At just 0.2%, monthly year-over-year U.S. milk production growth has now been under 1% for 11 consecutive months, surpassing two recent lengthy periods when milk production growth was less than 1%: in seven of eight months to end 2014 and nine of 11 months from June 2011-April 2012.

August 2018-19 recap at a glance

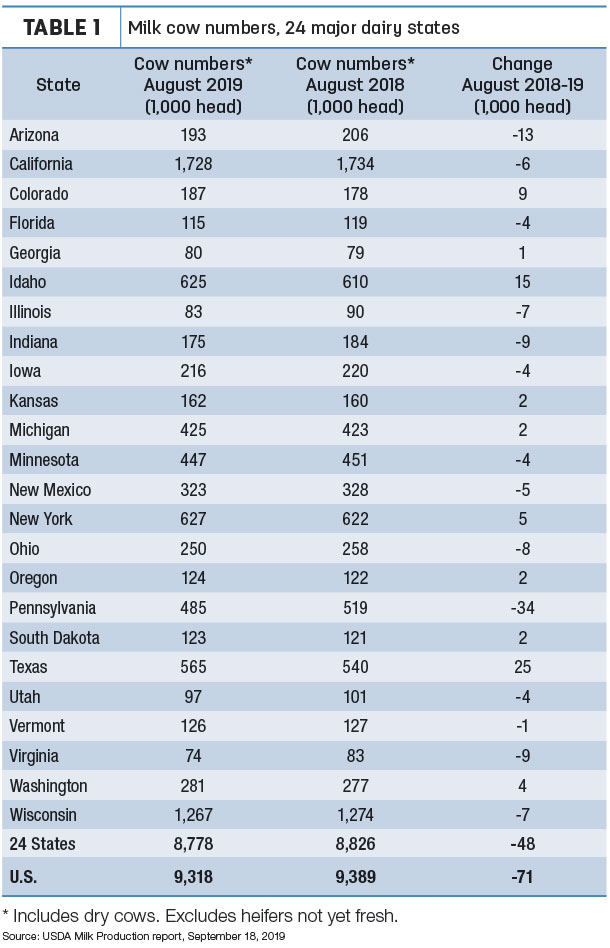

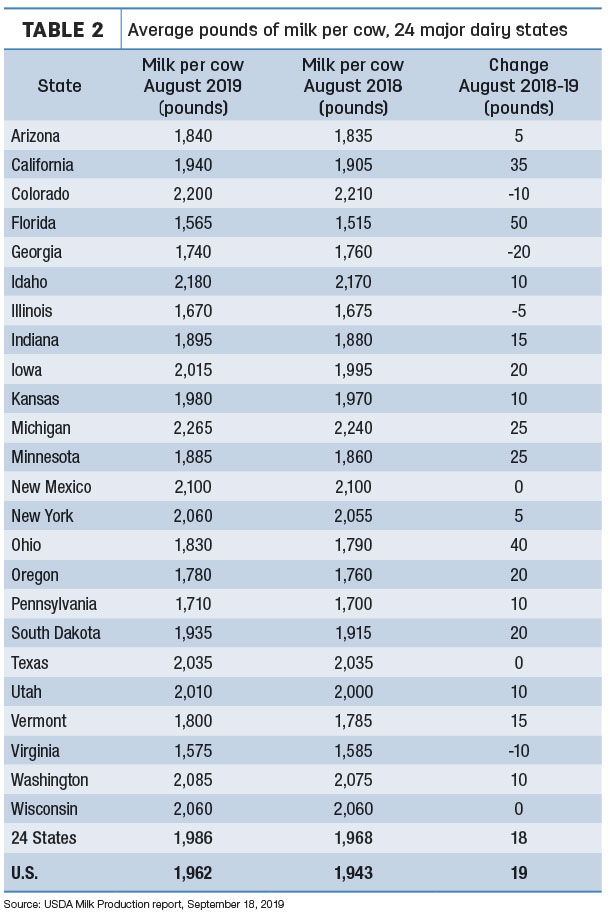

A smaller dairy herd is contributing to the slower growth in milk production. Reviewing the USDA estimates for August 2019 compared to August 2018:

- U.S. milk production: 18.28 billion pounds, up 0.2%

- U.S. cow numbers: 9.318 million, down 71,000 head

- U.S. average milk per cow per month: 1,962 pounds, up 19 pounds

- 24-state milk production: 17.43 billion pounds, up 0.4%

- 24-state cow numbers: 8.778 million, down 48,000 head

- 24-state average milk per cow per month: 1,986 pounds, up 18 pounds

Source: USDA Milk Production report, Sept. 18, 2019

Cow number decline slows

However, the contraction of the U.S. dairy herd has apparently slowed or perhaps stopped. The USDA revised the preliminary July cow numbers higher, indicating there were 10,000 more cows in the 24 major dairy states and U.S. than earlier reported.

With July’s revisions, August U.S. dairy cow numbers declined just 2,000 head from the previous month to 9.318 million head. Among the 24 major dairy states, August 2019 cow numbers were down 1,000 from July (Table 1).

Ten states increased cow numbers compared to August 2018, with the largest jumps in Texas (+25,000 head), Idaho (+15,000) and Colorado (+9,000). Largest declines were in Pennsylvania (-34,000) and Arizona (-13,000). Illinois, Wisconsin, Ohio, Indiana and Virginia were each down 7,000 to 9,000 head, with California down 6,000 head from the year before.

U.S. dairy farmers continue to move dairy cull cows to slaughter at a high rate. Federally inspected milk cow slaughter was estimated at 2.105 million through Aug. 28, 2019, about 74,000 head more than a similar date a year earlier, according to the USDA.

Nationwide, the increase in milk output per cow was modest. Cows in seven states yielded steady to lower milk output per cow in August compared to the same month a year earlier (Table 2). Biggest gains were in Florida (+50 pounds) and Ohio (+40 pounds per cow). Michigan again led all states in milk production per cow for the month.

Among all major states, Texas led in terms of milk volume and percentage growth in August 2019, up 51 million pounds (4.6%) from a year earlier. California output was up 49 million pounds (1.5%), and Idaho production was up 39 million pounds (2.9%).

Pennsylvania production was down 53 million pounds (-6%), while Arizona production was down 23 million pounds (-6.1%).

Based on the USDA’s latest World Ag Supply and Demand Estimates report, milk production is expected to follow the current trend.

The 2019 milk production forecast was raised by 100 million pounds to 218 billion pounds. If realized, 2019 production would be up less than 0.2% from 2018.

Looking to 2020, the USDA forecasts production to hit 221.2 billion pounds. In part due to an extra day to leap year, the agency forecasts 2020 milk production will rise 1.5% from 2019.

Read: USDA sees milk price moving closer to $19 next year.

October Class I base price steady

Also announced on Sept. 18, the October 2019 Federal Milk Marketing Order (FMMO) Class I base price is $17.84 per hundredweight (cwt), down 1 cent from September but up $1.51 from October 2018. Through the first 10 months of 2019, the Class I base price is $16.64 per cwt, up about $1.89 compared to the same period a year ago.

The regular monthly Dairy Situation and Outlook report from Mark Stephenson, director of dairy policy analysis, and Bob Cropp, dairy economics professor emeritus, with the University of Wisconsin – Madison, was not available at Progressive Dairy’s deadline. Check back later for details. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke