Livestock Gross Margin Insurance for Dairy (LGM-Dairy) is a subsidized insurance policy that provides protection to dairy producers against the loss of gross margin (market value of milk minus feed costs) for specified portions of milk produced by their dairy cows. Livestock Gross Margin Insurance for Dairy establishes a floor (minimum) on income over feed costs (IOFC), ensuring that the gross margin will not be less than the amount specified in the LGM-Dairy policy. It is a risk management tool very similar to using a bundled options strategy.

Benefits of LGM-Dairy

Livestock Gross Margin Insurance for Dairy has several advantages:

1. LGM-Dairy has a completely flexible contract size

2. Cost of an LGM-Dairy policy is the policy premium and is known before entering into the contract

3. The cost of insurance in an LGM-Dairy policy is much cheaper than in a similar bundled options strategy because the premium is subsidized

4. Livestock Gross Margin Insurance for Dairy does not require an established contract with a commodities broker or a milk marketing entity that offers forward price contracts. Very importantly, LGM-Dairy’s only cost is the cost of the insurance policy and the contract guarantees a minimum IOFC for covered milk production, but does not limit the producer from participation in higher milk prices and/or lower feed (corn, soybean) prices.

LGM-Dairy is a program administered by the USDA’s Risk Management Agency , but LGM-Dairy policies are purchased from firms selling federal crop insurance. Crop insurance agents must be certified to sell LGM-Dairy and have an identification number on file with the Federal Crop Insurance Corporation.

A list of approved agents can be obtained from a University of Wisconsin website – http://future.aae.wisc.edu – click on the “LGM-Dairy” tab, then click on the “List of LGM-Dairy Providers.”

Livestock Gross Margin Insurance for Dairy is available for purchase each month (12 contracts per year) and each contract covers from one to 10 months. Unfortunately, LGM-Dairy has a very short period each month when the product can be purchased.

The LGM-Dairy purchase period starts at the end of the last business Friday of each month and ends at 9:00 p.m. ET the next day (Saturday); therefore, there is only about a 27-hour sign-up window every month. This makes it critical that producers work with their insurance agent in advance of the sign-up period.

Overview of LGM-Dairy

The purpose of LGM-Dairy is to provide insurance protecting a minimum IOFC. This is achieved by first establishing an expected gross margin (GM).

Expected Gross Margin (GM) = expected market value of milk minus expected feed costs.

Feed usage in LGM-Dairy is expressed as corn and soybean meal (SBM) equivalents. The LGM-Dairy program allows the producer to select from a wide usage range for these two feed equivalents.

The producer may choose any feed usage numbers desired, even if they do not accurately represent their farm’s actual feed usage, as long as they stay within the LGM-Dairy’s feed usage limits.

If desired, producers may also convert the portion of their dairy rations that are not corn or SBM (for example, homegrown feeds like corn silage or haylage) to corn and SBM equivalents. The University of Wisconsin “Understanding Dairy Markets” website has software available to convert a wide variety of dairy feeds to corn and SBM equivalents.

Doing the calculations

Once expected milk production and feed usage are determined, the GM can be calculated. Expected milk, corn and SBM prices are derived from futures prices on the Chicago Mercantile Exchange (CME) for the three commodities: Class III milk, corn and SBM.

Expected prices are the average of the last three days of futures settlement prices for each month and commodity including the sign-up Friday.

Fortunately, producers do not have to collect this information and make the calculations on their own. The University of Wisconsin web page has web-based software (LGM-Dairy Analyzer v. 2.0) available that provides these data and makes all the necessary calculations.

Like most insurance, LGM-Dairy allows the producer to select a deductible. The higher the deductible selected, the more risk the producer assumes but the lower the premium becomes on the LGM-Dairy contract. Deductibles are available from $0.00 per hundredweight (cwt) of insured milk to $2.00 per cwt of insured milk in $0.10-per-cwt increments.

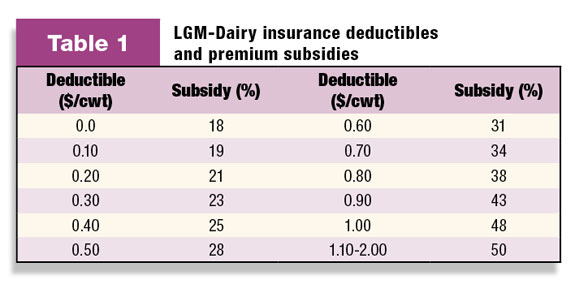

As LGM-Dairy deductibles increase, the amount of insurance premium subsidy also increases ( Table 1 ). The premium subsidy is expressed as the percentage the premium is reduced to.

For example, if a $0.50-per-cwt deductible is chosen, the premium for that covered month would be reduced by 28 percent. A producer must have targeted marketings in 2 or more months to qualify for the premium subsidy.

Once the deductible is selected it is possible to calculate the gross margin guarantee (GMG). Gross Margin Guarantee = GM minus deductible. The deductible is the portion of the GM you choose to leave unprotected.

The final calculation needed in the LGM-Dairy program is the actual gross margin:

Actual Gross Margin (AGM) = Actual market value of milk minus actual feed cost.

The futures markets also are used to determine the actual milk, corn and SBM prices. Very importantly, the LGM-Dairy program uses no actual farm-level prices, involves no futures market transactions and no local basis is used to adjust commodity prices.

Actual prices for Class III, corn and SBM are the average CME futures settlement prices for the first, second and third days prior to the futures contract last trading day.

In LGM-Dairy an indemnity payment occurs when the total actual gross margin (AGMTotal) for an LGM-Dairy contract period is less than the total gross margin guarantee (GMGTotal). That is, an indemnity (payout) occurs if: AGMTotal < GMGTotal.

It is important to remember that there is only one AGMTotal and one GMGTotal per LGM-Dairy contract; thus, the contract is evaluated over the entire contract period. In other words, indemnity payments in months where the AGM is less than the GMG may potentially be offset by other covered months where the AGM is greater than the GMG.

LGM-Dairy example

To better understand the rules of LGM-Dairy and how the program works, we will consider an example. Let’s assume a producer is going to purchase a contract during the purchase period at the end of September, 2011. The Example Acres Dairy consists of 500 cows averaging 25,200 lbs milk sold per cow per year.

Using the LGM-Dairy Analyzer v. 2.0 software, feed usage was determined to be 170.4 tons of corn equivalent and 42.6 tons of soybean meal (SBM) equivalent per month. Total monthly milk production was assumed to be evenly distributed across all 12 months with 15 percent of the herd dry in any one month. This results in a total of 8,925 hundredweights (cwts) of milk sold per month.

Let’s evaluate the Gross Margin Guarantee (GMG) for the month of November, 2011. Only 50 percent of targeted marketings were selected for coverage with a $1.00-per-cwt deductible. Expected milk price is $17.27 per cwt, expected corn price is $7.08 per bu and expected SBM price is $358.90 per ton.

Then,

GM = (8,925 cwts milk X $17.27 per cwt X 50 percent covered) minus [50 percent covered X ((170.4 tons corn X $7.08 per bu X 35.71 bu per ton) plus (42.6 tons SBM X $358.90 per ton))]

GM = $77,067 - [($21,541) + ($7,645)]

GM = $47,881

Now, the GMG must be calculated:

In our example, we chose a deductible of $1.00 per cwt; therefore,

GMG = $47,881 – (8,925 cwts milk X $1.00 per cwt X 50 percent covered)

GMG = $47,881 - $4,463

GMG = $43,418.

This same process is used to calculate the GMG for each month for targeted marketings. Keep in mind that a potential indemnity payment exists when Average(AGM) < GMG; therefore, for November 2011 a potential indemnity payment would exist if the AGMNovember, 2011 is less than $43,418.

Also, remember that there is only one GMG and one AGM per contract because contracts are evaluated over the entire contract period.

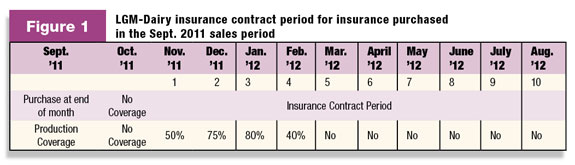

Thus, the producer would have to wait until after the actual prices are available for the last month of targeted marketings (March 2012 in Figure 1 ) to know if the AGMTotal is less than GMGTotal.

In the example (Figure 1), the last month of targeted marketings will be February 2012 and actual prices for that month will be available in March 2012.

Alternative to billings and payments

Dairy producers have alternatives when it comes to premium billings and indemnity payments. In the month following the last month with targeted marketings (March 2012 in Figure 1), the producer may choose to receive an indemnity payment if it is due. (In the example, the month following the last month with targeting marketings is March 2012.)

If the total indemnity payment is less than the total premium, the net premium payment can be made at this time and no indemnity payment is received.

Even if the producer owes a net premium payment, he or she may still choose to receive the indemnity payment in the month following the last month with targeted marketings (March 2012 in Figure 1) and then wait to pay the entire premium the month following the last month in the contract period (In the example, the last month of the contract is August 2012 and the entire premium could be paid in September 2012 in Figure 1).

Producers must file a marketing report to receive an indemnity payment. This report must be filed within 15 days of a notice of a probable loss from their insurance agent. The marketing report also must be supported by milk sales receipts showing evidence of actual marketings in each month with targeted marketings.

In the event total actual marketings are less than 75 percent of the total of targeted marketings for the insurance period, indemnities will be reduced by the percentage by which the total actual marketings for the insurance period fall below the total of target marketings for the period.

There are no limits to milk production covered per year, but annual indemnities are limited to a maximum of 240,000 cwts.

The example contract period (Figure 1) was available for purchase beginning from about 6:00 p.m. Eastern Time (ET) on the last business Friday of September (Sept. 30) until 9:00 p.m. ET the following day (Saturday, Oct. 1). Figure 1 shows that the LGM-Dairy insurance period extends for 10 months, from November 2011 to August 2012.

Program rules do not allow coverage in the month after purchase (i.e., October 2011). The producer does not have to insure each of the 10 months but can vary the coverage to the months desired and also vary the percentage of milk production covered within the months with targeted marketings.

In this example, only four months have covered or targeted marketings (November and December 2011; January and February 2012). Also, in the example the covered months are covered at less than 100 percent.

The producer in this example chose not to cover March through August of 2012. Because LGM-Dairy contracts can be purchased every month, he could choose to purchase coverage for the months without targeted marketings in the September contract using subsequent LGM-Dairy contracts in the following months.

When the rules of the LGM-Dairy program were changed during the first half of 2011, allowing premium payments to be made at the end of the insurance contract period, the program became very popular. Its popularity increased even more when market conditions in the spring of 2011 made LGM-Dairy a very attractive risk management tool.

The LGM-Dairy plan was allocated $16.2 million in underwriting capacity for fiscal year 2011 (Oct. 1, 2010 to Sept. 30, 2011) and that amount was exhausted during the March 2011 sales period. The program resumed sales when the fiscal year 2012 began in October 2011.

With the current budget woes in the U.S., it remains to be seen how much and how long this program will be funded. PD

—Excerpts from Michigan Dairy Review , Vol. 16, No. 4, pages 21-22 and Vol. 17, No. 1, pages 14-15

Craig Thomas

Extension Dairy Educator

Michigan State University Extension

thomasc@msu.edu