Due to escalating Class III milk prices, those who purchased Class III coverage never had a chance for payments.

Class III milk prices rallied after the deadline to purchase third-quarter (July-September 2020) coverage, June 15, 2020. The timing of a purchase any time prior to that really did not matter because the Class III market basically moved higher until the very end of the quarter.

Class IV prices offered two time slots for Dairy-RP coverage purchase that may have given you a payout. If you purchased coverage prior to January 2020, you would have gotten payments. The other time frame was very brief in early June. (See chart)

The percentage deductible you used and the USDA’s “milk per cow” number for your state or region may have impacted the final payout.

What do we learn from this? There are benefits to looking out into the future as we have suggested. The designers of Dairy-RP have a similar philosophy. Considering purchasing coverage six to 12 months out in the future. For the third quarter of 2020, that strategy made sense.

What happened if you covered a blend of Class III and Class IV? Or maybe you purchased separate quarterly endorsements for these two classes? These are very individual choices and it is hard to provide a general answer. Class III did not pay and Class IV may have paid, depending on your timing. A blended quarterly endorsement would have paid little or nothing.

Although Class III did not pay this quarter, it could have been worse. What if you would have sold futures in Class III and not used Dairy-RP?

Dairy-RP coverage is similar to a put option. As the market moved higher, it provided a floor price, with no margin calls. You were able to benefit from the higher milk prices that occurred in the third quarter. If you had sold futures as the market moved higher, you would not have benefited from the higher prices and had margin calls. You had locked in a specific price, with no upside possible.

In summary, early purchases of Dairy-RP coverage worked in the third quarter for Class IV milk. For Class III, Dairy-RP coverage did not pay due to the late timing of the Class III futures market rally.

Upcoming deadlines and dates

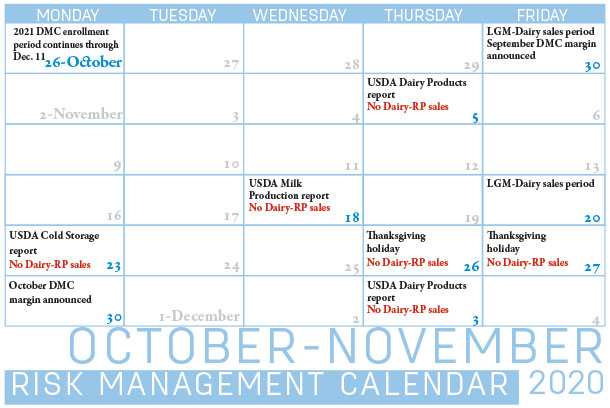

Now, let’s look at the dairy risk management calendar.

Click here or on the calendar above to view it at full size in a new window.

Dairy-RP

Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. Currently, coverage is available for all four quarters of 2021. The final day to purchase Dairy-RP coverage for the first quarter of 2021 is Dec. 15.

Dairy-RP is available every day except holidays and USDA report days that could impact markets (see the calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down.

LGM-Dairy

The next scheduled sales period for LGM-Dairy is Friday, Oct. 30. Coverage is available for up to 10 months, so you will be able to buy coverage for December 2020 through September 2021. You need to select coverage in two-month increments to get the premium subsidy.

Looking further ahead, the November LGM-Dairy sales period is Nov. 20, a week earlier than normal due to the Thanksgiving holiday.

LGM-Dairy covers milk prices (from falling) and also includes coverage for feed prices rising. LGM-Dairy is not only a milk price put option, but a call option on the price of corn and soybean meal. We are anticipating additional changes to LGM-Dairy in the near future.

Dairy Margin Coverage program

Finally, don’t forget that the deadline to enroll in the 2021 Dairy Margin Coverage (DMC) program is Dec. 11, 2020, at USDA Farm Service Agency offices. ![]()

Dairy-RP and LGM-Dairy coverage is available through a licensed and trained crop insurance agent. Ron Mortensen with Dairy Gross Margin LLC provides monthly updates on Dairy-RP and LGM-Dairy coverage for the readers of Progressive Dairy.

-

Ron Mortensen

- Co-Owner

- Dairy Gross Margin LLC