Global milk production may be starting to show signs of declining, but such is not the case in the U.S., according to USDA’s monthly milk production report released Oct. 20.

Nationally, September 2016 U.S. milk production was estimated at 16.967 billion pounds, up 2.1 percent from September 2015. On a percentage basis, it’s the largest monthly year-over-year gain since January 2014-15.

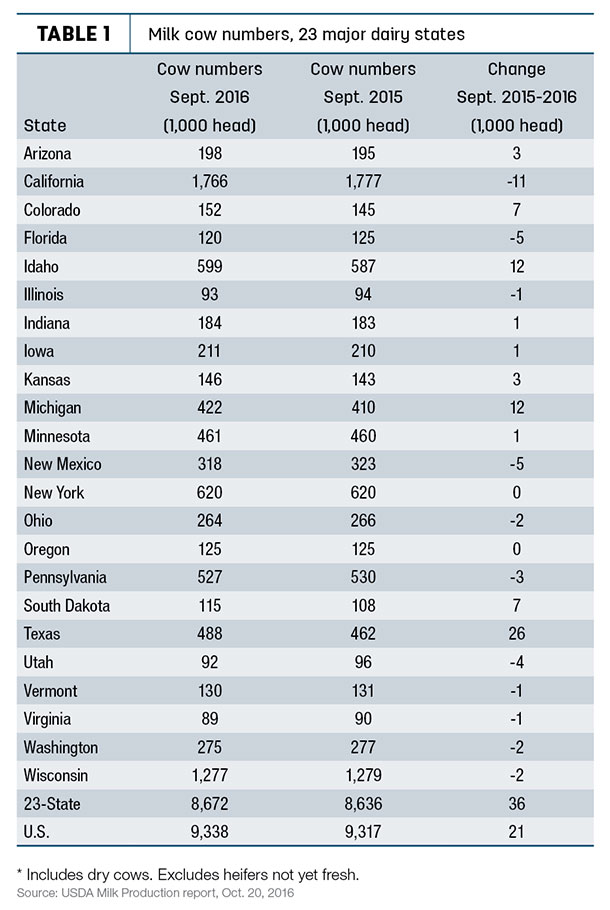

The number of milk cows in the U.S. was estimated at 9.338 million head, 21,000 head more than September 2015, but 3,000 head less than August 2016. Production per cow averaged 1,817 pounds for the month.

September milk production in the 23 major states was estimated at 15.975 billion pounds, up 2.3 percent from September 2015. The number of milk cows in those states was estimated at 8.672 million head, 36,000 head more than September 2015, but 2,000 head less than August 2016. Production per cow averaged 1,842 pounds for September, the highest production per cow for the month since the 23-state series began in 2003.

Finally, with the end of another quarter, U.S. milk production during July-September totaled 52.585 billion pounds, up 1.7 percent from the same quarter last year. The quarterly average number of milk cows was 9.336 million head, 9,000 head more than the April-June 2016 quarter, and 21,000 head more than July-September last year.

Cow numbers revised

While the production news was mostly bearish and expected, the market did get some bullish news from the report – retroactively.

After initially estimating August 2016 U.S. cow numbers at 9.36 million head, a two-decade high, USDA used this month’s report to scale back back both July and August cow numbers by 15,000 and 19,000, respectively. Nearly all the cow reductions came outside of the 23 major dairy states, which saw an adjustment of just 2,000 lower for August.

With those revisions, August 2016 revised milk production in the major states, at 16.658 billion pounds, was up 1.9 percent from August 2015. The August revision represented a decrease of 3 million pounds (less than 0.1 percent) from last month's preliminary production estimate.

Milk per cow continues to gain

Offsetting the adjustments to cow numbers, milk production per cow continues to grow, with September 2016 U.S. milk production per cow up 33 pounds compared to a year earlier. In the 23 major states, the increase was 35 pounds per cow for the month. Through the first nine months of 2016, average milk per cow has been running about 1.2 pounds per day higher than 2015.

A look at the major states

During September, the largest year-over-year increases in cow numbers (Table 1) were in Texas (+26,000), Idaho and Michigan (each +12,000), and Colorado and South Dakota (each +7,000).

California saw an 11,000-cow decline, followed by Florida and New Mexico (each -5,000).

U.S. dairy cull cow slaughter was estimated at 245,100 in September, up just 500 from August, but 6,700 less than September 2015. Through the first 9 months of 2016, dairy cull cow slaughter was estimated at 2.152 million, about 20,100 less than the same period a year earlier.

California’s milk production was virtually unchanged from a year ago, with a 10-pound increase in milk per cow offsetting 11,000 fewer cows.

Other states in the West had strong production increases compared to a year earlier, with Kansas up 6.3 percent, Texas up 5.3 percent, Idaho up 4.9 percent and Colorado up 4.5 percent. Most of those gains were due to higher cow numbers, although Kansas also saw a substantial jump in milk output per cow.

There were also relatively strong increases in the Northeast and Midwest, with New York milk production up 4.9 percent, Michigan up 5.8 percent, South Dakota up 5.1 percent, Iowa up 4.5 percent, Minnesota up 2.4 percent and Wisconsin up 3.3 percent. With the exception of Michigan, most of those gains could be credited to stronger milk output per cow.

With fewer cows, Florida’s production continues to run lower, down 2.8 percent compared to a year earlier.

Milk prices, outlook

Milk prices are feeling the impact of lower commodity prices, according to Bob Cropp, professor emeritus at the University of Wisconsin-Madison. After increasing to $16.91 per hundredweight (cwt) in August, the September Class III price slipped to $16.39 per cwt, and forecasts for October-December are in the low $15s. While domestic cheese sales continue strong, the increase in milk production and weak exports have increased cheese stocks, putting downward pressure on prices.

September’s Class IV price fell to $14.25 per cwt, and Cropp expects it to remain in the low $14s – or even a little below $14 per cwt – for the remainder of the year.

Slightly more optimistic than USDA and current futures prices, Cropp forecasts the Class III price will be in the $15s at least through the first quarter of 2017, reach the $16s by the end of the second quarter, and possibly move into the high $16s by the end of the third quarter.

Positives possible

In their monthly podcast, Cropp and Mark Stephenson, Director of Dairy Policy Analysis at the University of Wisconsin-Madison, cited a recent rally in cheese prices as a possible sign of optimism. Cropp is more optimistic than many, including the futures market and USDA. He said USDA may be overstating anticipated growth in milk production. Domestic dairy product sales will be good, and export markets should be stronger than forecast as domestic and global prices move closer together. Voluntary milk production cutbacks in the European Union, along with weather-related declines expected in New Zealand, Australia and Argentina, are bringing world milk supply and demand into balance.

On the demand side, it appears China will be more active in importing dairy products. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke