Continued moderate growth in milk production, combined with good domestic sales of butter and cheese and higher dairy exports, should strengthen milk prices.

The USDA released its July 2017 Milk Production report on Aug. 18, estimating total U.S. milk production up about 1.8 percent compared to July 2016. The pace of production growth compared to a year earlier has now been less than 2 percent in four of the last five months.

USDA: July recap

Reviewing the USDA estimates for July 2017 compared to June 2016:

• U.S. milk production: 18.24 billion pounds, up 1.8 percent

• U.S. cow numbers: 9.403 million, up 74,000 head

• U.S. average milk per cow per month: 1,940 pounds, up 20 pounds

• 23-state milk production: 17.19 billion pounds, up 1.9 percent

• 23-state cow numbers: 8.73 million, up 72,000 head

• 23-state average milk per cow per month: 1,969 pounds, up 21 pounds

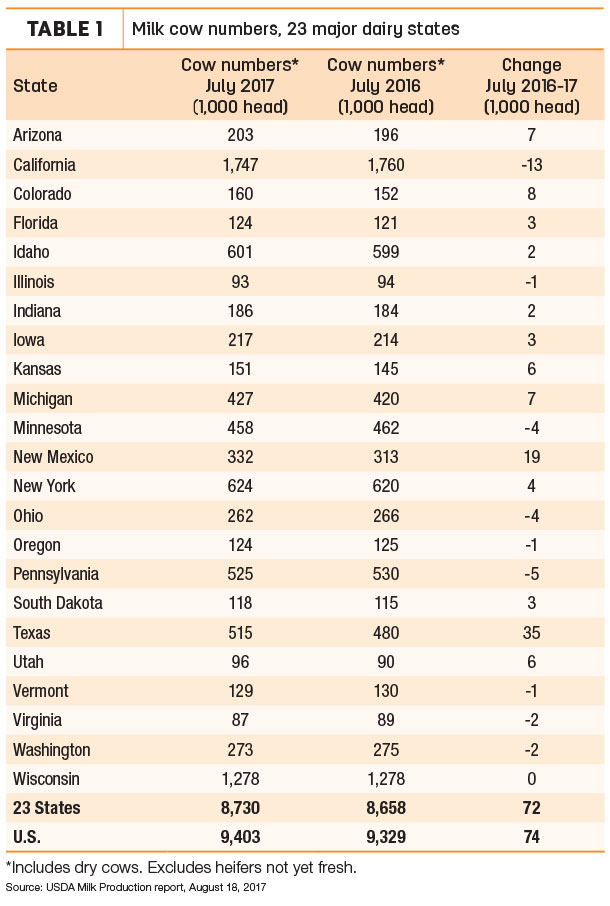

Cow numbers dip

Nationally, milk cow numbers declined from the previous month for the first time since last October. Based on preliminary July 2017 USDA estimates, U.S. dairy cow numbers were down 1,000 from June, but still 74,000 head more than July 2016 (Table 1).

Compared to a year earlier, largest growth was in Texas (+35,000 head), New Mexico (+19,000 head) and Colorado (+8,000 head). California cow numbers were down 13,000 head, while Pennsylvania, Minnesota and Ohio posted declines of 4,000-5,000 head.

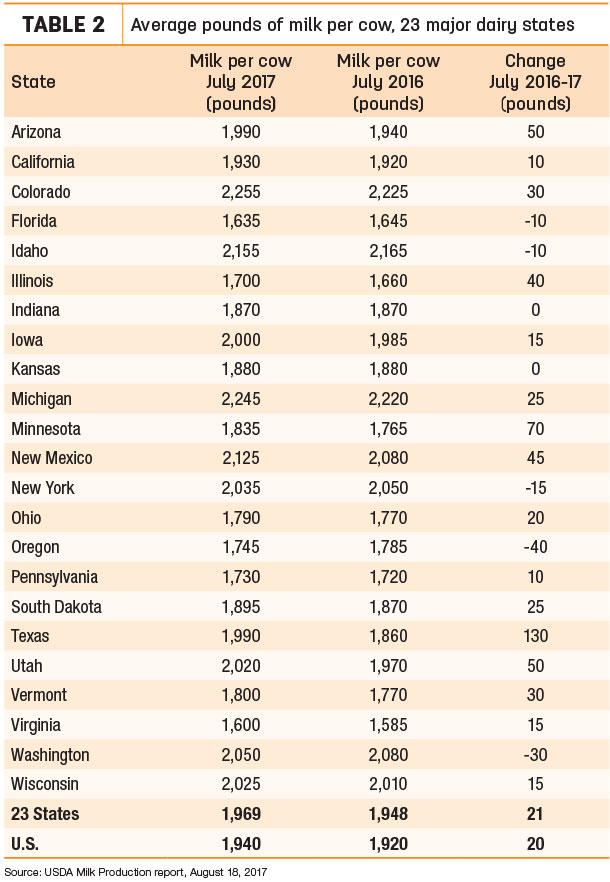

Milk per cow

Year-over-year gains in monthly milk output per cow showed a slight improvement from recent months (Table 2). Texas cows again led all states in achieving year-over-year milk production gains, up 130 pounds from July 2016. Minnesota output was up 70 pounds per cow, while Arizona and Utah were each up 50 pounds compared to a year earlier. Florida, Idaho, New York, Oregon and Washington saw output per cow shrink from a year ago.

Fundamentals, price outlook

After dipping lower in July, milk prices will increase in August, primarily on the strength of Class III milk, according to Bob Cropp, University of Wisconsin-Madison dairy economics professor emeritus. Stronger Chicago Mercantile Exchange (CME) cheddar cheese prices and somewhat stable butter prices in August will offset weakness in nonfat dry milk and dry whey. Improved exports have been aided by an increase in world demand.

Seasonal improvement in butter and cheese sales along with expected continued improvement in exports should add further strength to the Class III price for September and October, reaching into the $17s per cwt, Cropp forecasts. Higher butter prices should keep the Class IV price in the $16s per cwt. These higher milk prices will be supportive if the growth in milk production remains below 2 percent, he warned.

Looking further down the road, Cropp forecasts the Class III price falling back to the mid $16s in the first quarter of 2018.

In their monthly podcast, Cropp and University of Wisconsin-Madison’s Mark Stephenson, director of dairy policy analysis, agree the uncertainty ahead means there’s no need to rush to sign up for 2018 Margin Protection Program for Dairy (MPP-Dairy) margin protection. Although sign-up starts in September at USDA Farm Service Agency offices, it doesn’t close until mid-December, giving farmers time to evaluate market trends before buying coverage.

Affecting margins, recent crop production reports have sent corn and soybean futures lower, offsetting any potential weakness in milk prices. Current Program on Dairy Markets and Policy projections estimate milk income-over-feed cost margins above $10 per cwt through the end of the year before dipping to about $9.50 per cwt in the first quarter of 2018, well above the top $8-per-cwt indemnity payment trigger.

Dairy margins strengthened over the first half of August, in spite of volatile milk prices, according to Commodity & Ingredient Hedging LLC. Lower feed costs more than made up for slight weakness in Class IV milk.

With the U.S. Food and Drug Administration’s decision to use discretion in enforcing labeling on products containing ultrafiltered (UF) milk, it may be more economical to move milk around the country, easing processing capacity struggles in some areas, Stephenson said. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke