Economic conditions for dairy producers have been challenging over the last few years, mostly due to pricing pressures putting the squeeze on profit margins. Interest rates, however, were not a major factor, thanks to the Federal Reserve keeping short-term rates historically low in the wake of the recession.

But that’s over now, as the Fed has been steadily raising short-term interest rates since the end of 2015. The Fed has also indicated that rate hikes will likely continue in 2019, although possibly at a slower pace.

That means it’s a good time for dairy producers to examine their interest rate exposure. When rates rise, your interest expense costs go up as well. Coupled with tight margins, that’s a sign to take a hard look at how you can reduce the impact of rising interest expense costs. Performing a stress test is a particularly good way to see if your operation is prepared to withstand an increase in interest rates.

Performing a stress test

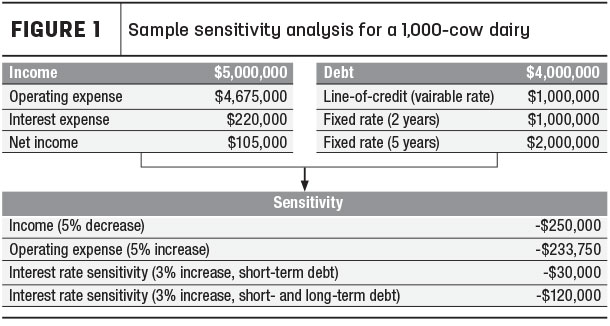

A stress test is essentially a “what-if” scenario. Bankers tend to apply a 5-5-3 sensitivity analysis when conducting a stress test on a business (see Figure 1). That is, what is the impact of a:

- 5 percent reduction in income, or

- 5 percent increase in expenses, or

- 3 percent increase in interest rate expenses

With rates remaining so low for so long, interest rate sensitivity didn’t receive much attention in these analyses. But now that it’s a concern, dairy producers would be wise to begin by looking at their debt structure. That is, how much variable debt you’re carrying compared to fixed-rate debt.

An interest rate hike doesn’t impact fixed debt until the debt matures. Variable debt, on the other hand, takes on the biggest stress because its immediately responsive to interest rate increases. The more variable debt you have outstanding, the more you’re exposed to interest rate risk. In a rising interest rate environment, high exposure to variable-rate debt can lead to margin erosion.

Also, because of the strain the dairy industry has been under over the last couple of years, we’ve noticed that many producers have drawn lines of credit without having the excess cash available to pay it down. Because more of that debt is outstanding than other types of variable-rate debt, it’s more responsive to higher interest rate expenses.

Ultimately, a stress test is a matter of looking at the breakdown between variable- and fixed-rate debt, then conducting the interest expense sensitivity on the portion that’s likely to be affected by rising interest rates.

Debt strategy

Generally speaking, when interest rates rise, it’s been a good idea to shift exposure from short-term to long-term debt. That’s because with a normal yield curve, short-term interest rates have a lower yield (or return) than intermediate- and long-term rates. In a normal environment, the higher yields from long-term debt offset the risk of inflation chipping away at the value of the investment over time. But with the yield curve flattening (and in some cases, inverted), the cost of shifting to longer-term debt is questionable.

So the question becomes, “How do you minimize interest rate risk?” Having a mix of rate maturities is one way. That is, holding some floating debt, some fixed for one to three years, and some fixed for five years or longer. That way you can take advantage of interest rates as they move up or down. In the sample analysis (Figure 1), for example, short-term sensitivity is significantly lower than longer-term interest rate sensitivity.

It’s also a good idea to periodically re-examine your maturities mix – say, once a year. That way, when your one-year maturities are due, you can determine if it’s best to continue for another year or move that debt to a longer-term maturity. How you adjust your mix will depend on the economic circumstances at the time and the prevailing sentiment for what’s likely to happen in the future.

Performing a stress test helps you prepare for both real and hypothetical scenarios. By taking a proactive approach, you may be able to better position your operation to navigate interest rate increases as well as anticipate changes to economic conditions in the future. ![]()

For more agriculture industry insights, visit the BMO Harris Bank website.

References omitted but are available upon request. Click here to email an editor.

-

Sam Miller

- Managing Director, Head of Agriculture Banking

- BMO Harris Bank

- Email Sam Miller