Alfalfa hay exports set new record high

U.S. December 2019 alfalfa hay exports were the smallest since February, but the total was still enough to push total 2019 sales to a new record high.

Monthly alfalfa hay exports were estimated at 205,998 metric tons (MT), raising the 2019 total to 2.685 million MT, edging out the previous high of 2.661 million MT in 2017.

December sales to China totaled 71,577 MT, down about 23,000 MT from November and the smallest volume since June. Alfalfa shipments to China totaled about 865,400 MT in 2019, down slightly from last year and the lowest annual total since 2014. China purchased about 32% of all U.S. alfalfa hay exports in 2019.

Japan remained the second-leading alfalfa hay customer, purchasing 50,546 MT in December and just under 664,000 MT for the year, 25% of the year’s total.

Saudi Arabia, the United Arab Emirates and South Korea each purchased between 21,300-22,600 MT in December. Saudi Arabia ended the year as the third-largest alfalfa buyer, at 417,500 MT.

Like alfalfa, December exports of other hay declined slightly in December, to 115,199 MT. The 2019 total was about 1.393 million MT, up slightly from 2018 but still the second-lowest annual total in at least 15 years.

After peaking for the year in November, December shipments to Japan (66,869 MT) and South Korea (30,607 MT) were lower. Japan ended the year as the largest buyer of other hay, at 770,750 MT, or more than 55% of the U.S. total; South Korea was second, at 351,770 MT, 25% of annual total.

Normal seasonal challenges affected December exports: the holidays resulted in fewer loading and shipping days, and snowfall in the mountain passes restricted hay from being brought to ports in the Pacific Northwest.

An issue we usually don’t talk about in relationship to exports – human health and the coronavirus in China – is impacting shipping logistics, according to Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington. In an effort to control spread of the disease, China extended the New Year holiday season, with ports and shipping terminals operating with skeleton crews and disrupting sailing schedules. And, with hay sellers reluctant to travel to China due to health concerns, the disease has the potential to impact U.S. hay sales into spring.

New regulations regarding ship-fueling practices are adding expense or causing delays in ports. Shippers can either switch to low-sulfur fuel, at a higher cost, or retrofit engines with scrubbers, resulting in several days in dry docks, impacting vessel schedules and port movement.

Drought areas, moisture conditions

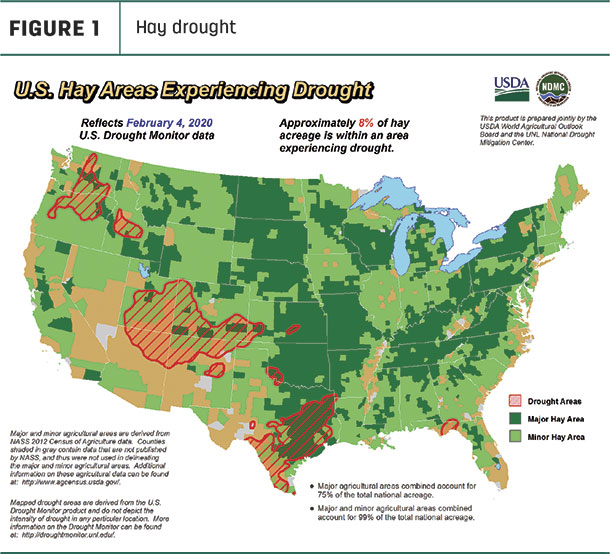

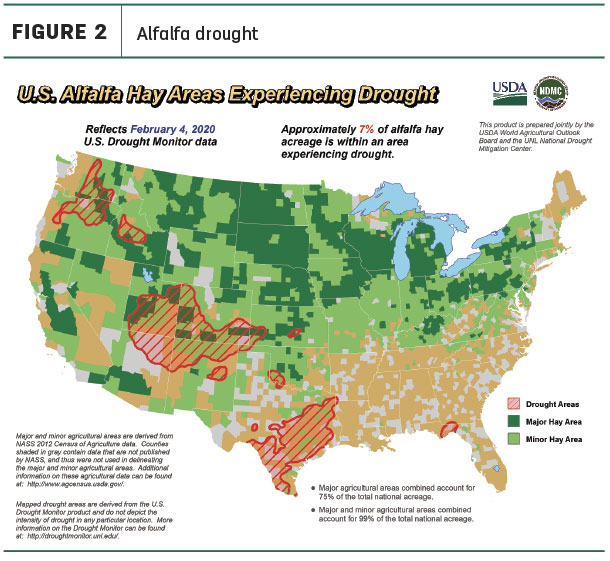

Moving into February, hay-producing areas impacted by drought hadn’t changed much. About 8% of U.S. hay-producing acreage (Figure 1) was considered under a drought, a 1% decline from the previous month. At 7%, alfalfa-producing areas under drought conditions increased 1% (Figure 2). Largest dry areas were in Texas, Colorado, Utah, Oregon and Washington, with emerging drought in central Idaho.

