November’s restrained growth was due to a slowdown in milk production per cow. And, cow numbers were unchanged from a month earlier, although that comes with a caveat: The USDA revised October 2019’s preliminary cow numbers higher by 4,000 head.

November 2018-19 recap at a glance

Reviewing the USDA preliminary estimates for November 2019 compared to November 2018:

- U.S. milk production: 17.44 billion pounds, up 0.5%

- U.S. cow numbers: 9.331 million, down 27,000 head

- U.S. average milk per cow per month: 1,869 pounds, up 15 pounds

- 24-state milk production: 16.67 billion pounds, up 0.9%

- 24-state cow numbers: 8.81 million, up 8,000 head

- 24-state average milk per cow per month: 1,892 pounds, up 16 pounds

Source: USDA Milk Production report, Dec. 18, 2019

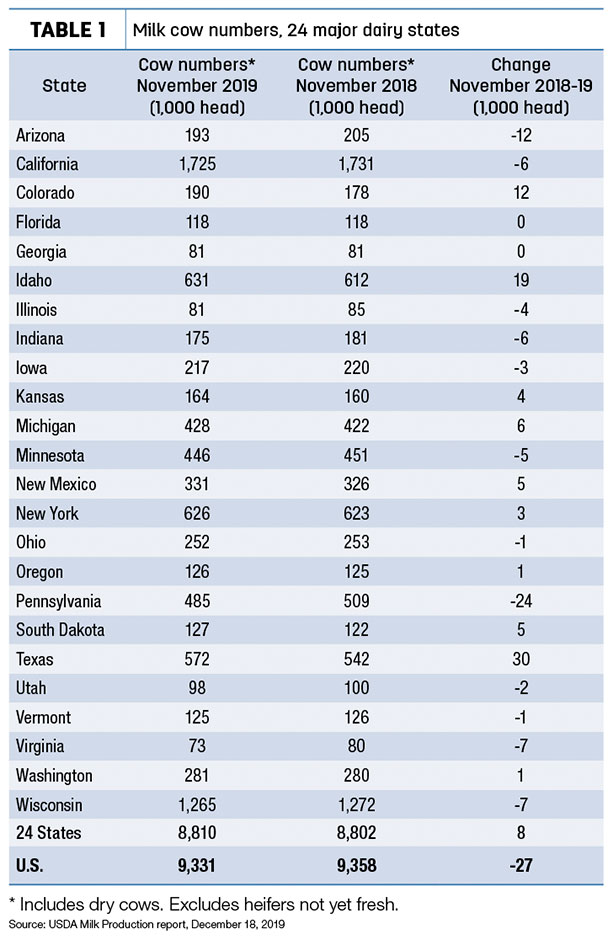

Cow numbers still building in some major states

Compared to a year earlier, November’s cow numbers were down 27,000 nationally but up 8,000 in the 24 major dairy states. Compared to a month earlier, U.S. and major dairy state cow numbers were unchanged but, as noted above, October 2019 U.S. and major state cow numbers had been revised upward by 4,000 head.

Since June, U.S. cow numbers are now up 11,000 head, and cow numbers in the 24 major dairy states are up 33,000 head.

Strongest year-to-year growth in cow numbers is in Texas, Idaho and Colorado, up 61,000 head combined (Table 1). More moderate increases were in Michigan, New Mexico, South Dakota and Kansas. Pennsylvania continues to pace decliners, down 24,000 cows from a year ago, followed by Arizona, down 12,000 head. The USDA estimated dairy farms in 10 other states were milking fewer cows than a year earlier.

Compared to a month earlier, producers in New Mexico added 2,000 cows, with Texas up 1,000. Those gains were offset by declines in Wisconsin (-2,000) and Minnesota (-1,000).

