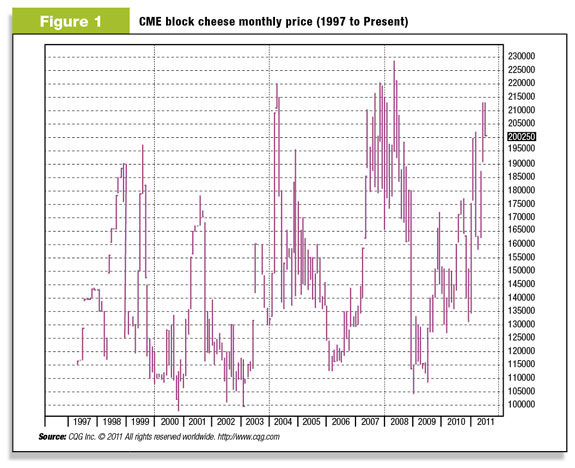

For more than a month, the CME spot cheese trade was able to maintain pricing above $2 per pound. That marks the third-longest stay in the history of the cheese trade above this very closely watched threshold. (See Figure 1.) Much of the thanks goes to a sudden squeeze on available supplies that came in late May following a hold put on 15 million pounds of cheese made in Hilmar’s Texas plant. Additionally, a very dramatic spring planting season created concerns over available feed supplies in the coming months and year. All of this preceded the seasonal summer heat, which often reduces supplies of milk. Together, these factors presented the cheese market with good cause to move to such levels. It was not alone.

Whey prices moved to four-year highs, and butter has maintained its 2011 stay above $2 per pound. Nonfat dry milk has also continued to hover in the $1.50 range since rocketing higher in early January. However, while domestic markets have remained firm, world product values have recently begun to slide lower.

For example, skim and whole milk powder have slid consistently from early spring highs. How much longer can U.S. markets hold at current price levels?

If one looks at the entirety of the milk market, it is apparent in the current futures market structure that a substantial fall in product values is expected. While the market is offering $20 per hundredweight (cwt) for current Class III milk, you need only go to January before getting back to prices in the $16-per-cwt range.

The real question will be whether the market has considered the entire impact of all potential market-influencing factors in advance of such fall. As we have seen in the past, the market can expect one thing early on, only to find its expectations didn’t match reality in the final hour. The effect is a major upward or downward price swing that takes place in a very short period of time.

We have seen this before. In the spring of 2007, cheese prices made a remarkable run that led prices from $15 per hundredweight (cwt) to over $19 in a month’s time. In the summer of 2008, futures markets projected $20-per-cwt milk prices to last through the spring of 2010. The market could not see a change in demand and projected ongoing market strength with no expiration date.

In December of that same year, everything came to a head. Product prices toppled over and pulled milk back to levels below $11 per cwt. Obviously there is no way to predict when these changes will occur. The market, however, will make an attempt to use current information to make such projections. If projections are correct, the party will be close to over by the time you read this article.

The best way to sum all of these observations up is to say that futures markets work to forecast prices based on what we know today, with the understanding that these expectations will change. This is exactly why it is important to understand such things as market cycles, price volatility profiles and historical price ranges as I have outlined in previous articles.

(See Figure 2 for an update from my June 11th article .)

Having this foundational understanding of the market allows the producer to more deeply understand why price structure is what it is and then follow up by making sales, using option strategies and managing margins. It is apparent that the “smart guys” in the market expect a change to come … and soon.

Will they be right? No one knows. Have they considered all of the things that will impact the market from now until those expectations can be gauged against reality? Likely not.

So how does the prudent dairyman respond to all of this? We have talked strategy in the past. These are discussions that involve planning, number crunching and a series of decisions that surround your personal situation. Take up these conversations with your adviser.

I want to take a moment to touch on one of the greatest pitfalls in risk management. If there is one area where major disconnects take place between producers’ intentions and their final outcome, it is in their action … or lack thereof. Some producers will run all of their numbers, identify the opportunity and then pull the trigger, but never with enough volume to impact their bottom line.

For example, if you sell 10 percent of your milk at $20 per cwt and the balance at $12, when you finally ship the milk to the plant, your final average price will be $12.80 per cwt. The very best actions, done in too small a quantity, will become almost inconsequential.

Other producers will go through the same analysis and not act at all. This is obviously much worse. Many of these dairymen get caught in the trap of watching the very immediate pricing the market is offering and thinking those prices will be maintained indefinitely.

Before long, the $20-per-cwt milk that was once present is now gone and $12-per-cwt milk is found in its place. A dairyman is a victim once again, but not to the market; rather a lack of action. Still others will blame their inability to manage risk on an absence of profitability. I heard this many times in 2008.

Here again, we must appreciate that the market does not always offer or lead to profitability. 2009 is a perfect example of this. Neither one of us likes that truth, but it remains truth nonetheless. We don’t always have to “lock in” profit. Managing risk sometimes involves identifying the opportunity to limit a potential for growing losses. For some, depending on feed costs, 2012 may fall into this category.

I do not want to come off as though these are easy choices. When it comes to doing the right thing, the choices are seldom easy. That does not dismiss us from making them. Get together with your market adviser and start working through these decisions now. Map out a plan of action; then do it before the right time passes. PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

Mike North

First Capitol Ag