Two dairymen who have been test-driving web-based margin projection software since the start of the year say they are now getting a better handle on their real-time operating margins.

Dan Brick of Brickstead Dairy in Greenleaf, Wisconsin, and Jack Pirtle of P7 Dairy in Roswell, New Mexico, began using a one-year, free license to MarginSmart from Wisconsin-based Dairy Analyzer LLC in January.

Since that time and with the help of the company, they’ve input their ration formulations, feed costs, herd numbers, milk and feed options and contracts, and in some cases other operating expenses and revenue to aim for a real-time margin projection each of them thinks is representative of his operation.

In return for their free use of the software, a $10,000 value, the producers have agreed to ongoing interviews about their experience at margin projection. Progressive Dairyman recently interviewed both producers after they had their first quarterly meeting of the year with their financial advisers.

Dan Brick

Brickstead Dairy

Greenleaf, Wisconsin

“The program has been very accurate,” says 800-cow dairy operator Dan Brick. “The numbers are matching our other financials, so I am gaining confidence in the margins.”

Brick believes his calculated margin, which includes most of his revenues, operating expenses and finance payments, is within $0.10 to $0.15 of that in real life.

“I definitely can see that as we work with it more we’ll get even more accurate,” he says.

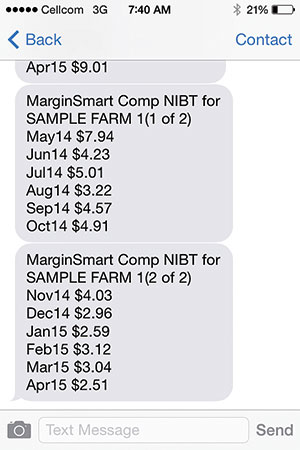

Brick receives twice-daily updates showing his income over feed cost and profitability margins for the next 12 months via texts to his cell phone. He keeps the texts and looks back over them in the span of a week to see how his margins change. It takes about four to five minutes to get caught up on his margins, he says.

One big surprise was Brick’s cost of production margin – the software calculations indicate it’s about $1 lower than he had previously pegged it. After seeing his first-quarter financial statements, Brick says he’s “just about as confident” in the software’s margin as he is in the prepared accounting statements.

“It’s made me decide to accelerate the growth of my business,” Brick says. “I don’t know if that is because the margins are there and I’m confident in them or what. But I think it’s going to work both ways. When the milk price drops and margins are tighter, it’s probably going to make me decide to slow down a little bit.”

Brick has yet to use the future margin projections to lock in milk prices or feed costs, although he wants to try. He does use the program’s text-delivered margin alerts to notify him when the Chicago markets are offering a margin he’d be interested in protecting with contracts or options. Because he’s not yet acting on them, Brick admits he’s gotten so used to them coming in he’s started to ignore them and only check the alerts once in the evening.

“Even without doing any contracting of feed or milk, I feel much more in control using the margin projection software,” Brick says. “I feel like I was driving blind without it. But now I feel like I have a much better handle on the steering wheel of my dairy.”

Since he started using the software, Brick has scrutinized his feed bills even more closely, challenging his nutritionist at times about the effectiveness or value of some of his ration’s additives. Some of those recent reviews have resulted in decreasing the amount of corn in the ration and tweaking the ration’s protein mix.

“I’m a high-input, high-output dairy. One thing you really notice is when you make a feed change, you can see the impact on your bottom line,” Brick says. “A very small change can make a real difference.”

As Brick heads into the 2014 forage production season, he’s also using the software to analyze the cost differences between growing haylage himself versus purchasing it. He’s recently entered different amortization options for the purchase of a new piece of equipment into the software to see how it would affect his feed costs and margins over time.

MarginSmart developer Mark Linzmeier says both producers in the test-drive opted to have the software set up to calculate their margin using similar accounting methods to those their financial consultants use to calculate their quarterly and annual financial statements.

This is possible in the software’s platinum level subscription, which can include other operating income such as cull cow sales and other expenses besides feed costs.

At the start of the trial, Brick sent Linzmeier all of his feed bills, ration changes and feed contracts. He continues to do so, although he says he’s getting more comfortable making changes in the software by himself. He can almost make the change himself as fast as it takes to scan and email attachments of his bills to Linzmeier.

Linzmeier says when he started the company he thought more dairy producers would prefer putting their own information into the software, but he’s finding 70 percent are comfortable letting Linzmeier and his company do it for them. About 20 percent are like Brick and do some themselves and let Linzmeier do the rest.

“I think the reason for that is because these guys are so busy,” Linzmeier says.

In total, Brick estimates he spends an hour each week ensuring the software has all the data it needs. He and Linzmeier also meet every three weeks to regularly review any changes on the dairy and fine-tune the software margin’s calculations.

“Mark is very detailed,” Brick says. “His software is very user-friendly, probably one of the most user-friendly programs that I have on the dairy.”

Jack Pirtle

P7 Dairy

Roswell, New Mexico

“By getting this program, it forced me to write up revenues and costs per hundredweight,” 3,000-cow dairy operator Jack Pirtle says. “Mark says that’s how most guys track their margins. Now that I can see it in this way, it’s helping me manage my dairy.”

Prior to using online margin projection software this year, Pirtle was reviewing his cash flow and finances as a whole for all of his agricultural enterprises on a monthly basis.

During months in the fall and summer when he would traditionally buy corn or cottonseed to supplement the ingredients in his forage-dense rations, Pirtle’s revenues would be small, perhaps even negative, but he knew as long as the other months were showing revenues in the end it would all balance out.

“Some months our total bills were more than our milk check because we usually buy feed in batches,” Pirtle says. “Any time we would say that we should be making money but the books didn’t show it we’d say in the back of our mind, ‘Well, yeah, that’s because we bought this or that feed this month.’ Of course, you can’t say that for too long or you’re going to go broke.”

Using his previous checkbook balancing method to assess profitability, Pirtle had estimated his breakeven cost of production was between $16 and $17 per hundredweight. The margin tracker is so far showing him it’s higher than that. The way Pirtle prices the homegrown silage his family grows and sells back to him for his ration, based on market value rather than just its cost of production, may contribute to his higher-than-anticipated cost of production.

“That was an eye-opener for me, that my breakeven isn’t as low as I thought it was,” Pirtle says.

Linzmeier says every dairyman will likely choose to calculate his margin differently, but that the software can accommodate these preferences.

“Each of these producers felt it would be important to have the software mirror how they were receiving and viewing their third-party prepared financial statements,” Linzmeier says. “We can customize the info within the program to display in whatever format the customer uses to make financial decisions, and we can help guide them in making that decision.

Our goal with the software is to help dairymen improve their reliability and confidence in projecting their real-time margin numbers 12 to 24 months in advance so they can make informed decisions and that those margins then match their other, less frequently reported, actual historical financial information.”

Typically, by this time of the year, Pirtle says he would have already stockpiled some supplemental feedstuffs to feed in the coming months, but this time he is holding off.

“If I didn’t have this program, and I thought my breakeven was at $17 like I thought it was before, I may be trying to buy feed right now,” he says.

After three months of use, Pirtle says the software is just now including only his dairy expenses and revenues. At the beginning of the trial, Pirtle handed off his financial documents to Linzmeier to enter into the software.

A temporary side project to feed-out a few beef steers threw off his margins at first. Those ration costs, which were drawing down his future margins while not showing any revenue until they were sold, have since been removed from his dairy margin calculations.

“I think we’re just now getting to the point I can start looking at whether it’s dialed in,” Pirtle says. “Mark and his team are on the other end of the line whenever you want to call. They’ve been really accessible.”

Pirtle likes how the software is helping him visualize where he’s spending money on the dairy.

“In my mind, I can almost see it in a pie chart now. It’s a lot easier to see how much is going to feed or labor, for example,” Pirtle says.

He was happy to see that the program confirmed his suspicion that buying the dairy next to him would lower his labor costs per pound of milk. The new dairy has needed some renovations, and Pirtle says the program is showing him how much those improvements have cost him per hundredweight and how much future improvements could cost.

It’s also helping him see, when something needs fixed on the dairy, if it will be better in the long run to replace it new or keep fixing up what he’s got.

Like Brick, Pirtle is subscribed to the program’s daily margin text alerts.

“It will grab my eye if the monthly margin has moved $0.20 or $0.30,” Pirtle says. “Then I’ll go check the markets on my computer to see what happened.”

If the margins the software is currently showing prove to be mostly accurate, Pirtle says he won’t be comfortable making many, if any, forward contracting decisions for six months. He needs to see his margins in the new way the software displays them – on a per-hundredweight basis – to re-acclimate himself to what they mean for his bottom-line profitability.

“I’m comfortable with the fact that the way our family companies are designed, we’re diversified from major price swings,” Pirtle says. PD

PHOTO: This example screen capture of MarginSmart’s twice-daily text updates shows monthly profitability margins for a sample Midwestern dairy. This margin has been calculated on an accrual accounting basis to include all contracts, futures, options, committed prices and production and operating income and expenses for the sample dairy. It displays net income per hundredweight before income taxes.

-

Walt Cooley

- Editor-in-chief

- Progressive Dairyman

- Email Walt Cooley

Editor’s observations

Progressive Dairyman Editor Walt Cooley made the following observations about each of the participating producers and their use of the featured new technology:

“Costs of producing milk were a surprise to both dairymen. I think each of the producers is still trying to ensure that the way they’ve chosen to have the software calculate their margins are both accurate and comfortable to them.

From their comments, it’s clear the software itself is fairly flexible to calculate a margin in as much detail as a producer wants. They seem to be questioning what constitutes an accurate margin for them individually, one that they can have confidence reflects real life, more than they are the accuracy of the program at doing the auto-calculations to arrive at that number.”

Dan Brick

“Of the two producers featured, Dan seems to feel more comfortable with his chosen margin calculations. He’s interested in securing margins further out. His next step will be to compare the costs of forward contracting options available to him and to evaluate which methods will allow him to keep the most of a future margin after factoring in those costs.” — Editor Walt Cooley

Jack Pirtle

“After just a few months, Jack seems more skeptical of what is a profitable margin for his dairy. Granted, he’s looking at his margin in a completely different way than before. I think he’s starting to realize this will be a very personal number and one that only he and his family will likely ever understand. He seems comfortable with that prospect.” — Editor Walt Cooley