Producers familiar with Livestock Gross Margin for Dairy (LGM-Dairy) will see improvements to the policy beginning July 1. Starting that Thursday, LGM-Dairy will be available weekly. The increase in the number of sales days will allow producers to build coverage levels with more data points.

The price discovery period will be Tuesday through Thursday each week. The average price becomes a middle-of-the-week calculation for Class III milk, corn and soybean meal, with an average price calculated from the closing prices on Tuesday through Thursday.

The policy sales period will begin on Thursday starting at 4:30 p.m., with sales closing at 9 a.m. (both times Central time) on Friday.

Remember, LGM-Dairy is a margin product. It is the Class III milk price minus corn and soybean meal prices. LGM-Dairy protects policyholders from lower milk prices and rising feed costs. This provides a margin floor price. It is like a milk put, a corn call and soymeal call all packaged in one bundle.

If milk prices go down and feed prices go up, a producer will receive an indemnity if the ending margin is less than the margin minus the deductible in the policy. If milk prices go higher, producers will benefit from the higher cash milk prices.

LGM-Dairy allows for more flexibility regarding deductibles. Dairy producers can purchase a policy with a zero deductible all the way to a $2-per-hundredweight (cwt) deductible. Most producers have used 50 cents to $1 per cwt.

Coverage is available out 12 months, excluding the first month.

LGM-Dairy is a subsidized USDA Risk Management Agency (RMA) backed insurance policy. There are no transaction fees. Premium subsidies range from 18% to 50%. For example, a zero deductible policy has an 18% premium subsidy. A deductible of 50 cents per cwt has a 28% subsidy, and the $1-per-cwt deductible has a 48% subsidy. Premiums are due at the end of the coverage period.

LGM-Dairy premiums are the same across the country. Before the high volatility in the corn and soybean markets, LGM-Dairy has been a little cheaper than Dairy Revenue Protection (Dairy-RP). This also depends on the state: Dairy-RP premiums are different for every state or region, so coverage may be more expensive in some states than in others.

Dairy-RP is also different because it is a revenue product. Revenue = Milk (Class III, IV or components) x yield. The yield is the milk per cow factor. The milk per cow is calculated for a state or region, not an individual farm. It is possible to have an indemnity payment reduced because the milk per cow number increased.

One other thing to note: You cannot have Dairy-RP and LGM-Dairy in the same quarter.

LGM-Dairy: Feed level coverage options

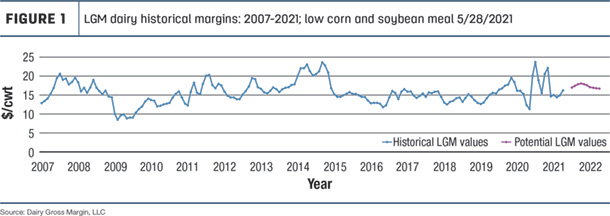

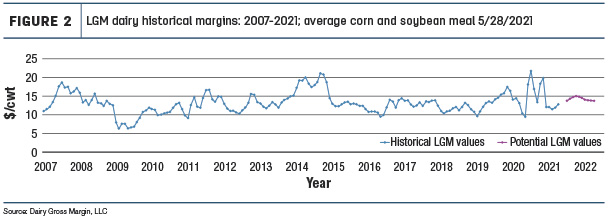

LGM-Dairy offers various feed coverage options. Figures 1 and 2 display long-term LGM-Dairy margins for low and average feed coverage, respectively.

Producers may pick any feed coverage between the highest and lowest amounts:

- Lowest feed – 10,000 cwt milk, 36.6 tons corn (1,307 bushels) and 8.1 tons soybean meal

- Average feed – 10,000 cwt milk, 131.4 tons corn (4,693 bushels) and 38.5 tons soybean meal

- Highest feed – 10,000 cwt milk, 381 tons corn (13,607 bushels) and 119 tons soybean meal

What do you cheer for?

If milk prices go higher without significant changes in feed costs, you win. Pay the premium and receive the higher prices in the cash market.

If milk prices go lower and feed prices are near steady, margins may have gone down. You could get an indemnity payment if the ending margin is below the margin in your policy. (Remember to adjust for your deductible.)

If milk prices go lower and feed prices go higher, there is a much greater probability margins have gone down. You could get an indemnity if the ending margin is below the margin in your policy. (Remember to adjust for your deductible.)

Dairy-RP changes

Dairy-RP will also have some changes beginning July 1:

- If one class of milk is limit-up or limit-down, Dairy-RP quotes will be generated in the other class or components.

- Georgia will be a stand-alone state, not part of the Southeast region. In the future, Georgia will have its own milk-per-cow number. (Earlier this year, RMA revised the math for milk per cow in California, Illinois and Texas.)

- Last year, RMA removed the Class A requirement for claims. This may be helpful for organic dairies wanting to use Dairy-RP.