We’re into the fourth quarter of 2017. Looking back to late summer, August might have provided the high point for prices and margins.

August milk prices rise

August 2017’s U.S. average milk price of $18 per hundredweight (cwt) was up 70 cents from July and up 80 cents compared to August 2016, according to the USDA’s monthly Ag Prices report. The January-August 2017 average of $17.56 per cwt is $1.96 more than the same period a year earlier.

Among individual major states (Table 1), Minnesota (up $1.20), Oregon, South Dakota and Wisconsin (all up $1.10) and Kansas (up $1) saw the largest increases compared to July.

Compared to a year earlier, August 2017 milk prices were up $2.30 in Florida and $2 in Pennsylvania, and $1.30 or more per cwt in Arizona, Indiana, New York, Ohio, Vermont, Virginia and Washington.

MPP-Dairy margin improved

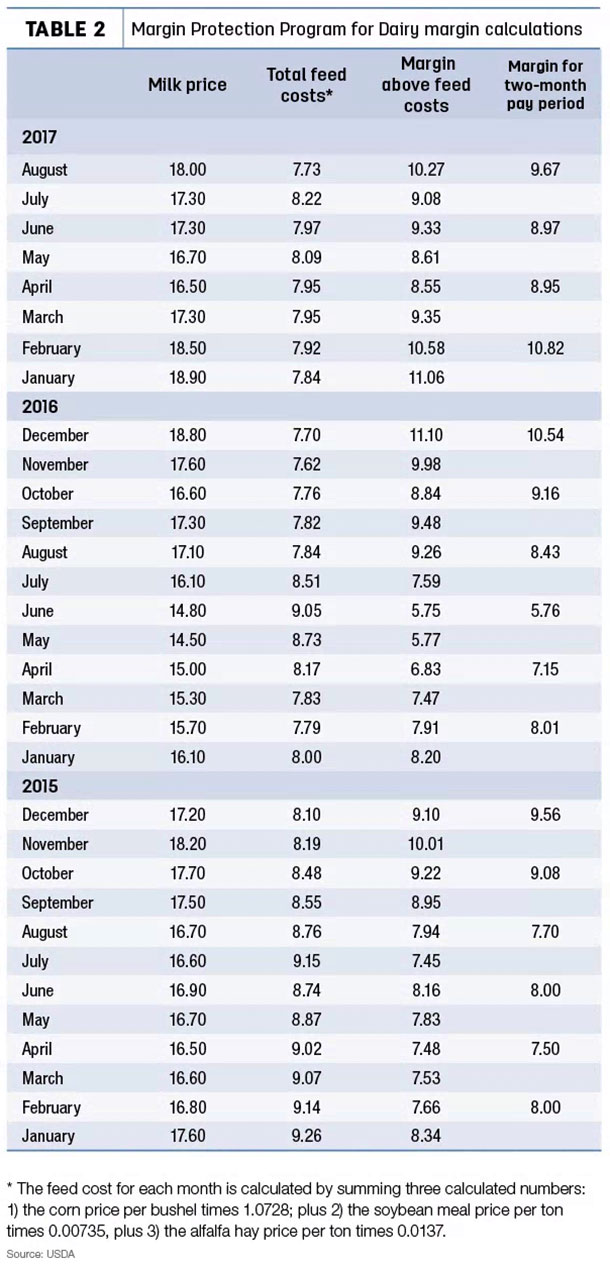

Combined with lower feed costs, the higher milk price improved U.S. average income margins for August, at least according to MPP-Dairy calculations.

The U.S. average price for corn received by growers was down 22 cents from July, to $3.27 per bushel. At $301.05, soybean meal was down $25 per ton. Alfalfa hay averaged $147 per ton, down $5 from July. The overall feed cost was $7.73 per cwt of milk sold, down 49 cents from July (Table 2) and the lowest since December 2016.

Subtracted from the average milk price, the August MPP-Dairy income margin was $10.27 per cwt, up $1.19 from July.

The August MPP-Dairy calculations are the second half of two-month factors used to determine potential payments for the July-August pay period. The July-August margin averaged $9.67 per cwt, well above any MPP-Dairy indemnity payment triggers.

Based on milk and feed futures prices as of Sept. 29, the Program on Dairy Markets and Policy projected monthly MPP-Dairy margins to start a steady decline through May 2018, bottoming out at about $8.50 per cwt in April and May. Although conditions may change, those margins are well above MPP-Dairy indemnity payment triggers.

Read also: Weekly Digest: MPP-Dairy late filing a ‘black swan’ option

August cull cow prices dip

With heavier slaughter rates, U.S. average cull cow prices declined.

August 2017 cull cow prices (beef and dairy combined) averaged $76.30 per cwt, down $1 from July and $4.30 per cwt less than August 2016. Year-to-date, the cull cow price average is $71.75 per cwt, down $7.72 from January-August 2016.

New global milk price cycle starting in 2018

The International Farm Comparison Network (IFCN) held its 15th annual “supporter conference ” to analyze the world dairy market and look ahead to milk price developments for 2018. The short-term outlook isn’t bright.

According to a conference summary, the global dairy industry is headed for another “cycle” in 2018, and prices will trend downward unless there’s a strong increase in milk demand.

IFCM identified five world price cycles – of different lengths and price impacts – since 2006. After starting at the low end of the global milk price cycle in 2006, prices peaked in late 2007 before declining and bottoming out in much of 2009. Minor price peaks were established intermittently in 2010 and 2011 before hitting another valley in mid-2012. Prices peaked again in 2013-2014 before entering another lengthy slide through mid-2016. A mid-2017 peak was well below previous highs, and prices have been trending downward since then.

A key driver in all cycles is how and how long milk supplies react to price changes, according to Łukasz Wyrzykowski, IFCN data analysts. “Overall, it takes 3 to 12 months from a price signal on the world market to a change in milk supply growth,” Wyrzykowski said.

“We are living in a complex and fast-changing dairy world,” said IFCN managing director Torsten Hemme. “The milk price will remain volatile, but is not a fully unknown factor. All cycles are following patterns, so does the milk price and with it the delay in supply response. Be ready for the next cycle with its ups and downs.”

The conference, held Sept. 19-21 in Switzerland, brought together about 100 representatives from 80 international businesses, primarily dairy processors.

In addition to previewing the current and future global dairy situation, attendees also discussed “what makes a dairy region successful?”

Participants identified natural, market and political factors as main drivers in the past. In the future, new technology and social issues – especially related to consumer acceptance – will play a bigger role.

Visit IFCN for more on global dairy prices. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke