The 2012 Census of Agriculture is this country’s 28th agriculture census. The first agriculture census was taken in 1840. President George Washington is given credit for seeing the need for an agriculture census. The recently released 2012 census contains hundreds of pages and tables of agricultural demographic, economic and statistical data. Many of you, including me, filled out and returned a census form back in 2012, which is the basis of the census.

The many uses of this vast amount of data include showing the value of agriculture to this country, identifying agriculture trends, helping develop agricultural policy and programs including disbursement of government funds and assisting the industry in developing new products and services, marketing and more efficiently allocating resources.

In my initial review of the census, three items stand out which I see as pertinent to the dairy industry, as well as interesting. They are: milk sales as part of total farm sales, trends in farmland and cropland, and the growing number of small farms.

Milk sales

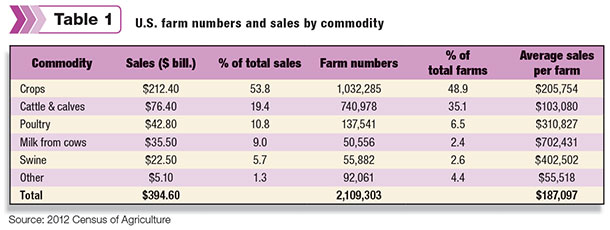

Farm numbers peaked in the U.S. at 6.8 million back in 1935. The 2012 census reports 2,109,303 farms, less than one-third of the peak number. Note: The census defines a farm as any place from which $1,000 or more of any agricultural products were produced and sold or normally sold during the census year. These 2.1 million farms generated sales of $394.6 billion in 2012 as shown in Table 1 .

Crops, with sales of $212.4 billion, accounted for almost 54 percent of farm sales, according to the census. Cattle and calves were second with sales of $76.4 billion, followed by poultry at $42.8 billion. The sale of milk from cows ranks fourth in farm sales at $35.5 billion. The sale of milk was 9 percent of total farm sales in 2012.

Almost one-half, or about one million farms, generated crop sales in 2012. As seen in Table 1, about 50,000, or 2.4 percent of all farms, reported milk sales in 2012, the smallest number of farms in any of the commodity categories.

Dairy may be relatively small in farms and sales compared to the total numbers. However, note that farms selling milk have the highest sales per farm of any of the commodities listed. In 2012, the average dairy farm generated sales of more than $700,000.

Again, total farms selling milk may be low in numbers, but each farm makes a significant economic impact. Plus, we must not forget dairy farms are the buyer of a large percent of crop sales and are responsible for a large portion of cattle and calves sales.

Farmland and cropland

The common perception among many is that the U.S. loses thousands of acres of farmland each year. Let’s see what the census numbers tells us. First, it is important to understand how the census defines farmland.

Farmland is defined as any land used for crop production, pasture and grazing. Plus, it includes any other land which is considered part of a total farm operation. This includes woodland, wasteland, land in conservation or wetland reserve, and open land.

And, for my North Carolina mountain farm, it also includes land too steep to farm and many gullies. Or as my father used to say, land that is only good for holding the good earth together. Any land, whether it grows anything or not, that is part of a total farm operation is defined as farmland.

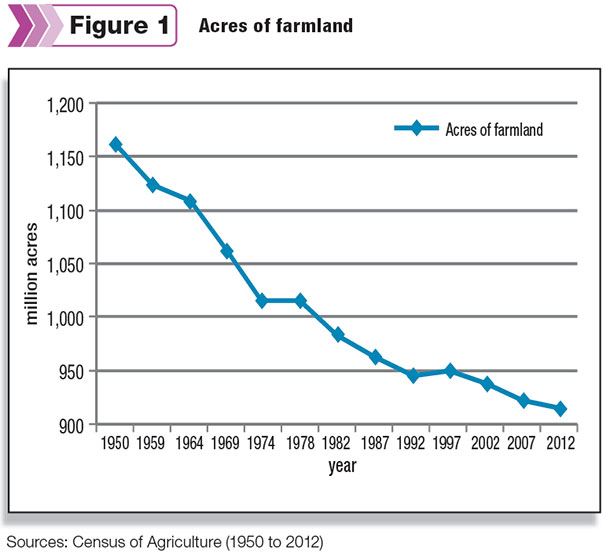

Keeping this definition in mind, farmland peaked at almost 1.2 billion acres in 1950. Since 1950 the number of acres defined as farmland has declined each year (See Figure 1 ). The 2012 census reports 914.5 million acres of farmland, which is down about 24 percent since 1950. This is a large decline, but considering the U.S. population today is more than twice the population in 1950, this country has done a fair job of keeping acres in farmland.

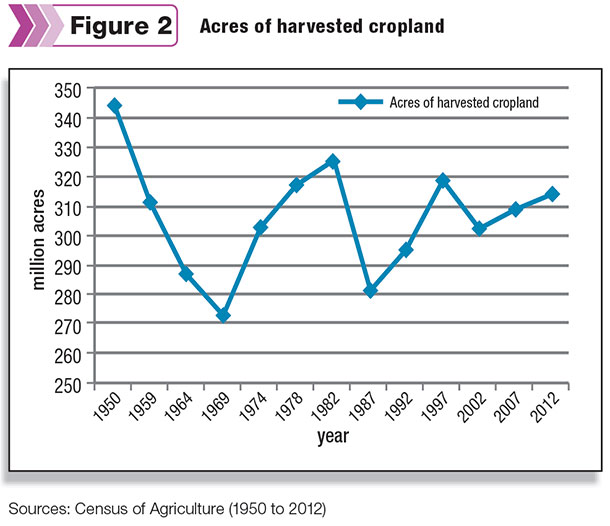

A better indicator of farmland is harvested cropland. As shown in Figure 2 , harvested cropland has declined much less than total farmland. Harvested cropland peaked in 1950, the same year as total farmland, at 344.6 million acres. In 2012, it was reported at 315 million acres. However, note that since 2007, harvested cropland increased almost 12 million acres.

Unlike the continuous downward trend in farmland, there is more variability in harvested cropland. Profit potential, government programs and weather impact the acres of harvested cropland. In that the dairy industry is dependent upon forage and grain, it is good news to see an upward trend in acres of harvested cropland.

More small farms

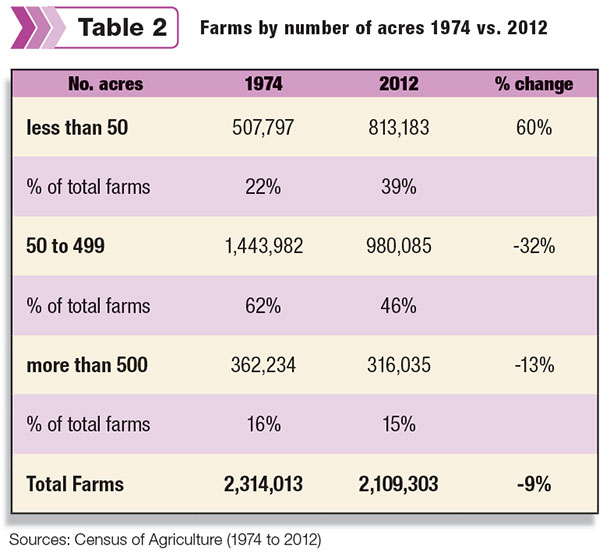

A major trend in agriculture is more small farms, farms less than 50 acres. Since 1974, the numbers of farms less than 50 acres increased 60 percent (See Table 2 ). Small farms were 22 percent of all farms in 1974. In 2012, they were 39 percent of all farms.

On the other hand, farms between 50 to 499 acres declined almost one-third from 1974 to 2012. Farms with more than 500 acres represented almost the same percentage of total farms in 2012 compared to 1974. Rural sociologists call this trend “bipolarity in agriculture.” Farms are either small or large with a shrinking middle.

The impact of this “bipolarity in agriculture” is already seen in the commercial sector. Look at tractor companies’ marketing of utility tractors for small farms. A recent tractor television ad emphasized they could teach “tractor” to anybody. More farm supply stores have expanded their marketing efforts toward the small farm.

In the political area, this dichotomy in farm size will impact policy decisions more in the future. There will be more issues separating small and large farms, including dairy. Granted the 316,035 farms with more than 500 acres generate the bulk of farm sales. However, the 813,183 small farms represent 2.5 times as many votes.

For many of us who fill out and return those Census of Agriculture forms, we may question the necessity of the census. President Washington thought it was necessary more than 200 hundred years ago. And I agree with him; it is needed and the data it provides helps provide a more efficient agriculture. PD

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing, and public speaking.

Calvin Covington

Retired Dairy Cooperative Executive

.jpg?t=1687979285&width=640)