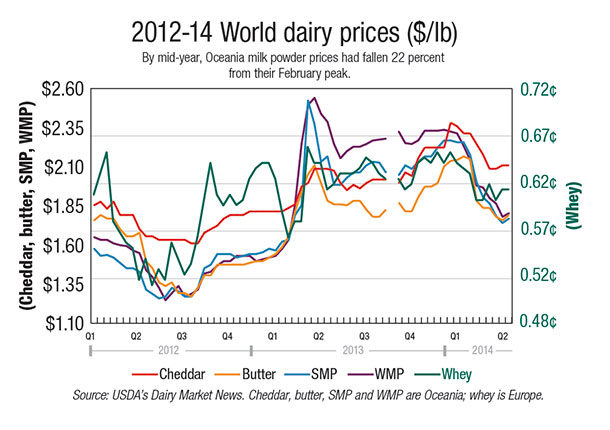

Heavy supplies weigh on markets World dairy prices fell to a 16-month low in June, tumbling roughly 15 to 20 percent from their February peak.

Heavy milk production from Europe and New Zealand has pressured the market. In the first four months of 2014, milk production from the pair was up 6.9 percent compared with the prior year (+5.6 percent for the EU-28 and +15.7 percent for New Zealand).

Record-high milk payouts, plus favorable weather, have driven production. In addition, European farmers in some areas are ramping up to take advantage of the elimination of quotas as of April 2015. As a result, EU exports of milk powder have been particularly heavy.

In the January-April period, China imports of milk powder were up 78 percent from the prior year. But after restocking the cupboard in the early part of 2014, it appears their needs are met. Reports suggest Chinese buyers are even cancelling orders, which has put more product back onto the market.

However, at the midway point in the year, the markets have stabilized. Buyers seem willing to support the market at or near current levels. While they don’t feel the same sense of urgency they had earlier, buyers still need to get orders in to ensure their pipelines are sufficiently stocked. Negotiations for third quarter continue, and some are looking for coverage into fourth quarter as well.

The outlook for the second half of the year really depends on three factors:

1. The strength of the New Zealand flush when the season starts again in August

2. How quickly and how aggressively China comes back in the market

3. And whether the imminent El Niño event causes any disruption to milk supplies

Prices are expected to drift near current levels well into the third quarter until the trade has a clearer sense of how these drivers will play out.

U.S. exports up 35 percent in January-April

U.S. dairy exports continued their record pace in the first four months of the year. U.S. suppliers shipped 708,154 tons of milk powders, cheese, butterfat, whey and lactose in the January-April period, up 19 percent from last year. Total value of all exports was $2.57 billion, up 35 percent.

U.S. exports (on a total milk solids basis) were equivalent to 16.2 percent of U.S. milk solids production in January-April. Imports were equivalent to 3 percent of production.

Nearly two-thirds of U.S. sales went to the top four customers: Mexico (+27 percent versus a year ago), Southeast Asia (+39 percent), Middle East/North Africa (+60 percent) and China (+91 percent).

Exports of nonfat dry milk/skim milk powder (NDM/SMP) were nearly 180,000 tons in the first four months of the year, with more than two-thirds of sales going to Southeast Asia and Mexico. In addition, shipments to China more than tripled, to 18,318 tons.

Cheese exports in January-April were 133,304 tons, up 39 percent from last year. Shipments to Mexico were up 21 percent, while South Korea (+51 percent), Japan (+63 percent) and Saudi Arabia (+110 percent) also posted large gains.

Butterfat exports in 2014 are more than double what they were a year ago. In the first four months, exports topped 40,000 tons, the most in 20 years.

U.S. exporters also continue to expand shipments of whey products (+11 percent year-to-date), whole milk powder (+177 percent) and milk protein concentrate (+70 percent).

U.S. tapping the WMP market

Skim milk powder, cheese and butterfat get most of the headlines, but the U.S. has enjoyed a surge in whole milk powder (WMP) exports in recent months. From July 2013 to April 2014, U.S. suppliers shipped out 45,897 tons of WMP, nearly three times as much as they sold in the same period of the prior year. According to USDA export data, major customers during that period were Algeria (11,150 tons), Vietnam (9,715 tons), China (7,896 tons) and Mexico (5,011 tons).

Several U.S. manufacturers have added WMP processing capacity over the last year to broaden their portfolios and take advantage of a growing export market. WMP is a large category globally, valued at around $8 billion.

Demand is driven by China, which imported 619,000 tons last year, almost all from New Zealand. China’s imports alone are equivalent to nearly 5 million tons of milk (10.5 billion pounds). And in just the first four months of 2014, China imported another 420,000 tons. PD

This update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders.

Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products. USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to the U.S. Dairy Export Council (USDEC) website .