Ag producer sentiment improves despite financial pressures

Producer optimism picked up slightly in July despite continued financial pressure from higher input costs, according to results of the monthly Purdue University/CME Group Ag Economy Barometer survey. The modest rise in the index was surprising given that key commodity grain prices all weakened during the month.

Farm operators responding to the survey voiced concerns about several key issues affecting their operations, including higher input prices, lower crop prices, rising interest rates and availability of inputs. Although producers still expect sharp increases in crop input prices in 2023 compared to 2022, their views appear to have moderated somewhat, said James Mintert, the barometer's principal investigator and director of Purdue University's Center for Commercial Agriculture.

July represented the fifth month in a row in which survey respondents expressed concerns over capital and machinery investments, citing an increase in prices for farm machinery and new construction, uncertainty about farm profitability and rising interest rates.

The Ag Economy Barometer provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. The survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn/soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs. Latest survey results, released Aug. 2, reflect ag producer outlooks as of July 11-15.

A breakdown on the Purdue/CME Group Ag Economy Barometer July results can be viewed here. Find the audio podcast discussion for insight on this month’s sentiment here.

April all-milk, mailbox price spread averaged 88 cents

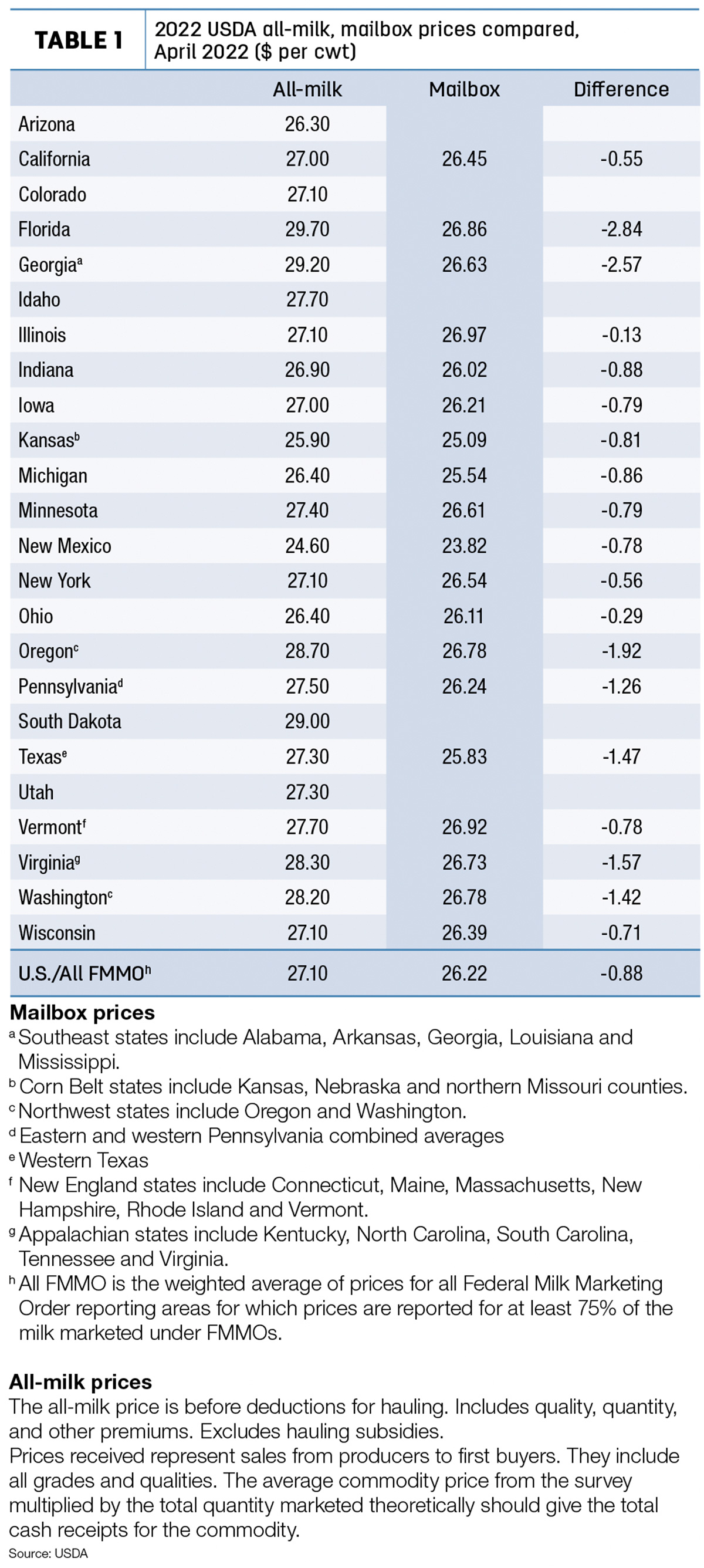

April 2022 “mailbox” prices averaged about 88 cents per cwt less than announced average “all-milk” prices for the same month, based on a preliminary look at two USDA milk price announcements.

During April, U.S. all-milk prices averaged $27.10 per cwt, up $1.20 from March 2022 and $8.50 more than April 2021.

The April 2022 mailbox prices for selected Federal Milk Marketing Orders (FMMOs) averaged $26.22 per cwt, up $1.33 per cwt from March 2022 and $8.99 more than April 2021 but 88 cents less than the announced all-milk price.

In Table 1, Progressive Dairy attempts to align the state-level all-milk prices and the FMMO marketing area prices as closely as possible. The April spread between individual states or regions varied widely, with a difference of -$2.84 per cwt in Florida and -13 cents per cwt in Illinois.

The difference in the two announced prices can affect dairy risk management, since indemnity payments under the DMC, Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price.

As Progressive Dairy notes each month, there are disclaimers. Comparing the all-milk price and mailbox price isn’t exactly apples to apples.

The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded. Prices are reported monthly by the USDA National Ag Statistics Service (NASS).

The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing. Based on latest annual data, about 61% of U.S. milk production was marketed through FMMOs in 2021. Data included in all payments for milk sold are over-order premiums; quality, component, breed and volume premiums; payouts from state-run over-order pricing pools; payments from superpool organizations or marketing agencies in common; payouts from programs offering seasonal production bonuses; and monthly distributions of cooperative earnings. Annual distributions of cooperative profits/earnings or equity repayments are not included.

Included in mailbox price costs associated with marketing milk are hauling charges; cooperative dues, assessments, equity deductions/capital retains and reblends; the FMMO deduction for marketing services; and federally mandated assessments such as the dairy checkoff and budget sequestration deductions. Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) but generally lag all-milk price announcements by a month or more.

The price announcements also reflect similar – but not exactly the same – geographic areas. The NASS reports monthly average all-milk prices for the 24 major dairy states. The mailbox prices reported by the USDA’s AMS cover selected FMMO marketing areas.

For example, while NASS reports an all-milk price for Georgia, the mailbox price lumps Georgia with other Southeast states: Alabama, Arkansas, Louisiana and Mississippi. Similarly, Kansas is part of the Corn Belt states, Oregon and Washington are combined in the Northwest states, Vermont is among six New England states, and Virginia is clustered with Kentucky, North Carolina, South Carolina and Tennessee among Appalachian states.