A changing weather pattern was affecting snowfall in the West, according to Eric Snodgrass, atmospheric scientist with Nutrien Ag Solutions. Beneficiaries were in the Pacific Northwest and Northern Plains, where moisture levels and snowpacks were improving, at the expense of Arizona, Nevada and California.

Meanwhile, moisture levels in the Missouri, Mississippi and Ohio River watersheds were surplus, an indication spring flooding could be problematic with the onset of spring, Snodgrass said in his regular “Weather Insights” video presented by Northwest Farm Credit Services.

2019 and December prices summarized

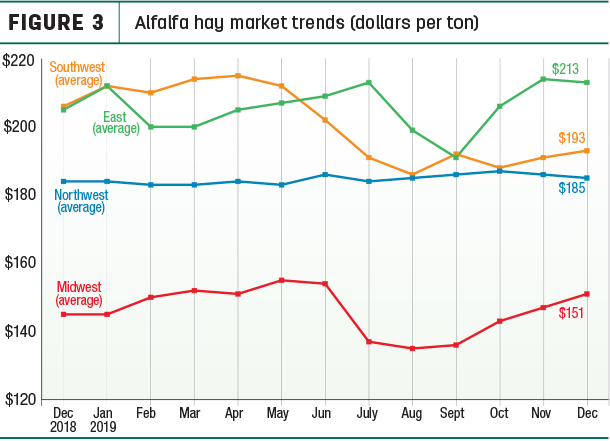

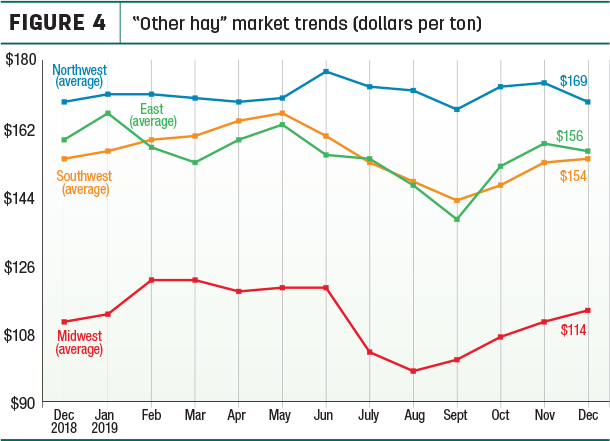

Calendar year 2019, U.S. average prices for alfalfa and other hay both increased $10 per ton from the year before. Alfalfa hay averaged $184 per ton in 2019, while other hay averaged just under $139 per ton.

Alfalfa

The U.S. average alfalfa hay price increased $2 per ton in December 2019, to $175 per ton; prices rose in three of four regions tracked by Progressive Forage, with only the Northwest posting a small decline (Figure 3).

Reflecting high demand from dairy producers faced with lower-quality forage supplies, Wisconsin saw the highest all alfalfa hay price during the month, up $56 from the year before, to $242 per ton. Colorado ($230) and Pennsylvania ($225) followed, and eight other states averaged $200 or more per ton. The low was in North Dakota ($87).

Compared to a month earlier, alfalfa prices fell about $35 per ton in Kansas and New Mexico but jumped about $15 per ton in Wisconsin and Ohio.

Other hay

After a nice bump in November, the U.S. average price for other hay fell to $133 per ton in December. Increases in the Midwest and Southwest were offset by declines in the East and Northwest (Figure 4).

Highest average prices in December were in Colorado ($220 per ton), with Oregon and Arizona at $200 per ton. Prices averaged under $100 per ton in five states, including Kansas, Nebraska, North Dakota, Oklahoma and South Dakota.

Compared to a month earlier, prices were stronger in Iowa, Ohio and Nebraska, but weaker in Colorado, Idaho, Michigan, New York, Wyoming, Minnesota and Pennsylvania.

Dairy hay

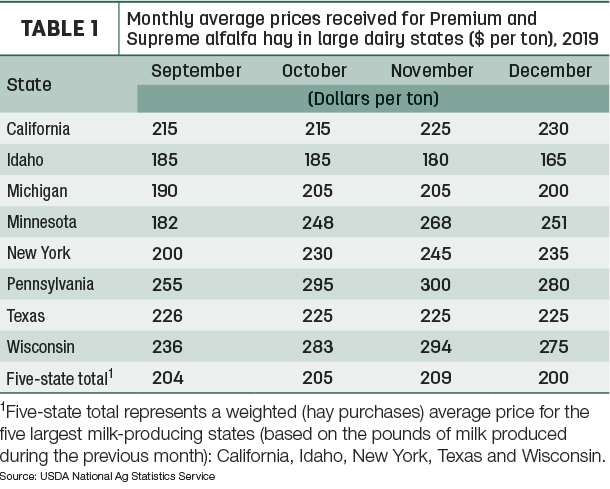

December prices for Premium and Supreme hay in the top milk-producing states averaged $200 per ton, down $9 from November and the low for the year (Table 1).

Organic hay

According to the USDA’s organic hay report released on Jan. 29, f.o.b farm gate prices paid for Supreme alfalfa large square bales averaged $250 per ton. A mix of Premium/Supreme alfalfa large square bales averaged $256 per ton, with Premium large squares in a range of $179-$201 per ton.

Regional markets

Here’s a regional summary of early February conditions and markets:

- Midwest: In Nebraska, many contacts said January’s demand and movement had been the slowest month in recent memory. More hay was on the market in the central part of the state. There appears to be a wide range of quality of alfalfa, grass hay and other baled forage available.

Kansas and Missouri shared similar stories: snowstorms and wide temperature swings slowed hay movement, with loading and feeding complicated by thawed ground or snow. In Missouri, the hay supply was moderate; demand was light to moderate and prices were steady.

In South Dakota, there was moderate to good demand for all types and qualities of hay, but the market activity was slower. The weather was conducive for hay hauling, but a cool down and more snow was forecast.

Top-quality hay was in demand in Wisconsin, where feed inventories and alfalfa winterkill were a concern.

In southwest Minnesota, prices were steady, with a limited supply of hay at the market.

- Southwest: In Oklahoma, alfalfa and hay trade movement was halted by heavy snowfall across the entire trade area. Demand was moderate with concerns of dwindling hay inventories if cold and wet weather continued.

In Texas, snow blanketed the Panhandle in early February, giving much-needed moisture to the winter wheat crop. Dry conditions in southern and western Texas made grazing very scarce, and supplemental feeding was in full swing. Fieldwork in the north and east was halted due to soaking rains; this also slowed the hay trade as producers had a hard time loading out customers.

- Northwest: In Montana, heavy snow helped increase demand. Ranchers continue to buy hay in rounds on an as-need basis. Demand for square bales to ship east continues to be mostly good. Canadian buyers were more active in the market.

In Idaho, there was good demand for feeder-type hay as calving season approached. Dairies reported ample supplies; supplies of alfalfa remain in firm hands.

In Colorado, hay trade activity light on moderate demand. Snow and/or precipitation updates showed above average water equivalent percentages.

In Wyoming, contacts stated this has been the snowiest season they can remember for several years. Hay has been slow to move, waiting for trucks. Most of the hay is going out of state to horse owners and dairies. Some local buying is for cattlemen to supplement cow herds. At a late-January video auction, demand was very good with active bidding from dairy interests, with most of the hay going to Colorado dairies. Most of the hay offered was second- and third-cutting alfalfa consigned from eastern Wyoming and the Nebraska Panhandle.

- East: In Pennsylvania, buyer demand was moderate, and all varieties of hay and straw sold mostly steady to weak on a heavy supply.

In Alabama, hay prices were steady on moderate supply and good demand.

Other things we’re seeing

- Dairy cattle numbers are down. The USDA’s semiannual estimate of cattle inventories indicates there were fewer dairy cows and replacement heifers to start the new year. As of Jan. 1, 2020, U.S. dairy herds contained about 9.335 million dairy cows, down about 18,800 from a year earlier and the smallest total since 2016. Combined, dairy herds in Texas, Idaho and Colorado had 67,000 more dairy cows than a year earlier. In contrast, herds in Pennsylvania, Arizona and Wisconsin were down a combined 47,000 head from Jan. 1, 2019.

Looking at potential dairy replacements, there were about 4.637 million dairy heifers weighing 500 pounds or more as of Jan. 1, down 64,500 from a year earlier and the lowest number to start a year since 2014.

-

The beef herd expansion has stopped. Even though the number of beef cattle in feedlots is up, indications are the U.S. beef herd expansion has also come to an end. According to the USDA’s inventory report, beef cows in U.S. herds as of Jan. 1, 2020, at 31.3 million head, were down 1% from a year earlier. Beef replacement heifers, at 5.77 million head, were down 2%.

-

Fuel prices are lower. U.S. average retail diesel and regular gasoline prices fell in early February, with diesel prices falling below year-earlier levels.

- The number of U.S. farms restructuring debt by filing Chapter 12 bankruptcy rose in 2019. At 595, Chapter 12 filings were up 20% from a year earlier and the highest annual total since 2011, according to analysis by the American Farm Bureau Federation. More than two-thirds of the filings were in the 24 major dairy states, although the total does not necessarily mean all were dairy operations. Chapter 12 bankruptcies were at decade-high levels in Wisconsin, Georgia, Iowa, Illinois, Kansas, Minnesota, Ohio, South Dakota and Vermont.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin .

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke