The U.S. Senate Agriculture Committee approved its 2018 Farm Bill proposal, so far a less contentious version than the House proposal defeated on the House floor in May. For the most part, dairy provisions of the Senate version of the 2018 Farm Bill are similar to those contained in the House version, but there are differences. Those include the premium structure and the flexibility (or lack of flexibility) to make changes in annual coverage selections under a revised and renamed Margin Protection Program for Dairy (MPP-Dairy).

Senate version

Dairy provisions of the Senate version of the proposed 2018 Farm Bill are addressed in “Subtitle D – Dairy Risk Coverage” (pages 25-42) of the Agriculture Improvement Act of 2018. See the full version or a section-by-section version.

The Senate ag committee voted 20-1 to approve the bill on June 13. It now moves to the full Senate, where it is expected to be considered by July 4.

House version

Dairy provisions of the House version of the proposed 2018 Farm Bill are addressed in “Subtitle D – Dairy Risk Management Program and other Dairy Programs” (pages 80-94) of the Agriculture and Nutrition Act of 2018. (Progressive Dairyman previously reviewed the House proposal. Read: What’s in it for you: House 2018 Farm Bill proposal lays out dairy outline.)

The House version of the 2018 Farm Bill was defeated by the full House, 213-198, on May 18, with Democrats and members of the hardline Republican House Freedom Caucus voting in opposition. It’s unclear when a revised 2018 Farm Bill proposal will be brought back to the full House.

MPP-Dairy renamed and revised

Like the House version, the Senate version of the 2018 Farm Bill renames the Margin Protection Program for Dairy (MPP-Dairy). Instead of the Dairy Risk Management Program (DRMP), as had been proposed in the House, it would be called the Dairy Risk Coverage (DRC) program by the Senate. Both the House and Senate versions would extend the revised program through 2023.

Compare and contrast

A breakdown of key provisions where House and Senate versions align or differ follows:

• Production history. Both the House and Senate versions maintain the existing production history calculation from the 2014 Farm Bill, allowing producers to use 2011, 2012 or 2013 as their base production level and accounting for annual updates indexed to national milk production growth. However, those annual updates are eliminated in both versions – after 2018 in the House bill and after 2019 in the Senate bill.

• Milk percentage coverage. Both versions eliminate the minimum 25 percent milk production history coverage requirement. The maximum amount of milk eligible for coverage remains at 90 percent.

• Margin categories. Both the House and Senate versions maintain catastrophic coverage at $4 per hundredweight (cwt) and both add insurable margin levels of $8.50 and $9 per cwt to options offered.

• Coverage selection. The House version requires producers to make one election (percent of production and margin level covered) for the life of the 2018 Farm Bill (through 2023). The Senate version allows producers to make annual changes.

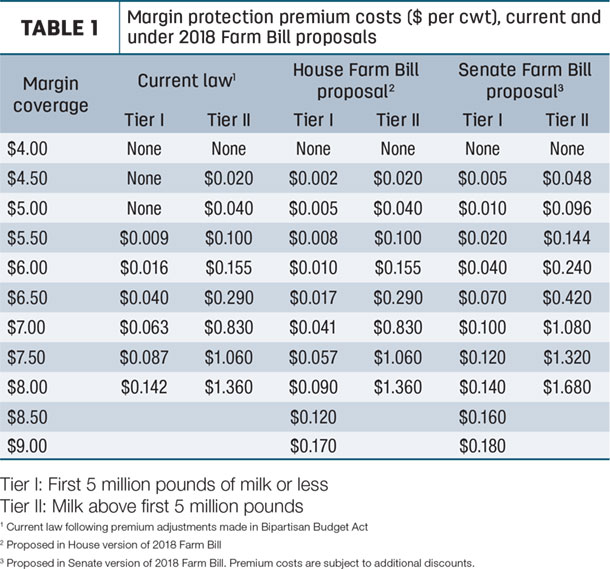

• Premium rates. House and Senate versions diverge regarding premium costs (Table 1), with the Senate version also offering discounts.

Starting with the premium adjustments made in the Bipartisan Budget Act approved earlier this year, the House version adds small premiums for $4.50 and $5 margin levels for Tier I (coverage on up to the first 5 million pounds of milk production), but lowers premium rates for higher buy-up levels. All original premium costs for Tier II (milk beyond the first 5 million pounds covered annually) are retained.

The Senate version also adds small premiums for $4.50 and $5 margin protection levels, and adjusts premium costs for higher buy-up margin coverage levels. Tier II premiums are all raised.

Production history also affects premiums in the Senate version, which creates premium discounts for “small” (operations with a production history of 2 million pounds or less ) and “medium” (operations with a production history of between 2 million and 10 million pounds) in both Tier I and Tier II premium schedules, as applicable (Table 2).

Under the Senate proposal, dairy operations with a production history of less than 2 million pounds of milk per year would receive a 50 percent discount on the annual Tier I premium; dairy operations with a production history of between 2 million and 10 million pounds would receive a 25 percent premium discount on either the Tier I premium or the Tier II premium (if the operation covers more than 5 million pounds of milk).

• Feed cost calculations. While the House version addresses the often-criticized formula used to determine feed costs when calculating milk income margins, the Senate version does not. The House bill would have required the USDA to evaluate the accuracy of data used to evaluate the average cost of feed used by a dairy operation to produce a hundredweight of milk. The Senate, however, included a similar provision in the report that accompanied the 2018 Agriculture Appropriations bill.

• Multiple program participation. The House version would allow a dairy operation to participate in both the Dairy Risk Management Program and a separate Livestock Gross Margin for Dairy (LGM-Dairy) program, but not on the same production. The Senate version contains no such provision, following the 2014 Farm Bill, which prohibited dairy producers from participating in both programs.

An amendment to the Senate bill, initiated by U.S. Sen. Kirsten Gillibrand (D-New York), calls for dairy farmers to receive $77.1 million in MPP-Dairy refunds, representing premiums paid from 2015-17. The provision would ensure that dairy farmers automatically receive a refund for any premiums not used to pay claims during the previous year. Currently, leftover funds go into the U.S. Department of Treasury, rather than being returned to the farmers who paid them.

Other 2018 Farm Bill dairy provisions

Both House and Senate versions address dairy policy outside the margin protection area.

Both change the formula used to determine current Federal Milk Marketing Order (FMMO) Class I prices. The change replaces the current monthly “higher of” Class III and Class IV milk prices used in calculations, instead setting the monthly beverage milk price equal to the simple average of the advanced Class III and IV milk prices, plus 74 cents per hundredweight.

Both proposals also reauthorize the Dairy Forward Pricing Program through 2023. That voluntary program allows dairy processors to lock in long-term milk supplies with individual farmers or their cooperatives at a fixed price to reduce volatility, even if those prices are below minimum federal order prices. The current program allows handlers regulated under FMMOs to agree on contract prices for Class II, III or IV milk, but prohibits forward contracting on milk used for Class I (fluid) purposes.

Both versions also extend the Dairy Indemnity Program and the National Dairy Promotion and Research Program through 2023.

Donated dairy

While the House version would repeal the Dairy Product Donation Program, established under MPP-Dairy in the 2014 Farm Bill, the Senate version creates a Milk Donation Program in its place. The program would reimburse eligible dairy organizations for costs incurred for donating milk, providing the difference in the FMMO Class I milk value and the lowest classified price for the applicable month (either Class III milk or Class IV milk). A maximum of $5 million per year would be made available for this program each year, but any unspent funds would roll over and be available for subsequent years.

After each version of the 2018 Farm Bill clears passage in its respective congressional body, any differences must be reconciled by a conference committee before a final version is developed. The current farm bill expires Sept. 30, 2018. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke