This month’s forage market snapshot looks at how we weathered the dog days of a summer. And, we unveil a new format for monthly hay prices.

U.S. hay exports slow

U.S. exports of alfalfa and other hays slipped to five-month lows in June, with shipment volume down to nearly all major foreign markets.

At 234,464 metric tons (MT), June exports of alfalfa hay were down about 46,000 MT from May and the lowest volume since February. The value of June alfalfa hay exports was estimated at nearly $79.1 million, also the lowest since February.

China remained the biggest alfalfa customer; although at 98,642 MT, the volume was down more than 19,000 MT from May and nearly 30,000 MT less than April. June sales to Saudi Arabia, at 22,146 MT, were down 13,000 MT from May. Smaller sales declines were reported to South Korea, the United Arab Emirates (UAE) and Taiwan.

June exports of other hay totaled 110,527 MT, down more than 29,000 MT from May and also the lowest monthly volume since February. At 68,477 MT, sales to the leading market, Japan, fell almost 14,000 MT from May. The second-leading market, South Korea, saw a decline of almost 11,000 MT, with smaller sales volumes also reported to Taiwan, the UAE and China. The value of June exports of other hay was estimated at $37.3 million, the lowest since January.

Some of the slowdown in exports has to do with the surge in sales in previous months, when buyers sought to build inventories due to concerns over potential port closings, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. She expects the trend to continue to be reflected in July and August export reports. In Japan, buyers sought U.S. hay ahead of the Summer Olympics. Even though the Olympics have now been canceled, shipment schedules have remained as planned.

The U.S. political relationship with China is adding risks and unknowns to hay marketing. China is increasing testing requirements of U.S. alfalfa, which could lead to shipment rejections. China continues to review other hay market options and is researching potential replacement products, including domestically produced alfalfa silage.

In the Pacific Northwest, the new crop harvest did not get off to a great start due to rain, limiting the availability of high-quality alfalfa and raising prices.

With COVID-19 travel restrictions limiting customer visits, marketing is more difficult. Mastin characterizes buying hay to purchasing a pillow online: “You can see the color and size, but you have no idea how soft it is or hard it is, if the filling has a specific smell or if the shape works for you. It is very hard to be confident you are purchasing what you want, and there is no real return policy.”

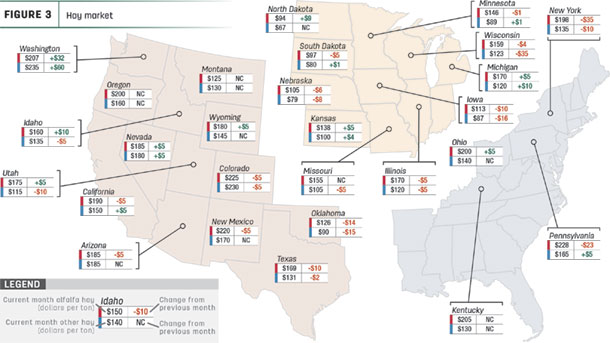

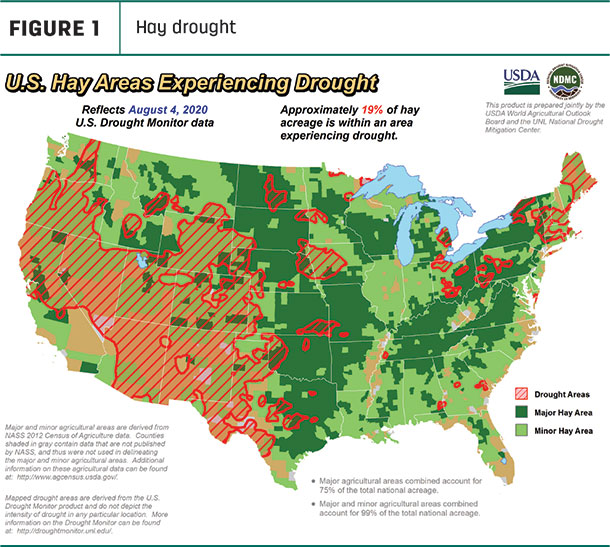

Drought areas expand

Early August weather maps showed an expansion of hay-producing areas impacted by drought. Dry conditions now cover the northern half of California and nearly all of Nevada, Utah, Arizona, New Mexico, Colorado, Wyoming and Oregon. Dry pockets expanded in Idaho, Iowa, Montana and Nebraska, and emerged in Michigan, Ohio, South Dakota and Pennsylvania. Conditions improved slightly in Minnesota, North Dakota and Oklahoma.

About 19% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions as of Aug. 4, a 2% increase from the first week in July. At 29%, alfalfa-producing areas affected by drought increased 5% over the same period (Figure 2).

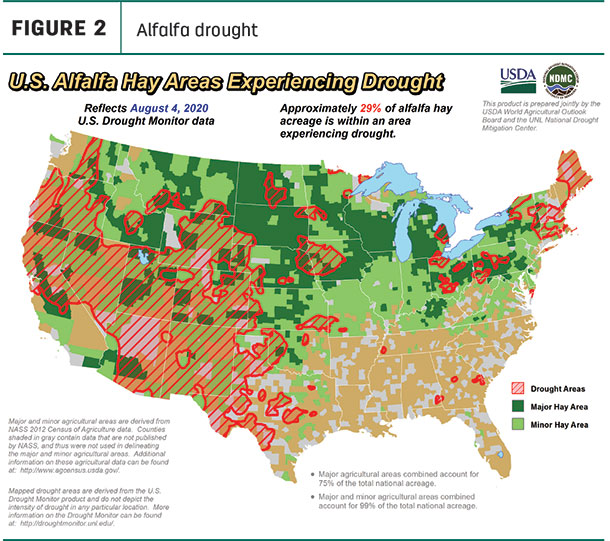

Hay prices: A new look

Regular readers of Forage Market Insights will notice something new this month: a map (Figure 3) highlighting hay prices in major forage states.

Click here or on the map above to open it at full size in a new window.

In the past, we’ve featured graphs showing regional average hay prices. However, it became more apparent that regional averaging failed to reflect what was actually happening in individual states.

The new graphics highlight monthly average prices for alfalfa and other hay as compiled by the USDA, as well as price changes from the previous month. The updates are meant to provide a snapshot-in-time look at hay markets, with a general overview of price trends. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets specific to the needs of buyers and sellers, so check individual market reports elsewhere in Progressive Forage.

Alfalfa

The U.S. average alfalfa hay price averaged $179 per ton in June 2020, unchanged from May 2020 but down about $14 per ton from June 2019.

Compared with May 2020, June average prices were up $32 per ton in Washington and $10 per ton in Idaho. Largest declines were in New York and Pennsylvania, down $35 and $23 per ton, respectively.

Even with the decline, Pennsylvania’s June alfalfa hay prices were the highest among major forage states, according to the USDA. At $228 per ton, the statewide average nudged out Colorado and New Mexico at $225 and $220 per ton, respectively. North Dakota and South Dakota prices averaged less than $100 per ton.

Other hay

The U.S. average price for other hay declined slightly in June, down $3 per ton from May and $18 per ton less than June 2019.

Countering the narrow national trend, Washington took a substantial jump in the average price for other hay, up $60 per ton from May. Decliners were led by Wisconsin, down $35 per ton, with average prices in New York, Utah, Oklahoma and Iowa down $10-$16 per ton.

With the large increase, Washington had the highest average price for other hay in June at $235 per ton, followed by Colorado at $230 per ton. Prices averaged under $100 per ton in six states: Iowa, Minnesota, Nebraska, Oklahoma, North Dakota and South Dakota.

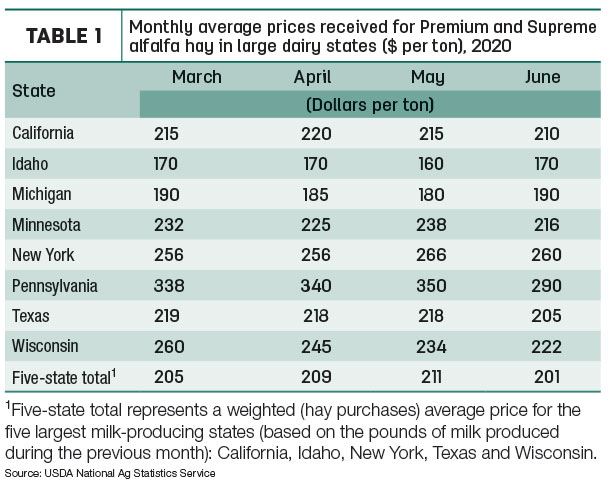

Dairy hay

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $201 per ton in June, down $10 from May (Table 1). Price trends were mixed to mostly lower among the dairy states.

Organic hay

The USDA’s organic hay price report was limited. For the two-week period ending July 29, f.o.b. farm gate prices for Premium midsquares of alfalfa hay averaged $175 per ton; good large squares of alfalfa hay averaged $220 per ton. There were no sales reported for delivered organic hay.

Regional markets

Here’s a regional summary of conditions and markets during the first week of August:

- Midwest: In Missouri, hay prices were steady, supply heavy and demand light. August brought unseasonably cool temperatures and improved drought conditions, with pastures greening back up. A lot of hay was being offered for sale, but there wasn’t much movement.

In Iowa, offerings were mostly new-crop hay of average quality. Alfalfa sold steady and grass hay sold steady to weaker.

In Kansas, trade was slow and demand light; prices were steady. Late July and early August rains slowed haying, hurting quality and making grinding and blending difficult.

In Central and Platte Valley areas of Nebraska, baled hay, dehydrated pellets, ground and delivered hay sold steady. In the west, alfalfa, ground and delivered hay sold steady. Buyer inquiry was moderate.

