Exports remain strong, and after a weak stretch, dairy’s outlook has improved somewhat.

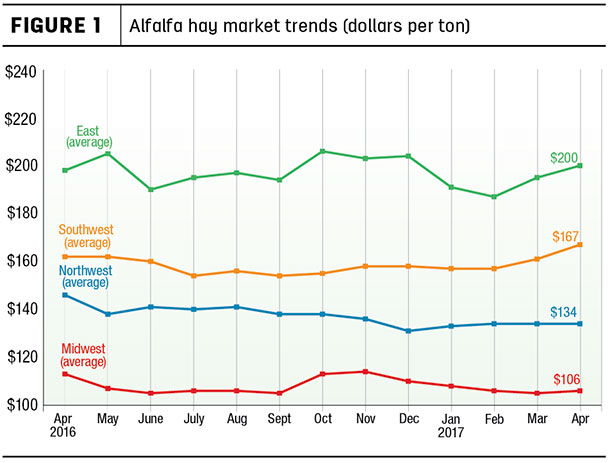

Alfalfa hay prices

The latest available USDA monthly ag prices report was released May 31, summarizing April 2017 prices.

Alfalfa

The April 2017 U.S. average price paid to alfalfa hay producers at the farm level was $148 per ton, up $13 from March and the highest average since April 2016. It’s still $6 less than a year earlier.

On a regional basis, April prices were higher in the East and Southwest, but mostly steady in the Midwest and Northwest (Figure 1).

Within regions, the average price was up $25 per ton in New York, and $20 per ton higher in Colorado and New Mexico. Largest declines compared to a month earlier were in Illinois (-$15 per ton), and Montana and Oregon (-$10).

Compared to a year earlier, price changes were substantially higher in Nevada ($45), New York ($34) and New Mexico ($25), but $20 to $25 lower in seven states, led by Utah, Washington and Minnesota.

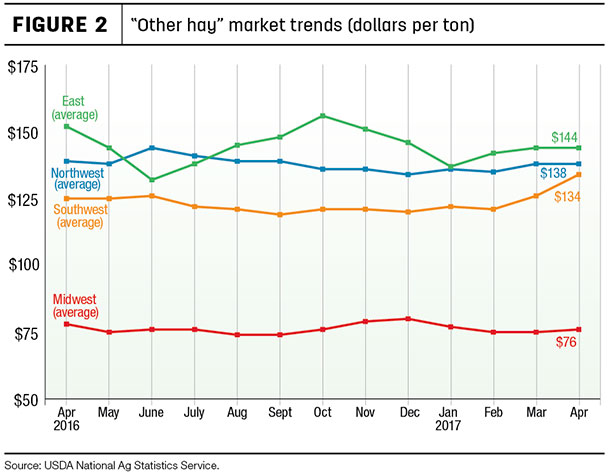

Other hay

The April 2017 U.S. average price for other hay was estimated at $132 per ton, up $5 from March and the highest average in well over a year.

Regionally, prices for other hay were up in the Southwest, based primarily on a $20 per ton jump in New Mexico, but mostly steady to weaker elsewhere (Figure 2). Prices in California and Colorado also rose, but Idaho saw prices dip $10 per ton.

Compared to a year earlier, price changes for other hay were also diverse: up $30 per ton in California, but $20 to $30 lower in Ohio, Pennsylvania and Oregon.

Organic hay

Small square bales of Oregon-sourced, Supreme-quality organic alfalfa hay sold for $250 per ton (delivered) for the period of May 25 to June 7, according to USDA’s biweekly organic feedstuffs reports. Fair-quality, Oregon organic alfalfa hay sold for $110 per ton.

Good-quality, Iowa-sourced organic alfalfa/grass hay in small square bales sold for $160 per ton (USDA national organic grain and feedstuffs).

Hay exports

April exports of alfalfa hay nearly equaled the record-setting total in March. U.S. alfalfa hay exports topped 268,700 metric tons (MT) for the month, the eleventh time sales volumes topped 200,000 MT in the past calendar year. The alfalfa exports were valued at about $75.8 million. China was the leading foreign market for alfalfa hay during the month, at about 122,600 MT.

April 2017 sales of other hay totaled just over 128,875 MT, with Japan and South Korea combining to purchase about 109,500 million MT. The other hay exports were valued at about $39.1 million.

April exports of alfalfa cubes and meal were mixed.

Auction and market summaries

Here’s a peek at early June auction market summaries:

-

Southeast: Alabama hay prices were steady, with light supply and good demand.

-

Southwest: All classes of California hay traded steady, with moderate demand. Oklahoma demand for Supreme- and Premium-quality dairy hay was moderate at best, with prices fully steady in the limited test. Supplies of top-quality alfalfa are moderate. A great deal of first- and second-cutting alfalfa received at least some rain damage. Some fields that were not cut due to rain became overmature and fell into lower grades.

Demand for grass hay is very light. In Texas, most hay classes remained steady, except instances of new crop alfalfa selling $5 to $10 higher. Movement was slow to moderate. Panhandle pastures received some much needed rain, but that curbed hay movement. Utah hay prices are starting to strengthen, although trading remains slow.

New Mexico alfalfa hay prices were steady, with trade and demand moderate. Southern and Southwestern areas were between second and third cutting. Southeastern areas are 70 to 100 percent into second cutting. Rain showers throughout the area have hampered harvest.

-

Northern Plains: Marketings of larger volumes of new crop hay were reported in South Dakota. Prices continue to hold mostly steady. New crop hay prices have not been established. Cattle producers are starting to make some tough decisions, and some have begun marketing some cow-calf pairs as some pastures are not able to sustain their normal stocking rates.

In Montana, hay sold mostly $5 to $10 higher as dry conditions in the eastern portion of the state have producers looking for supplemental feeds as drought areas expand. Limited loads of old-crop hay continue to move. Some producers in central portions of the state are selling hay straight out of the field.

Prices were mostly lower with activity very light and demand good in all classes across Wyoming, western Nebraska and western South Dakota. Moisture and cooler temperatures have made for a later harvest than usual in many areas, but some areas are now getting dry quickly. Most producers were looking at a mid-June first cutting of alfalfa, with some areas looking to July 1.

-

Central Plains: In Nebraska, grass hay, ground and delivered hay, and dehydrated alfalfa pellets sold steady. Reports of first-cutting tonnage varied across the state, with some areas reduced by damage from insects, hail and late snow.

Other areas report average or above tonnage, with better than expected relative feed values. Colorado prices were steady with activity light and good demand in all classes. Rain and cooler temperatures delayed hay cutting in the state, especially in the southern portions.

Growers are reporting pest problems in the southwest regions. Southwest/south-central Kansas hay market activity is slow, with steady prices and light demand for all classes of hay. Yields and quality are mixed.

-

Northwest: In Idaho, trade was limited with moderate demand for new crop. In Oregon, prices trended generally steady in an extremely limited test. Some producers are preparing to start selling 2017 hay.

So far, new-crop hay pricing seems generally steady compared to 2016 pricing for similar quality hay. In the Washington-Oregon Columbia Basin, new-crop alfalfa sold steady to $5 higher. Trade is moderate with good demand; new-crop trading is gaining momentum. Rain slowed timothy cutting.

-

Midwest: In Iowa, prices trended mostly steady with some weakness noted. Overall, first-cutting hay looks good, but bale weights seem a touch light. In Missouri, hay harvest has finally kicked into high gear. Several farmers are saying the delay in cutting has helped yields. The yield difference between fertilized areas and nonfertilized areas is as drastic as anyone can remember.

Hay movement is light, supplies are moderate, demand is light and prices are steady to weak. In northern Wisconsin, hay maturity has been slow. Overall, hay is reported of good quality with reduced yields. Prices are moving higher as better-quality hay reaches the market.

- Northeast: In Pennsylvania, all varieties of hay sold mostly steady on limited comparable receipts. In the Lancaster area, all varieties of hay sold unevenly steady. Small bales of straw sold firm while large bales sold mostly steady.

Drought areas

USDA’s World Agricultural Outlook Board said just 9 percent of U.S. hay acreage was located in areas experiencing drought as of June 13. Drought areas are primarily in eastern Montana and North and South Dakota, with a small pocket in northern Missouri.

Check out the hay areas under drought conditions (U.S. Drought Monitor).

Fuel prices lower

Fuel prices moved lower, according to the U.S. Energy Information Administration (EIA). As of June 12, U.S. on-highway diesel fuel prices averaged about $2.52 per gallon, down 4 cents per gallon from a week earlier, but up about 9 cents per gallon compared to a year ago. California diesel prices averaged nearly 40 cents per gallon higher than the national average.

EIA estimated U.S. retail prices for regular gasoline averaged about $2.37 per gallon as of June 12, down about 5 cents from the week before, and about 3 cents per gallon lower than a year ago.

USDA’s latest Ag Trade Outlook report projects stable crude oil prices for the remainder of 2017. EIA forecasts a Brent crude spot price of $52.60 per barrel for 2017, about equal to current levels, but up from the 2016 average of $43.74 per barrel.

However, this forecast was made before the recent announcement from Saudi Arabia and Russia that they intend to extend production limits through March 2018, an action that other Organization of the Petroleum Exporting Countries (OPEC) members are expected to follow. This may put some upward pressure on prices, but is not expected to result in dramatic increases.

Dairy outlook: Price improvements projected

USDA’s latest monthly World Ag Supply and Demand Estimates (WASDE) report reduced both 2017 and 2018 production forecasts, with a slowing pace in the increase of milk production per cow offsetting expected gains in cow numbers.

Milk income margins over feed costs are expected to bottom out in May-June, with higher milk prices improving margins later in the year.

The U.S. average all-milk price for 2017 is now projected at about $18 per hundredweight (cwt), up about $1.75 from 2016. Early forecast put the 2018 all-milk price in a range of $18.10 to $19.20 per cwt, with a midpoint of $18.60 per cwt.

Beef cattle outlook

USDA lowered beef production estimates for 2017, based primarily on lighter carcass weights that more than offset higher expected slaughter later in the year. Increased expected placements support beef production in 2018. Projected 2017 cattle prices were raised from last month, although they have likely peaked for the year. The 2017 steer price was estimated in a range of $122 to $126 per cwt, but will fall to $113 to $123 by the fourth quarter and hold in that range through 2018.

Figures and charts

The prices and information in Figure 1 (alfalfa hay market trends) and Figure 2 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke