marketed in the first quarter, they will likely add to an increased pool of slaughter-ready cattle in the second quarter, putting pressure on prices. If feedlots opt to slow marketings, weights in the second quarter may not show as strong a seasonal decline.

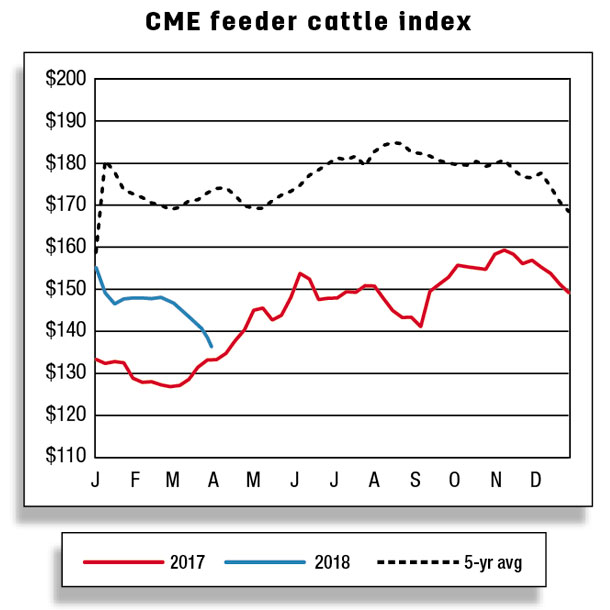

Strong feeder cattle prices may reflect availability of placements in spring 2018

Based on the latest NASS Cattle on Feed report, net placements in January were 3.7 percent higher than last year. To the extent that drought conditions in the Southern Plains have diminished pasture availability, more cattle have been placed in feedlots in late 2017 and early 2018 than in the prior year.

This likely diminishes the pool of cattle available for placement throughout first-half 2018. The price forecast for feeder steers 750 to 800 pounds was adjusted lower for the first quarter to $146 to $149 per cwt on current price movements. In the second quarter, fewer calves will likely be available for placement, which should keep prices relatively strong at $144 to $152 per cwt.

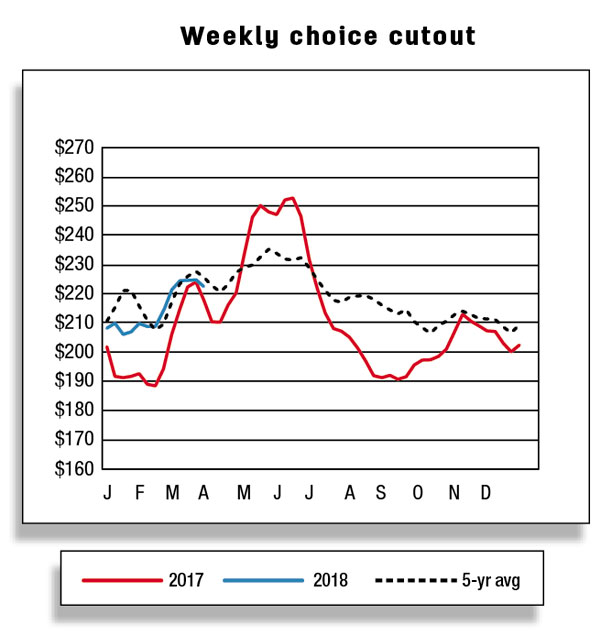

Packer margins have recently improved as wholesale beef prices stayed above 2017 levels and fed steer prices retreated from the mid-February high of $130 per cwt. Based on current cash cattle prices and expectations of wholesale beef prices expressing continued demand strength, the fed steer price forecast for the first quarter was adjusted higher to $124 to $127 per cwt.

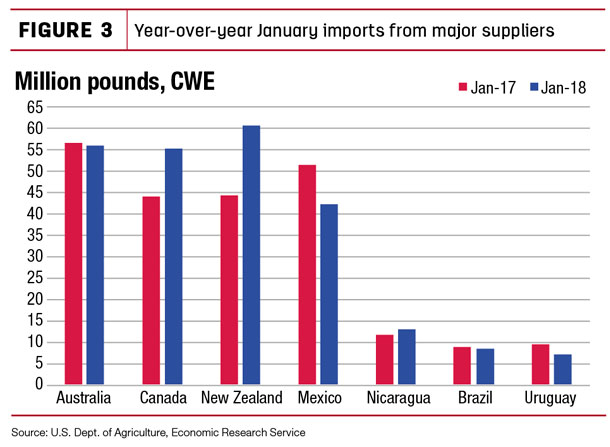

2018 beef imports revised upward, exports unchanged

U.S. beef imports in January 2018 were 248 million pounds, up 8.6 percent from January 2017. Among the major suppliers, year-over-year higher imports from Canada (+23 percent), New Zealand (+37 percent) and Nicaragua (+14 percent) more than offset the declines from Mexico (-18 percent), Australia (-0.5 percent), Brazil (-2.3 percent) and Uruguay (-25 percent) in January 2018 (see Figure 3).

Based on USDA, AMS weekly reports of Imported Meat and Poultry Passed for Entry (LSWIMPE), stronger year-over-year imports are expected in February as well. Based on the current pace of imports and strong domestic demand for lean meat in the first quarter of 2018, U.S. beef imports for 2018 were revised upward by 10 million pounds, to 3.04 billion pounds.

Australia, though still in a herd-rebuilding phase, marketed a large number of cattle in late 2017, which has diminished available cattle for marketing in early 2018. Meat and Livestock Australia (MLA), the marketing, research and development body for Australia’s red meat and livestock industry, has estimated relatively lower beef supply available in 2018.

Higher Australian feed grain prices may limit the time cattle are on feed, which could reduce dressed weights, further limiting Australia’s beef production. Agriculture and Agri-Food Canada is reporting an 8 percent year-over-year increase in Canadian beef production through the week ending Feb. 24, potentially providing a greater supply available to ship to the U.S. Next month, USDA Foreign Agricultural Service (FAS) will release updated cattle and beef forecasts, providing greater insights into how these countries will impact U.S. and global trade relations.

The 2018 beef export forecast remains unchanged at 3.025 billion pounds. January exports increased by 32 million pounds from the year-earlier level to 244 million pounds. Major export destinations recorded significantly higher U.S. beef imports: South Korea (+21 percent), Hong Kong (+53 percent) and Taiwan (+22 percent).

Demand from South Korea should remain strong as the tariff on U.S. beef was reduced to 21.3 percent, down from 24 percent in 2017, further increasing U.S. competitiveness with other beef exporters. Based on export sales reports from the USDA FAS, sales to South Korea, Hong Kong and Taiwan remained firm in February. However, U.S. exports to Canada have declined slightly in early 2018, likely due to higher beef production in Canada.

Cattle imports declined in January 2018

In January, cattle imports were at 114,276 head, 18,078 head lower than year-earlier levels. Imports declined from both Canada and Mexico. Poor pasture in the Southern Plains may have impacted imports of feeder cattle from Mexico, which tend to be lighter-weight animals and are often backgrounded prior to placement in U.S. feedlots.

Imports from Canada were lower for both feeder cattle and steers and heifers for slaughter. U.S. cattle imports from Canada will likely moderate in early 2018 as Canadian cattle production slows, due to marginal growth in cattle production, higher slaughter and growing domestic beef demand. The forecast for U.S. cattle imports was lowered to 1.905 million head. The 2018 cattle export forecast (200,000 head) is unchanged. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.