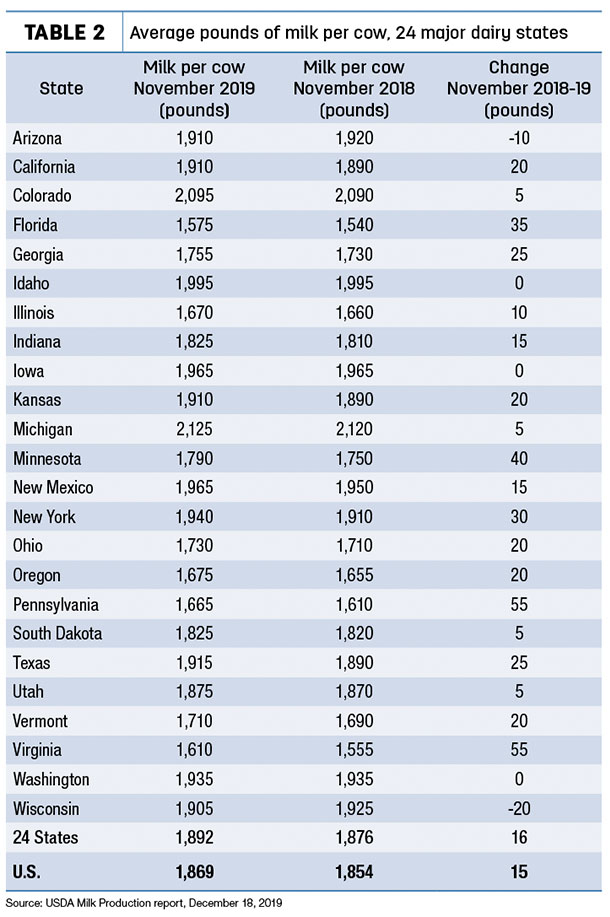

Milk per cow weakens

The USDA revised October 2019 milk output per cow lower, although monthly gains were still relatively stronger (26 pounds per cow) compared to October 2018.

Looking at November’s preliminary estimates, year-over-year monthly growth in milk per cow slowed to 16 pounds in the 24 major dairy states and 15 pounds nationally.

Cows in 19 states yielded higher milk output per cow in November compared to the same month a year earlier (Table 2). In contrast to recent months, however, increases were more restrained, and biggest gains were in Pennsylvania and Virginia (each up 55 pounds). At 2,125 pounds, Michigan continued to be the national leader in milk output per cow on a monthly basis.

Among all major states, Texas led in terms of milk volume growth in November 2019, up 71 million pounds (6.9%) from a year earlier. Colorado led in terms of percentage growth, up 7% (26 million pounds).

California output was up 23 million pounds (0.7%), and Idaho production was up 38 million pounds (3.1%).

Wisconsin milk production was down 39 million pounds, a 1.6% decline. Arizona production was down 25 million pounds (-6.3%), and Pennsylvania production was down 11 million pounds (-1.3%).

Cropp and Stephenson share similar outlook

Following the USDA’s monthly Milk Production report, Mark Stephenson, director of dairy policy analysis, and Bob Cropp, dairy economics professor emeritus at the University of Wisconsin – Madison, provided an overview of dairy markets in their monthly podcast.

The stabilization of cow numbers in November, combined with caps on growth in milk per cow due to widespread feed quality challenges, helped tone down overall production, they noted. Milk per cow will continued to be challenged as farmers feed 2019 forages.

Corn grain test weights have also been lower.

Despite a slight rebound in Chicago Mercantile Exchange (CME) cash cheese prices on Dec. 18, Stephenson and Cropp said the plummeting cheese price has put downward pressure on milk futures prices. Part of the cheese price correction is, in part, that U.S. cheese prices have been well above global prices and, as such, unsustainable. They said the sharp cheese price decline has likely been an overaction, and recovery is expected.

Stephenson remains optimistic for next year. He said conversations with dairy economists during a recent trip to Germany indicate dairy product inventories are shrinking worldwide, providing support for prices next year.

“I don’t think the collapse of cheese prices sets the tone for a real problem next year,” Stephenson said.

Cropp was encouraged by CME trading on Dec. 18 that saw Class III futures move higher, with all months again settling above $17 per hundredweight (cwt). He forecasts a Class III price average of $17.90-$18 per cwt in 2020.

Both agree 2020 prices will be stronger than 2019, especially in the second and third quarters of the year.

They noted the inversion of Class I and Class III prices resulted in Federal Milk Marketing Order (FMMO) depooling negative producer price differentials (PPDs) on most-recent milk checks. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke