The road to better marketing continues for Dave Geiser and Deb Reinhart of Gold Star Farms. After choosing a marketing consultant in November 2009, Dave and Deb began their journey. The destination: better control of their business through better marketing. Travel log entry: May 2010. “We had hoped that milk prices would rally, but since they have not, we are controlling our destiny by making marketing decisions that meet our goals. That process is empowering and certainly puts us in a different place than we were months ago. The positive attitude it generates makes it easier to conduct business on a daily basis…”

At the six-month mark after getting started with marketing, Deb and Dave say they “are very pleased with our progress.” Much of their July and August milk is contracted. April’s contract once again came in above the mailbox price – about $4,500 above.

Maybe it’s the onset of warm weather in Wisconsin. Maybe it’s the milk checks. Deb exudes a new attitude – confidence – that was not there a few months back.

Deb, the farm’s business manager, calls it “a shift in thinking.” A better understanding of input costs helps the couple identify cash flow needs. That knowledge is then used to make better decisions about when to lock in a price, and when to leave milk uncontracted, looking for a better opportunity.

Deb and Dave’s marketing consultant, Matt Mattke from Stewart-Peterson, credits the systematic decision-making process. “Making marketing decisions in the context of the farm’s overall goals leads to confidence,” Matt says.

Matt reports that Deb and Dave have sell targets in place for September through December milk production if prices move higher in those months. However, if the upside does not materialize, they have safety stops beneath the market at a level with which Deb is comfortable.

“Basically, for September through December, we have our targets both above and below the market,” Matt says. “We’re ready for whatever the market does.”

Behind the curtain

Each individual marketing decision is part of a larger, structured approach that Deb and Dave have created over time with the help of their adviser.

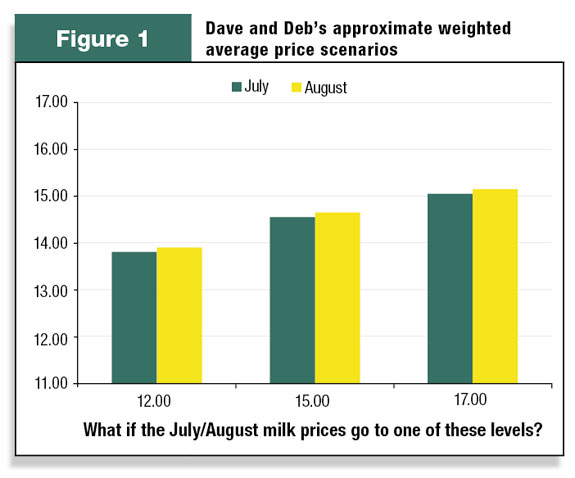

It all starts with a base set of recommendations, called “The Model Farm.” (See Figure 1 .) The Model Farm recommendations and the rationale for those recommendations are communicated to Deb and Dave regularly. Yet every dairy is different. Every producer’s risk tolerance and management style is different. For some farms the Model Farm recommendations work just fine; for other farms, customization is needed.

So far, Deb has preferred sale price trigger points (also called “stops” as we described in the last article in this series) that are more conservative than Model Farm base recommendations. That better suits Gold Star Farms’ financial position and Deb’s comfort level.

“We know what cost of production is and have decided that there are times when we might leave some money on the table, but if we can consistently lock in profit over time we will be successful,” Deb says.

Comfort level is important to make consistently better decisions, Mattke acknowledges. In addition, Mattke counsels clients to stay focused on building the best possible weighted average over time.

“After 2009, it’s important to lock the best margin while also looking for opportunity to gain back lost ground,” he advises.

July-August decision-making process

At the time of this writing, Gold Star Farms has 67 percent of its milk sold in both July and August. Each time a marketing decision like this is made, it leads to another marketing decision that needs to be made. It’s an ongoing, dynamic process, Mattke explains.

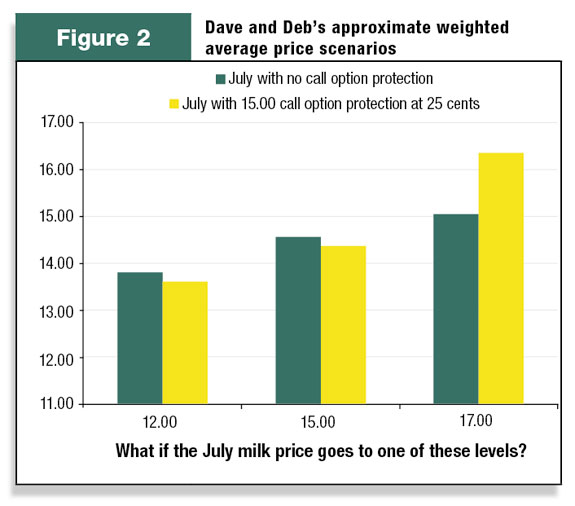

To help make the next decision, Deb and Matt run price scenarios, as seen in these charts:

• If the milk price drops to $12.00 in July or August, the contracts that are in place on Deb and Dave’s milk adequately shield them from any downside in the July price.

• If milk goes to $17.00, their price received will not move higher in sync with the market. That’s because they have 67 percent sold and only 33 percent can be sold at the higher market price. So, setting trigger points to get call options in place is the next marketing decision that needs to be made for their July milk. Call options, when bought at a premium, allow the seller to “call back” milk that is already under contract.

• This chart shows the impact of a potential reownership strategy on Deb and Dave’s July milk. Buying call option protection at $15.00 can really shore up their weighted average price in the event that the July price explodes to $17.00. The impact the cost of the call options has on their weighted average price if the market goes down is fairly minimal – 16 cents. They would still have almost $1.50 separation between the market price and their price in the event that milk prices went to $12.00 in July.

• At the time of this writing, Matt and Deb have not discussed any reownership scenarios for August because the call options are still pretty expensive at this time. A stop (trigger point to make a sale) will be kept at the most recent high price, and if the August price rallies above that trigger point, then Deb and Dave will want to take action to buy back their August sales.

• The basic approach to call options on their August milk is patience, because call options get less expensive as the month in question draws nearer. If the market does break through the trigger point we set, we know the time to be patient is over – action is needed.

• We know that if the market moves higher some money will be left on the table, but our goal is to try to minimize that as much as we can, in exchange for the security of protecting Deb and Dave’s desired profit margin.

Overall, going through the weighted average price scenarios demonstrates how Deb and Dave’s marketing strategies are aligned with their farm’s goals and their risk tolerance. We can see that:

• If July/August prices make an extreme move to the downside, Deb and Dave are well protected.

• If milk prices explode to the topside, a lot of money could be left on the table. That’s why they have discussed this possibility of getting trigger points and strategies ready if a buyback scenario develops. This discussion takes place in advance of the need, so that decisions are made objectively rather than as an emotional reaction to the market.

Lender’s turn: They “eased into it”

Deb and Dave’s lender, Steve Schwoerer of Badgerland Financial, likes the way his clients are approaching marketing. “They are blending a good average price on the way up and blending it on the way down. They are protecting themselves either way.”

Many producers hesitate to get started marketing because they do not understand how tools like futures and options work, says Schwoerer. (That was true for Deb and Dave. Recall Deb’s sentiments reported earlier in this series: “It’s better to do nothing than to do it wrong.”)

“Deb and Dave eased into it by using contracts with their milk plant rather than futures markets. That approach got them started,” Schwoerer observes.

It’s good to start somewhere, Schwoerer points out, because not many operations can afford to go through another year of equity losses like 2009. On the other hand, he adds that marketing does not have to be a defensive tool only. Some operations do it to preserve equity or grow the operation.

“Money is available for lending, but it’s on a case-by-case basis,” Schwoerer says. “The numbers have to be there, plus the intangibles, like management ability, which can be demonstrated through a good marketing approach.”

Schwoerer says that having a consistent and structured marketing program in place can help “even out” the farm’s revenue stream and ultimately lower the amount of working capital required in a loan situation.

He believes more producers are awakening to the possibilities. “Not everyone is at this (Deb and Dave’s) level,” he says. “But at least they are getting started.” PD

You can read more about Dave and Deb in the September 2010 issue of Progressive Dairyman .

Angie Molkentin is a writer from Oconomowoc, Wisconsin. She has access from Stewart-Peterson to observe Gold Star Farms’ interactions with its Market360 program.

Futures trading is not for everyone. The risk of loss in trading is substantial. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results.

Read previous "Road to better marketing" articles:

Let's get control of our business

How we mapped out our feed strategies

Scenario planning pays off for Wisconsin couple