In Michigan, rains aided some areas of the state, but not everyone received the necessary moisture. Dry weather impacted alfalfa and mixed hay yields, and there was an increase in potato leafhopper damage.

In South Dakota, all classes of hay sold steady to firm. Demand was moderate overall, with most hay users only buying to meet current needs. Third cutting volumes were light.

In Wisconsin, prices are steady for quality hay. Lower-quality hay prices have backed off.

In Minnesota, prices were steady with a limited supply of quality hay at the market.

- Southwest: In Texas, hay trade was mostly steady to firm in all areas, as weather conditions – from a hurricane to drought – hampered the majority of the regions. The south, coastal bend and east received extreme rains and damaging winds from Hurricane Hanna, although the full extent to the hay crop was unknown. The far west was still extremely dry and hot; pastures had little to no grass left, and livestock were being heavily supplemented. The Panhandle has been blessed with cooler temperatures and scattered rain showers, improving pasture conditions. The north and central portions of the state had received steady rains which boosted pastures and hay production.

In California, trade activity was moderate on moderate demand. The California Farm Bureau reported a large wildfire in northeastern California (Modoc and Siskiyou counties) caused damage to crops, including hay.

In Oklahoma, hay trade was slow due to heavy rains and cooler temperatures. Stock cow producers were hoping the weather will extend the grazing season, leaving less need to start stockpiling hay. Many dairies were looking for alternative feedstuffs. Producers were hoping for a second cutting of bermudagrass.

In New Mexico, alfalfa hay prices were steady, with north-central alfalfa hay going to dairies selling $15 higher. Trade was moderate on moderate-to-good demand. The southern, eastern regions were in fourth cutting. Some producers are storing hay due to lower offers.

- Northwest: In Wyoming, demand was moderate to good. Most lots of large squares and large rounds of alfalfa sold steady, as did alfalfa cubes and sun-cured pellets. Worsening drought conditions have Wyoming buyers looking to Montana for hay.

In Montana, hay sold fully steady with movement and demand mostly moderate to good. Drought conditions are spreading north there too. Grasshoppers and weevils were eating their way across much of the central and eastern portions of the state, raising concerns over second and third cuttings.

In Idaho, domestic new-crop alfalfa sold steady; there no reports of export sales. A lack of higher-testing new crop alfalfa has increased demand, while an abundance of feeder-quality rained-on supplies continue to put pressure on that market. Demand is good for green-testing supplies, light demand for high moisture.

In Colorado, trade activity was light on moderate-to-good demand for feedlot, dairy and stable hay. Northeast Colorado was wrapping up late second-cutting alfalfa. Cooler-than-normal temperatures helped slow some of the drought development in the mountain and northwest Colorado areas.

In Oregon, prices trended generally steady. Some growers are reporting first cutting sold out. In the Washington-Oregon Columbia Basin, Good and Premium alfalfa for export and domestic markets sold steady. Exporters were busy doing three-tie bales on third cutting. Most of the trade area was under a heat advisory in early August.

- East: In Pennsylvania, buyer demand was moderate to heavy, with moderate-to-heavy supply. July averaged 2º-6°F above normal, and rainfall was well below normal in most areas. Except for eastern and northern counties, much of Pennsylvania is dry.

In Alabama, hay prices were steady, with moderate supply and demand.

Other things we’re seeing

-

Dairy – Milk prices moved sharply higher while feed costs declined. That should have resulted in vastly improved dairy income margins, and financial conditions have improved. However, due to the complex nature of formulas used to calculate milk prices under the Federal Milk Marketing Order system, factors like negative producer price differentials and depooling weighed heavily on producer milk checks. (It would take hours and thousands of words to explain.) With improved milk prices, year-over-year U.S. milk production grew modestly in June 2020. One trend to watch: Total U.S. cow numbers declined for a third straight month. Growth areas were in Texas, Idaho, South Dakota and Colorado.

-

Counting beef cattle – The USDA’s Cattle report pegs the total number of beef cattle and calves as of July 1 at 103 million head, just slightly above last July’s inventory and fairly in line with market expectations. A separate update said the number of cattle in feedlots was down slightly from a year earlier. All things considered, prices for the next four quarters are likely to follow similar seasonal patterns as in prior years, albeit at lower levels. The major factors that could result in notably lower prices are uncertainties surrounding trade and the coronavirus.

-

Farm bankruptcies – There was mixed news in the latest analysis of Chapter 12 farm bankruptcy filing data from the American Farm Bureau Federation (AFBF). While the number of Chapter 12 filings slowed in the first six months of 2020, filings were up 8% for the 12-month period ending June 30, 2020. The lower number of filings through the first half of 2020 – at a time when farmers and ranchers are struggling with the impact of COVID-19 – is due in large part to federal financial assistance, and there’s a high likelihood the number of Chapter 12 filings will increase without additional financial assistance. Bankruptcy rates over the previous 12 months were the highest in the Midwest (led by Wisconsin), the Northwest and Southeast.

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke