Here’s an update on economic factors impacting your dairy finances entering the final week of November 2023.

- Ag loan interest rates nearing 9%

- Cheese falters but GDT index unchanged

- September 2023 fluid milk sales lower

- In case you missed it

- Coming up

Ag loan interest rates nearing 9%

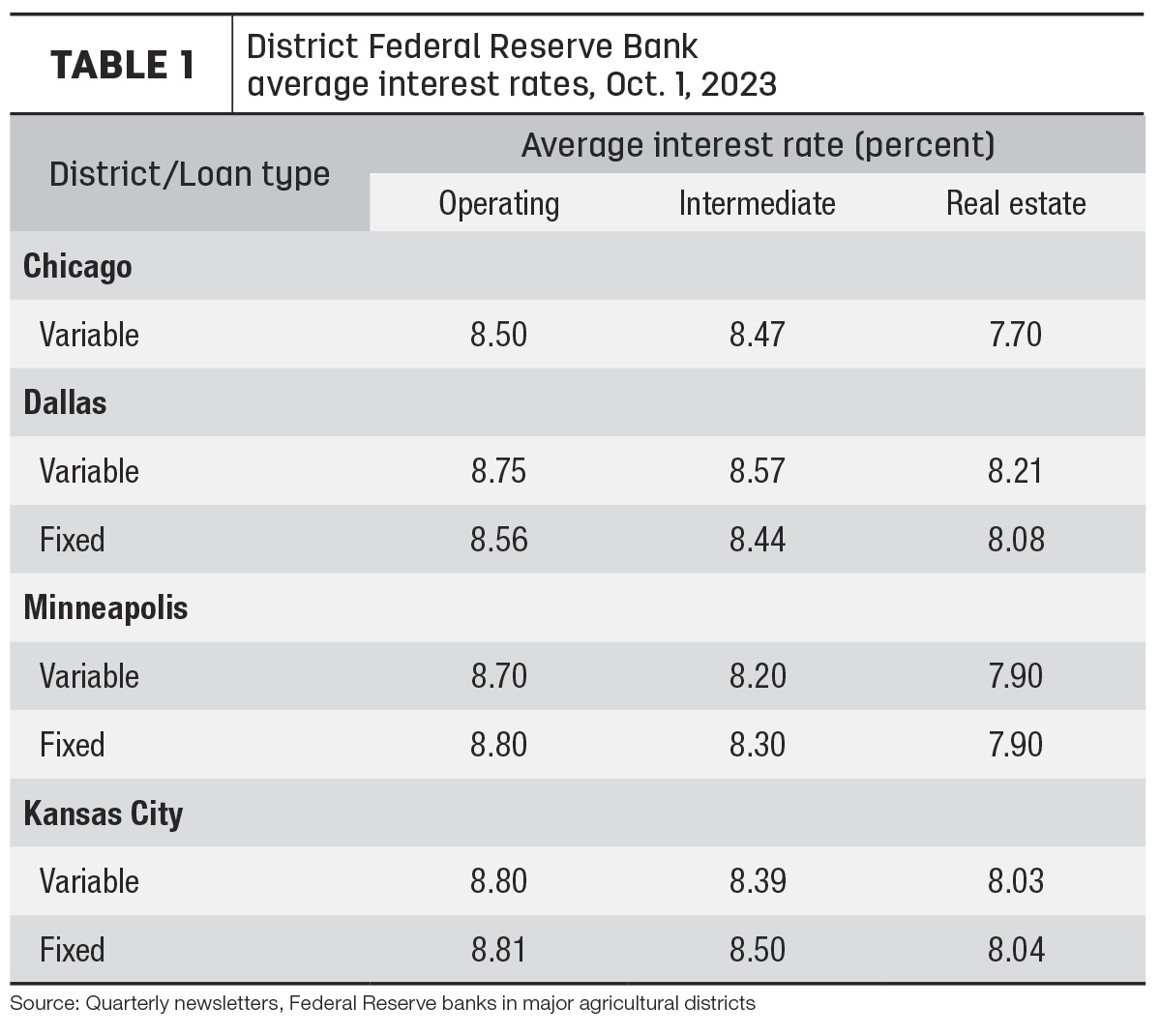

Quarterly lender surveys from Chicago, Dallas, Kansas City and Minneapolis Federal Reserve districts show interest rates on all agricultural loans increased during the third quarter of 2023, with rates in several loan categories nearing 9%. In most districts, interest rates were the highest since the second quarter of 2007.

According to lenders, the higher interest rates have decreased the appetite for real estate and capital purchases and decreased liquidity. Alongside a moderation in farm income, credit conditions have softened. In several districts, loan volume was down, loan renewals or extensions fell, while the rate of loan repayments dipped.

Reviewing quarterly lender surveys in predominantly agricultural districts, average interest rates included (Table 1):

- Chicago: Interest rates on variable-rate operating and intermediate loans were up about 0.3% compared to the previous quarter, with interest on variable-rate real estate loans up nearly 0.4%.

- Dallas: Average interest rates on both variable- and fixed-rate operating and intermediate loans inched higher to start the fourth quarter of 2023, up about 0.1% from the previous quarter. Real estate loans at 8.83% (variable) and 8.66% (fixed) posted slightly larger increases.

- Kansas City: Districtwide, average interest rates on variable operating and intermediate loans rose about 0.25%-0.36% from the previous quarter; variable rate real estate loan rates rose about 0.4%.

- Minneapolis: Average fixed and variable rates on operating and machinery loans increased 0.2%-0.4% in the third quarter; interest rates on real estate loans increased 0.4%.

The Federal Reserve Board’s Federal Open Market Committee (FOMC) meets eight times a year, and it has now left rates unchanged for two meetings in a row. The final meeting for 2023 is scheduled for Dec. 12-13. Meanwhile, rates on USDA Farm Service Agency (FSA) farm operating and ownership loans moved higher in November 2023. (Read Progressive Dairy’s Economic Update, posted on Nov. 2, 2023.)

Cheese falters but GDT index unchanged

The Global Dairy Trade (GDT) price index held serve in an auction held Nov. 21. Compared to the previous auction, prices were mixed across all product categories, moving up for anhydrous milkfat, lactose and whole milk powder but lower for butter, cheddar cheese and skim milk powder. The cheese price led all decliners, down 9.7%, while butter was down 1.1%.

The GDT platform offers dairy products from several global companies: Fonterra (New Zealand), Darigold, Valley Milk and Dairy America (U.S.), Amul (India), Arla (Denmark), Arla Foods Ingredients (Denmark) and Polish Dairy (Poland). The next GDT auction is Dec. 5.

September 2023 fluid milk sales lower

Fluid milk sales were lower in September 2023, although whole and flavored whole milk again provided some positive signs, according to monthly data from the USDA Agricultural Marketing Service:

- Total sales: Sales of packaged fluid milk products totaled about 3.55 billion pounds, down 0.9% from the same month a year earlier. At 31.5 billion pounds, year-to-date (YTD) sales of all fluid products were down 1.8%.

- Conventional products: Monthly sales totaled 3.32 billion pounds, down 0.7% from the same month a year earlier. YTD sales totaled 29.4 billion pounds, down 1.9% from January-September 2022. September sales of whole milk were up 0.2%, and flavored whole milk sales were up almost 82% from a year earlier.

- Organic products: September sales totaled 228 million pounds, down 4% from a year earlier. At 2.1 billion pounds, YTD sales of all fluid organic products were down 1.5%. Sales of organic whole milk were up from a year earlier and year to date. Organic represented about 6.4% total fluid product sales in September and 6.7% YTD.

The U.S. figures are based on consumption of fluid milk products in Federal Milk Marketing Order (FMMO) areas, which account for approximately 92% of total U.S. fluid milk sales, and adding the other 8% from outside FMMO-regulated areas. Sales outlets include food stores, convenience stores, warehouse stores/wholesale clubs, nonfood stores, schools, the food service industry and home delivery.

In case you missed it

Will it pressure cull cow prices next year? The USDA’s latest Cattle on Feed report was released on Nov. 17. It indicates cattle and calves on feed in large (1,000 or more head) U.S. feedlots totaled 11.9 million head, up 2% compared to a year earlier. October placements totaled 2.16 million head, up 4%. October 2023 marketings of fed cattle totaled 1.76 million head, 3% less than a year earlier.

Coming up

The USDA will release its November Ag Prices report on Nov. 30. It will include factors used to calculate the October Dairy Margin Coverage (DMC) program margin and potential indemnity payments. As of Nov. 20, the DMC decision tool forecast a margin of $9.42 per hundredweight (cwt), triggering a small indemnity payment for Tier I dairy producers insured at the top $9.50 per cwt level. Check the Progressive Dairy website for updates.