April 2019-20 recap at a glance

Reviewing the USDA preliminary estimates for April 2020 compared to April 2019:

- U.S. milk production: 18.7 billion pounds, up 1.4%

- U.S. cow numbers: 9.381 million, up 49,000 head

- U.S. average milk per cow per month: 1,993 pounds, up 18 pounds

- 24-state milk production: 17.83 billion pounds, up 1.6%

- 24-state cow numbers: 8.853 million, up 65,000 head

- 24-state average milk per cow per month: 2,013 pounds, up 17 pounds

Source: USDA Milk Production report, May 20, 2020

March production, at 18.5 billion pounds, was revised upward about 115 million pounds (0.6%) from last month's preliminary production estimate. The end result was that year-over production increased about 2.8% in March.

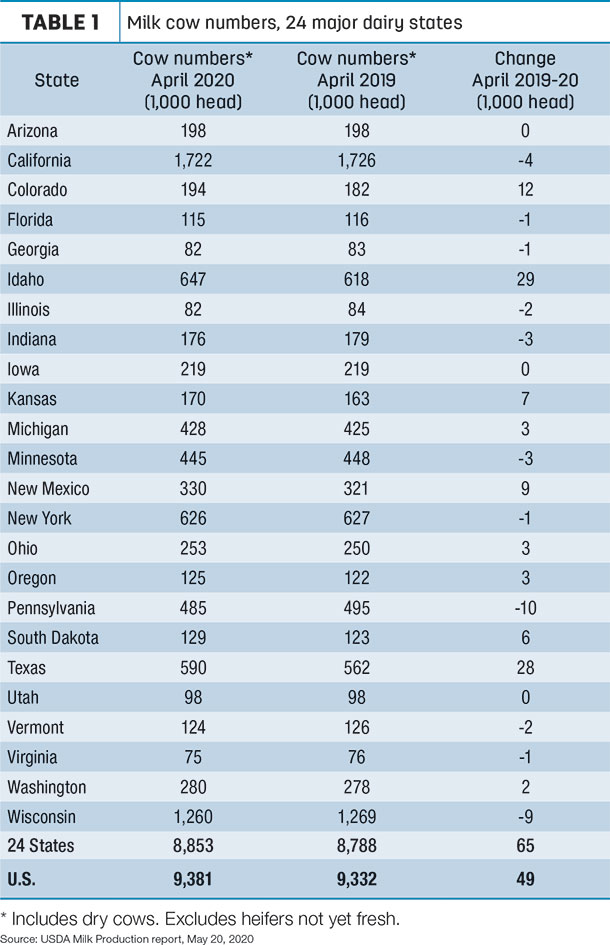

Cow numbers start to drop

While U.S. cow numbers were up from the year before, they were down about 4,000 head from March as more dairy farms faced pressures from lower milk prices and base production restrictions. In the 24 major dairy states, April 2020 cow numbers were up 65,000 head from April 2019, but down 4,000 from March 2020 (Table 1).

Compared to a year earlier, April cow numbers are up a combined 78,000 in Texas, Idaho, Colorado and New Mexico, but 19,000 lower in Wisconsin and Pennsylvania, combined. Cow numbers were reported higher in 10 states and lower in 11 states.

Since bottoming out in June 2019, U.S. cow numbers are up 69,000 head in the 24 major dairy states. Since last July’s low, U.S. cow numbers are up 66,000 head.

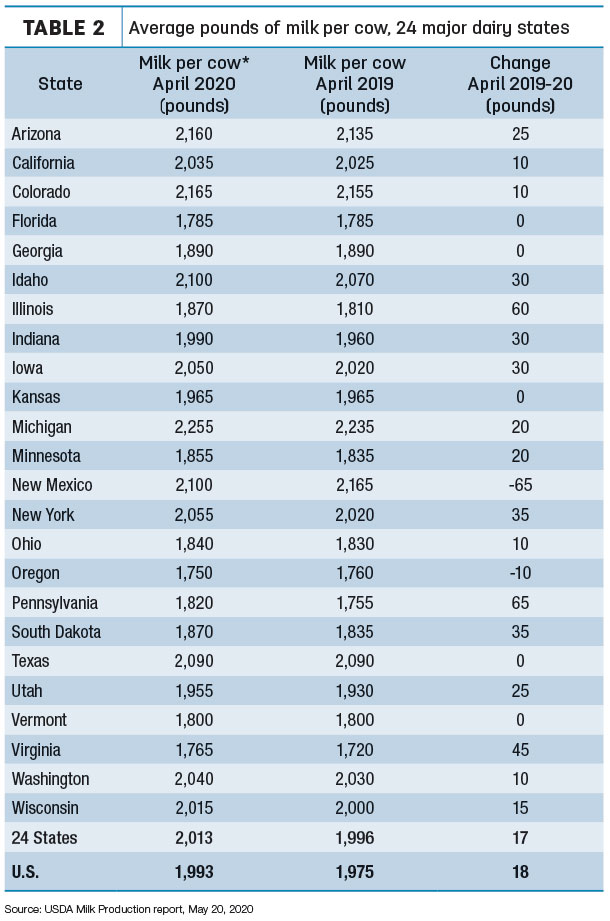

Milk per cow increase small

It’s slow growth in milk output per cow where total production moderation was felt. Compared to a year earlier, daily milk output per cow increased a little more than one-half pound. Producers in only five states (Pennsylvania, Illinois, Virginia, New York and South Dakota) saw year-over-year growth of more than 1 pound per day per cow (Table 2).

Volume, percentage growth

Idaho led all states in milk volume growth during the month, up 80 million pounds (6.3%) from April 2019. Texas was up 58 million pounds (4.9%). On a percentage basis, year-over-year April milk production jumped 7.1% in Colorado (up 28 million pounds), followed by South Dakota, up 6.6% (15 million pounds).

Only Florida, Georgia, Indiana, New Mexico and Vermont produced less milk than the same month a year earlier.

Outlook more optimistic

Bob Cropp, dairy economics professor emeritus at the University of Wisconsin – Madison, said the slowdown in milk production growth is one factor in an improving milk price outlook. Additional factors include government purchases of dairy products for federal feeding assistance programs and stronger retails sales which help offset some – but not all – of the losses in the food service sector.

With some milk buyers restricting milk volumes accepted from producers, pressure to slow production growth is mounting. The month-to-month decline in cow numbers as culling increases and the small 0.9% increase in milk output per cow due to changes in feeding and cow management may be signs dairy producers are trying, Cropp wrote in his monthly Dairy Situation and Outlook report. “Since then, retail sales of butter and cheese has increased but only partially offsetting the loss in restaurants and food service.”

Looking ahead, the outlook for Chicago Mercantile Exchange (CME) Class III and Class IV milk futures prices is more optimistic, Cropp said. June and July Class III milk futures prices are above $17 per hundredweight (cwt), holding above $16 per cwt for the remainder of the year. Class IV milk futures prices reach $14 per cwt by July and move above $15 per cwt in November and December.

However, for these prices to materialize, milk production needs to continue to slow down, domestic demand needs to increase through the opening of restaurants and food service, and dairy exports need to hold up, Cropp said.

“There is a lot of uncertainty as to where milk prices end up for the remainder of the year,” Cropp said. “But the outlook now appears more optimistic than a month earlier. Dairy producers may want to consider some price protection such as the use of the Dairy Revenue Protection Program, cash forward contracting with their milk buyer or purchasing put options.”

Additional insights from Cropp and Mark Stephenson, UW – Madison director of dairy policy analysis, incorporate the USDA’s Cold Storage report and other factors driving dairy markets. Due to the overall economic picture, they both caution the recent surge in milk futures prices may not last and recommend looking at considering use of risk management tools. View their monthly podcast here. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke