The landscape of dairy operations and the dairy industry as a whole are much different today than they were even a few decades ago. Operations are becoming larger, and multiple farms are being consolidated into one.

We see family members and business associates pooling their assets together and forming partnerships.

These arrangements have many benefits and can create many opportunities for those involved. However, the partners and shareholders can oftentimes get so caught up in the day-to-day management of the operation “big-picture” items can be missed. Take a step back and consider how your buy-sell agreement works for you.

What happens to the business ownership interests, management oversight duties and profits if there is a death, disability, retirement, bankruptcy or divorce of a partner? While the answer to these questions may seem easy or obvious initially, there are many dynamics among each partners’ personalities, financial feasibility and legal planning that deserve a closer look.

While we may not cover all of these issues in this article, let’s carve out a couple of key issues of why a partnership buy-sell agreement is so important.

Goals

First, the goals of developing a written buy-sell agreement are for the partners to accurately map out plans of action while everyone is healthy and thinking clearly, logically and rationally. When tragedy strikes, emotions tend to cloud judgement. When executed properly, the agreement should aim to:

- Preserve the business operations while maximizing business value to heirs

- Minimize or eliminate transfer taxes and estate taxes

- Facilitate the transition of ownership and management duties

- Ensure commitment of heirs to sell when an event happens, if applicable

There are a couple of events in particular in which a buy-sell agreement can be the salvation of a business.

Death

Death is not a fun subject to discuss or plan for; however, making plans with your business partners ahead of time does not mean your chances of death increase.

Some initial questions to consider: What happens to your business shares when your business partner passes away? Are you now in business with your partner’s spouse or kids? Is there is going to be a buyout of the shares, and if so, at what price? Will you have to negotiate with a grieving spouse? Will there be taxes due on the estate or on the transfer of shares?

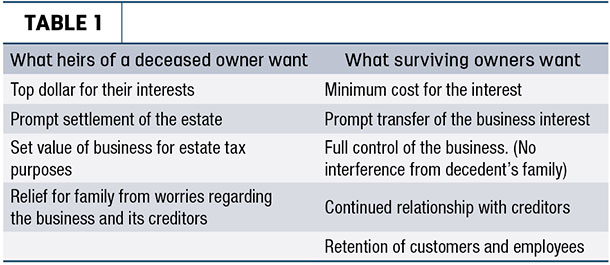

Leaving these questions unanswered while ultimately placing that burden upon the surviving business partner and grieving heirs can obviously cause some major conflicts. Reason being, they both have very different perspectives and desires, as illustrated in Table 1.

Disability

Consider the circumstances if your partner is disabled for the foreseeable future – or indefinitely. What amount of income will they receive? How long will the disabled partner be kept on the payroll? Can the business afford to pay the partner and hire the additional staff to cover their responsibilities? How will your bank react with a key person no longer able to be involved?

Developing a buy-sell agreement helps answer some of the questions. In addition, it helps to guarantee a buyer for the interest in a business, particularly a minority or limited interest, which may be of very little value to heirs. In addition, it spells out a financial plan for how this can be accomplished.

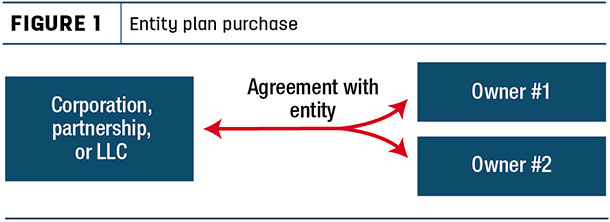

Out of the many strategies to set up the agreement, there are two that are the most common: entity plan purchase and cross-purchase plan.

Entity plan purchase

Under an entity plan, the corporation (or partnership) buys the interest of a partner when a triggering event occurs (death, disability, etc.). This type of arrangement is often used when there are several owners.

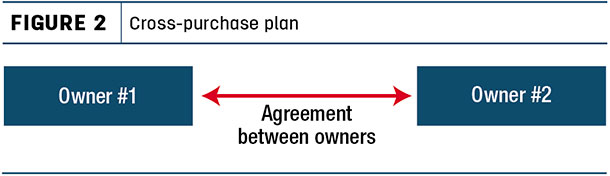

Cross-purchase plan

Under a cross-purchase plan, each surviving owner agrees to buy the interest of any partner that is deceased, disabled, etc. Within these plans, the partners should give some answers and direction to some of the questions proposed earlier.

In the case of a partner’s death, it may be decided there will be an automatic buyout of the decedent’s shares by the business or business partners, ultimately with cash going to the partner’s heirs. If it is decided the shares go to the heirs first, there can be stipulations in your contract to have “first right of refusal.”

It its simplest form, this would state that the shares have to be offered back to the partners or partnership before it can be sold to an outside third party.

For a partner’s disability, it may be decided their salary would be paid for 24 months, as an example. If the partner is not able to perform their duties after 24 months, the salary will cease, and a buyout will occur. These stipulations can evolve and change over time as well.

The initial terms of the buyout should be determined ahead of time, such as a specifically stated price or formula for how the price should be determined. Your legal and financial team should be consulted when making some of these decisions.

If done properly, this transition can potentially be completed with little (or no) income or capital gains tax due while also reducing potential estate taxes. Again, this process is a lot smoother when it is completed ahead of time while everyone in the partnership is healthy and able to think clearly, logically and rationally.

Funding your agreement

Setting up only the legal structure of the buy-sell without developing the funding strategy or financial feasibility can be detrimental to the plan. Seek to collaborate your financial professionals and your legal team to determine the best funding strategy for your buy-sell agreement. There are a few options below:

-

“Sinking fund” in the business: Putting cash aside on a systematic basis has its benefits but can have drawbacks. If there is a death or disability that is premature, the funds available could be inadequate. In addition, many dairy operators do not have large sums of liquid assets on hand because they have their money working in their businesses.

-

Borrowing funds: Borrowing money to buy out your partner’s share can be a good option – if it is financially feasible. The dairy business can be highly leveraged at times, and repurchasing remaining equity of your deceased partner may not be an option your bank agrees to allow.

In addition, losing a key person may impair the credit-worthiness of the business and other partners or shareholders.

-

Installment payments to heirs: Without a key owner involved in the day-to-day operations, the production of the farm may decrease. If the principal and interest payments are too burdensome, it may cause the business to fail, which will put a stop to the payments to your heirs.

-

Insurance: Paying money for the premiums is not particularly fun. Partners may be too old or uninsurable. However, it is often the most frequently used option, either exclusively or as part of another option named above. It can help address the shortcomings of the other options and provide an injection of cash exactly when it is needed and all funded in advance.

As you may already know, the benefit is tax-free. If the partners stay healthy until retirement age, the accumulated cash values or “return of premium” features of the insurance plan may provide some cash available to transition the partners into retirement.

While playing “devil’s advocate,” you can see each option has its strengths and its weaknesses. There is no perfect solution for all, but by working with your trusted team of financial and legal professionals, you can explore all options to determine a best-fit plan for you.

Regardless of your size of operation, the problems and risks are the same regardless of how many zeros are involved. Be sure to revisit your plan at least annually with your team to accommodate changes in business valuations, expansions, cash flow and added members. ![]()

-

Jon Holthaus

- Financial Planner

- Holthaus Financial Group

- Email Jon Holthaus