The cattle semen industry is undergoing significant changes, driven by the intersection of technology, market demands and innovative reproductive practices. U.S. producers are especially keen on new opportunities to increase genetic progress and herd profitability. Statistics from the National Association of Animal Breeders (NAAB) highlight ongoing and emerging trends.

1. Conventional semen: A declining choice in the domestic market

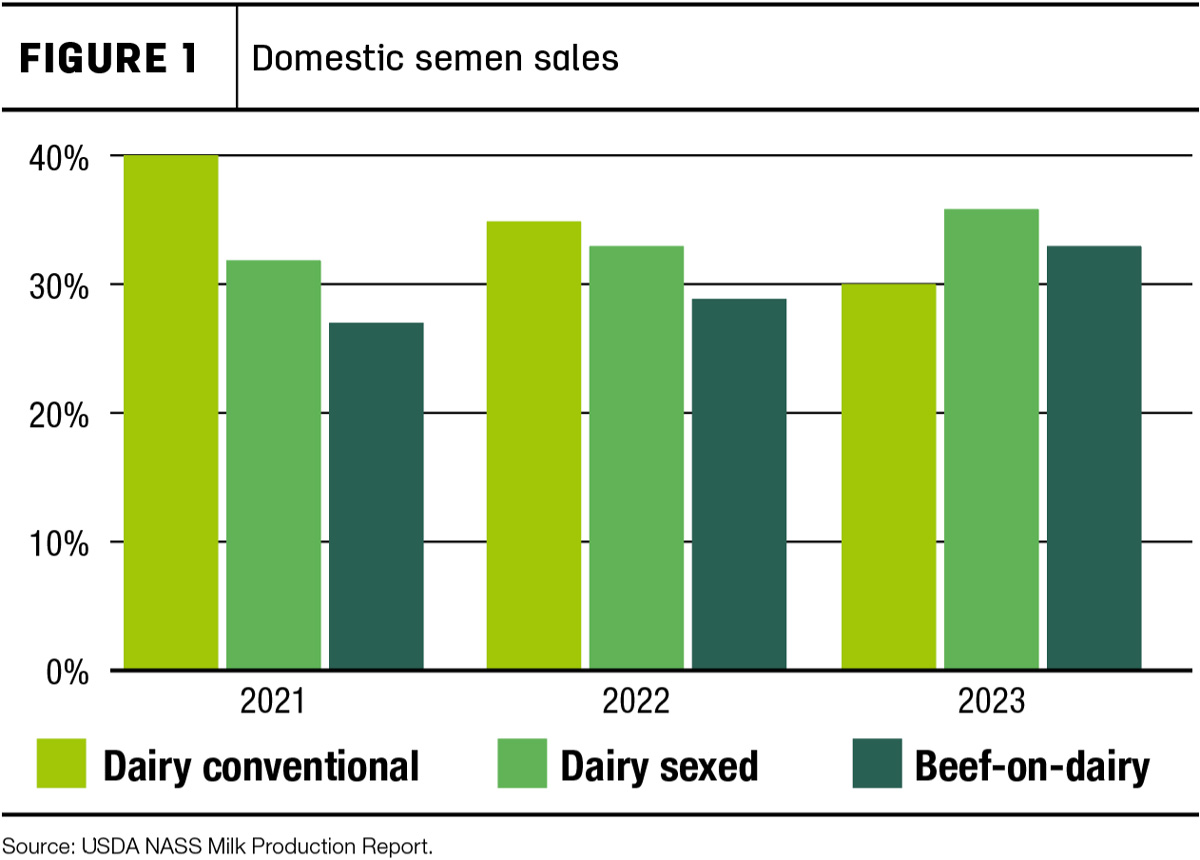

In 2021, conventional dairy semen was the preferred choice for American dairy farmers, accounting for 40% of all U.S. dairy semen produced for the domestic market at just over 18 million units sold. By 2023, this preference had shifted significantly. Dairy sexed sorted semen surged ahead in sales, overshadowing conventional semen, which dropped to under 30% of all sales. Dairy sexed semen now holds a 37% market share, with beef-on-dairy semen taking second place at 32% (Figure 1). Approximately 67% of all beef semen produced in 2023 went into dairy cows (assuming custom collection).

Driving forces behind the shift

Several factors contributed to this change:

- Market developments: Changes in market demand have played a crucial role. The rising popularity of beef-on-dairy crossbreds is a prime example. Market demand collided nearly perfectly with advances in technology, allowing dairy farmers to select and breed replacements strategically.

- Technological advancements: The improvement of sex sorted semen, combined with affordable genomic testing, enables dairy farmers to optimize their breeding programs more efficiently. Creating precise numbers of heifer replacements and selecting the best has enhanced herd productivity. Remaining animals of lower genetic quality have become available to be bred with (sexed) beef semen, which is provided as a singular or as a heterospermic semen product.

- Heterospermic semen: This more affordable and (potentially) more fertile product leads to a highly profitable terminal product whose ancestry is (currently) irrelevant. As more farmer-to-packer phenotypic data collection increases, genetic selection for the best beef-on-dairy retail product is expected to evolve, which may present a challenge for this product. According to the NAAB statistics, 1.8 million units of heterospermic semen were sold in 2023.

The flip side

As dairy farmers tighten their creation of replacements, the number of cows in America is declining and is currently at its lowest point since 2021. This means dairy farmers won’t be able to quickly increase production if there is a spike in demand for both milk and heifers. Global demand for U.S. heifers has increased due to multiple large exporting nations closing their borders with a focus on animal welfare. Foreign markets must now compete with the strong and healthy beef-on-dairy market in the U.S.

2. Popularity of crossbred bulls

Crossbred bulls have become the third-largest dairy breed in the active NAAB dairy cross-reference database. This rise is substantial, considering that all these crossbred bulls are produced domestically and are not typically exported. Most international markets still place high value on traditional purebred products or promote traditional dual-purpose breeds. Although still relatively small compared to the dominance of the Holstein and Jersey breeds, the group of crossbred active bulls has now surpassed traditional breeds such as Ayrshire, Milking Shorthorn, Brown Swiss and Guernsey.

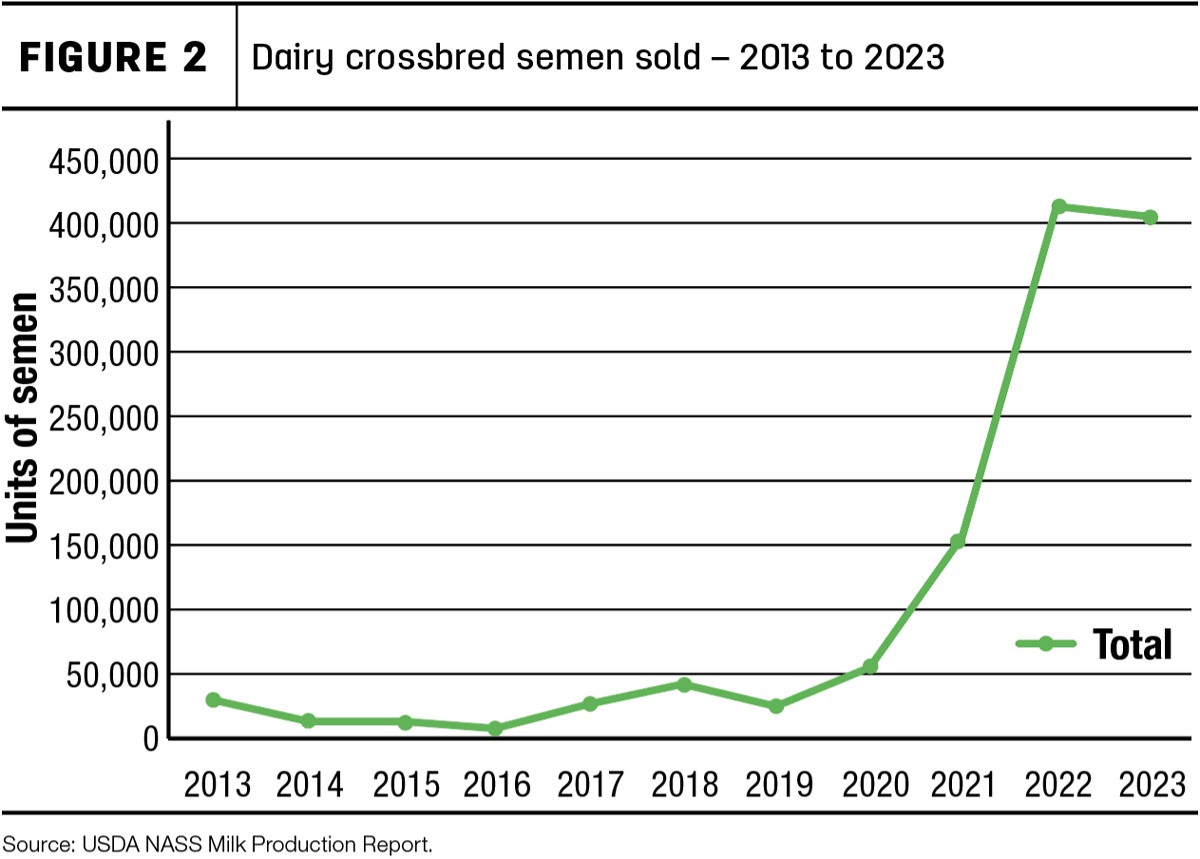

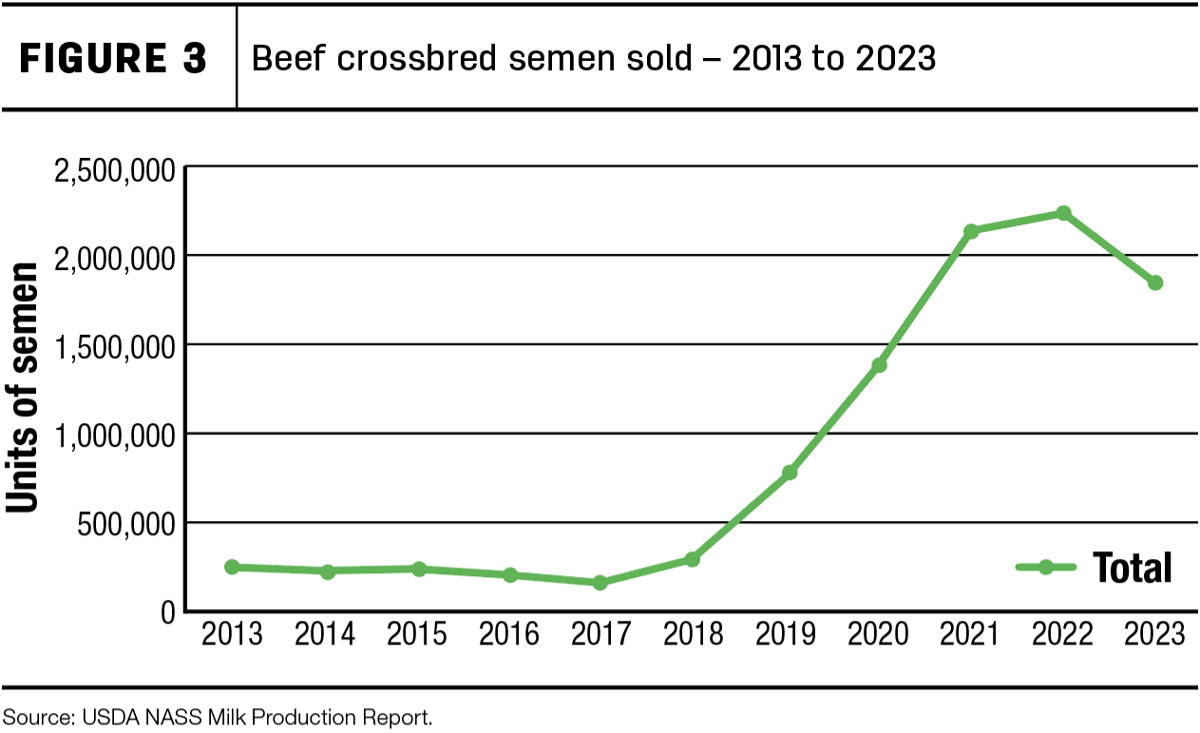

The popularity of crossbreeding has surged since 2020, with dairy crossbred semen sales increasing significantly (Figure 2). Beef crossbred semen trends align with the broader increase in beef semen sales, which began climbing in 2018 (Figure 3). Crossbred dairy bulls are predominantly Holstein-Jersey, while crossbred beef bulls are mostly branded composites.

The flip side

The U.S. is unique in its genomic evaluation for crossbreds, allowing crossbred bulls to be marketed similarly to purebred bulls using reliable predicted transmitting abilities (PTAs) and expected progeny differences (EPDs). The popularity of crossbred bulls highlights U.S. producers' focus on the profitability of a commercial cow over loyalty to a particular breed. This shift is reflected in the downward trends in registrations at dairy breed associations. Purebred associations still play a crucial role in the U.S. genetic evaluation system, traditionally built upon phenotypic data from breed associations and the Dairy Herd Improvement Association (DHIA). As the industry shifts, the allied industry must adapt to ensure the continuation of accurate services that support genetic progress on U.S. farms.

3. The rise of non-CSS semen

The production and sale of non-CSS (Certified Semen Services) semen has seen a significant increase, especially in the beef sector. Although no hard data tracks non-CSS semen, industry trends suggest its popularity. The decrease in dairy conventional semen does not fully align with the increase in beef-on-dairy semen, indicating a statistical data gap. While larger genetics companies handle most dairy semen production and participate in the CSS program, the scenario differs for beef semen. Beef semen, particularly for beef-on-beef purposes, often bypasses CSS certification due to minimal export demand, making non-CSS semen more prevalent.

Reasons for the rise of non-CSS semen

Several factors contributed to this change:

- Production speed: CSS certification involves rigorous health testing protocols, extending the production timeline. Beef farmers, operating within tight time schedules due to breeding seasons, often prioritize speed, making non-CSS semen more appealing.

- Cost considerations: The additional costs associated with CSS certification can be a point of hesitation, especially when there is minimal export demand for beef semen.

- Market dynamics: Domestic markets for beef semen do not demand CSS certification, allowing bull owners to producers to produce a lower health status product for the domestic market with a “buyer beware” approach.

The safety debate

While non-CSS semen offers benefits in terms of production speed and cost, it raises concerns about semen safety. Unlike the governmental agencies of many other countries, the USDA does not monitor bull health testing, relying on the voluntary CSS program to provide this assurance. This gives more power and freedom to the private sector but also allows for more risk. Non-CSS semen is not inherently unsafe, but it is not audited, so product safety cannot be taken for granted. Dairy producers have grown accustomed to semen that meets stringent health testing safety measures, as they have purchased dairy semen from companies that are CSS participants. However, with the heavy use of beef semen on dairy cows, it is more likely dairy producers will be purchasing non-CSS semen. CSS and non-CSS semen are not easily differentiated just by looking at the straw.

The absence of a mandatory national auditing program for semen sold in the U.S. means that international producers are often better protected than American producers. Ensuring the safety of all U.S.-produced semen requires more flexible and market-driven practices, possibly introducing standardized regulations to safeguard domestic producers and consumers. In the meantime, producers must weigh profit against the risk.

Continued collaboration

U.S. cattle producers are perhaps the best in the world at seizing opportunities to become more profitable. New technologies are adopted and combined to respond to market demands with agility, turning the tides of the entire industry within a few years. As these trends continue to develop, they are likely to influence global practices, setting new standards for the cattle semen industry worldwide.

It is crucial for the allied industry that supports producers with accurate breeding values, export documentation or third-party quality control to be as agile as the producers themselves. Progressive dairies may choose not to register their cows, yet often still use PTAs based on phenotypes contributed by breed associations. Additionally, dairy producers using an increasing amount of beef semen must realize that much of the beef semen accessible to them may not have undergone the same health testing safety measures as dairy semen, as there are no mandatory national standards. Narrowing the gap between producers and the allied industry is essential to the continued success of U.S. producers. It requires input from producers and the modernization of industry practices.

As our industry moves forward at lightning speed, those who can adapt and innovate will continue to lead the way.

References omitted but available upon request by sending an email to an editor.