August 2019-20 recap at a glance

Reviewing the USDA preliminary estimates for August 2020 compared to August 2019:

- U.S. milk production: 18.6 billion pounds, up 1.8%

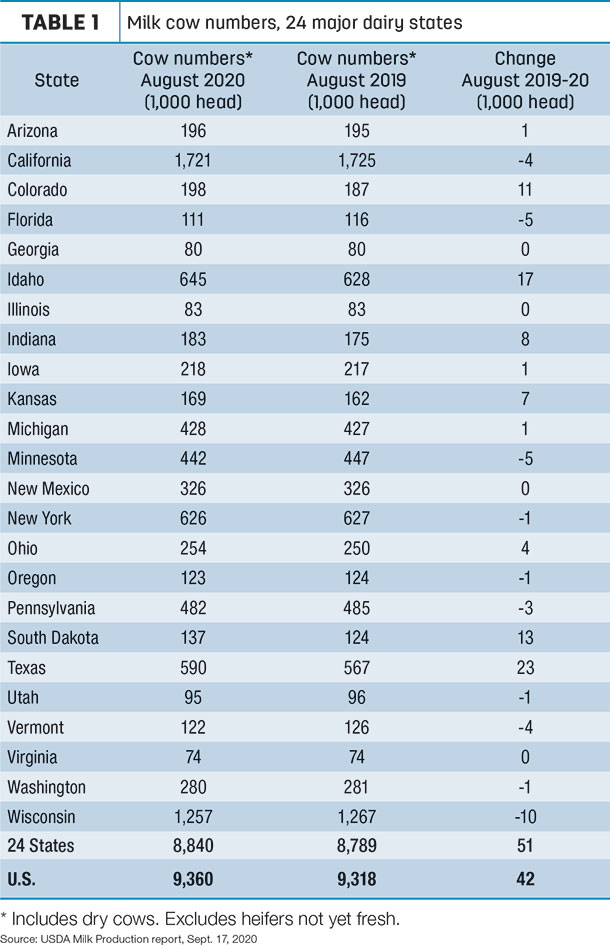

- U.S. cow numbers: 9.36 million, up 42,000 head

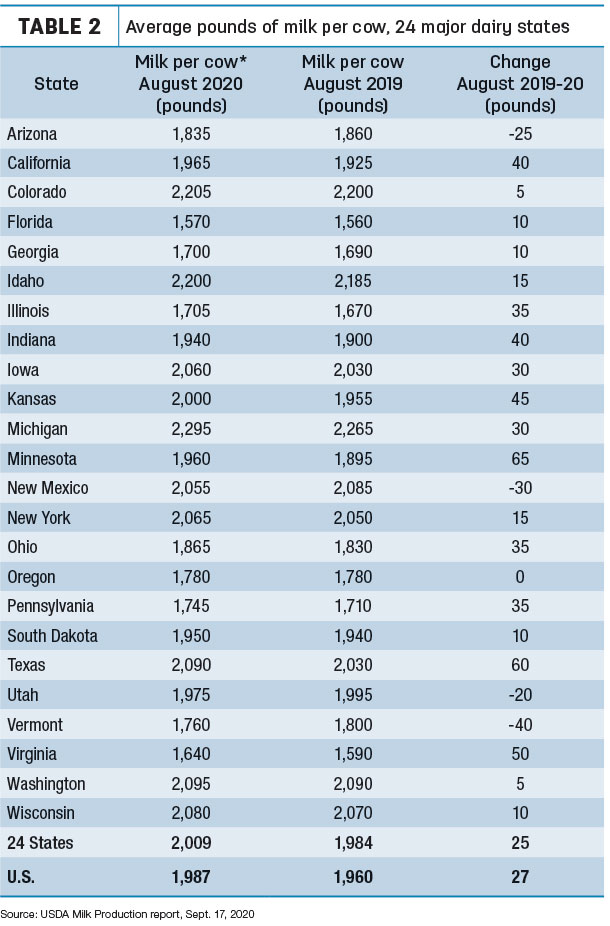

- U.S. average milk per cow per month: 1,987 pounds, up 27 pounds

- 24-state milk production: 17.76 billion pounds, up 1.9%

- 24-state cow numbers: 8.84 million, up 51,000 head

- 24-state average milk per cow per month: 2,009 pounds, up 25 pounds

Source: USDA Milk Production report, Sept. 17, 2020

Cow numbers steady but revised upward

There was good news and bad news related to cow numbers. The good news is that the size of the U.S. dairy herd held steady in August, unchanged from July. The bad news is that the USDA revised its previous preliminary estimates for July up 8,000 cows in the U.S. and up 11,000 cows in the 24 major dairy states. After posting significant declines in the first quarter of 2020, cow numbers are now back to levels seen at the start of the year.

Compared to a year earlier (Table 1), August cow numbers were reported higher in 10 states and lower in 10 states, with four others unchanged. Cow numbers were up a combined 64,000 in Texas, Idaho, South Dakota and Colorado, but down 28,000 head, collectively, in Wisconsin, Minnesota, Florida, Vermont and California.

Milk per cow growth slow

Growth in U.S. and major dairy state average milk output per cow remained somewhat subdued in August, up less than 1 pound per cow per day from the same month a year earlier (Table 2). In the 24 major dairy states, production was lower in just four states: Arizona, Utah, New Mexico and Vermont.

Minnesota led all states in increased milk output per cow compared to a year earlier at 65 pounds, followed by Texas at 60 pounds.

Michigan remained the nation’s leader, averaging 2,295 pounds of milk per cow in August 2020.

Volume, percentage growth

Texas led the 16 states with year-over-year milk volume growth in August, up 82 million pounds. California output was up 61 million pounds (1.8%). Texas, California, Idaho, Colorado and South Dakota combined to increase milk output by 242 million pounds.

In contrast, August 2020 milk production was lower than a year earlier in seven states, with Arizona, Florida, New Mexico, Oregon, Utah, Vermont and Wisconsin down a combined 44 million pounds.

On a percentage basis, growth in South Dakota continued at a torrid pace in August, up 10.8% compared with a year earlier. In addition to Texas (7.1%), production was up more than 6% in Indiana, Kansas and Colorado. Vermont (-5.3%), Florida (-3.9%) and Utah (-2.1%) led decliners.

Dairy margins start September flat

Dairy margins were flat to slightly weaker over the first half of September as feed costs rose and milk prices trended “sideways,” according to Commodity & Ingredient Hedging LLC.

Milk prices continue stabilizing, with nearby Class III futures at elevated levels, on expectations that the extension of the Farmers to Families Food Box program will maintain domestic demand through year-end. With block cheddar prices back above $2 per pound, however, the U.S. is no longer competitive on the global export market at a time when milk production looks to increase heading into autumn.

Demand for and strength in cheese continues to support Class III values relative to Class IV, which will likely maintain negative producer price differentials (PPDs) for domestic producers in the months ahead.

The Big 10 conference’s decision to resume their college football schedule this fall will be supportive for demand, although the market remains compromised by demand from food service outlets.

According to a survey released by the National Restaurant Association, almost 100,000 restaurants or about one in every six have all but closed permanently since March. In addition, only 40% believe they will stay in business another six months without additional government assistance.

The loss of food service purchases has weighed disproportionately on demand for butter and cream, helping to explain some of the discrepancy in class pricing and the divergence in value among dairy products. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke