Production, inventory up slightly

Production of all dry hay for 2019 was estimated at 128.9 million tons, up 4% compared to 2018. At 2.46 tons per acre, average yield was up 0.12 ton, but area harvested was down 1% from 2018, at 52.4 million acres.

Production of alfalfa and alfalfa mixture hay in 2019 was estimated at 54.9 million tons, up 4% compared to 2018. Harvested area, at 16.7 million acres, was up 1%, and average yield was up 0.11 ton, to 3.28 tons per acre. Record-high yields were estimated in Idaho and Nevada.

Production of all other hay totaled 74.0 million tons, up 4% from 2018. Harvested area, at 35.7 million acres, was down 2%, while average yield was estimated at 2.07 tons per acre, up 0.11 ton. Record-high yields were estimated in California, Kansas, Maine, Missouri, Montana, Nevada and Utah.

With higher production, all hay stored on U.S. farms as of Dec. 1, 2019 totaled 84.5 million tons, up 7% from a year earlier. The largest increases in stocks from one year ago were in Kansas, Missouri, Montana, South Dakota and Texas, all resulting from increased production. December inventories were at record lows in Connecticut, Illinois, Indiana, Maine, Minnesota, Pennsylvania and Rhode Island.

In a preview of things to come, the USDA estimated growers seeded 2.47 million acres of alfalfa and alfalfa mixtures during 2019, up 11% from 2018.

Progressive Forage will provide an in-depth look at state, regional and national hay and total forage production in its annual Forage Statistics issue, March 2020.

Exports: Alfalfa back to earth but other hay increases

U.S. November 2019 alfalfa hay exports came back to earth after rising to new heights in October. Monthly exports were estimated at 232,694 metric tons (MT), still the fifth highest total in the past 17 months. November’s sales pushed the U.S. alfalfa hay export year-to-date total to 2.48 million MT, ahead of the record-setting pace of 2017.

November sales to China totaled 94,497 MT, down about 34,100 MT from October. At 54,599 MT, alfalfa exports to Japan were the highest since July, while sales to Taiwan, at 9,106 MT, were the highest in at least five years. Sales to the United Arab Emirates (25,538 MT) and South Korea (22,021 MT) were about average in recent months.

While alfalfa exports softened somewhat, November exports of other hay rose to 135,607 MT, the largest monthly volume in more than two years. Year-to-date exports of other hay reached nearly 1.28 million MT, ahead of last year’s pace. Monthly shipments to Japan (72,089 MT) were the highest since February 2014, and sales to South Korea (44,001 MT) were the highest in two years.

According to Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington, several factors impacted November’s export totals. The start of the holiday season provided fewer available shipping days, and mechanical issues with vessels resulted in shipping delays and port changes to deal with repairs. Some ships were also in dry dock for three days to complete the switch to burn low-sulfur fuels. The uncertainty over U.S.-China trade affected shipping schedules, as well.

On the other hand, export volumes of other hay were fueled by deep price cutting in an effort to move product. The concern now is whether buyers used the low prices to stockpile supplies, impacting future sales.

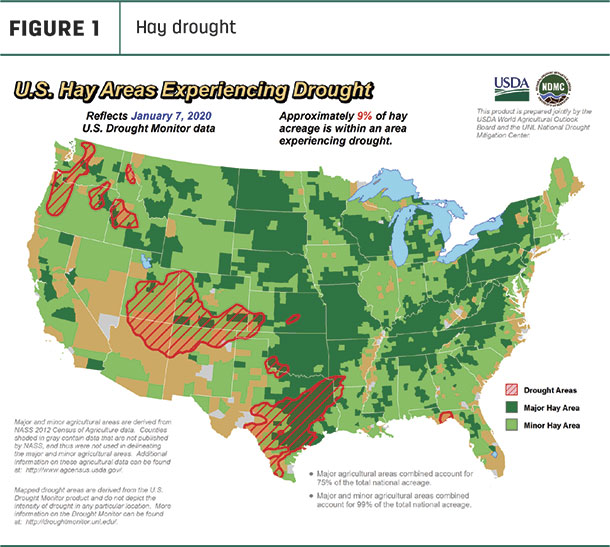

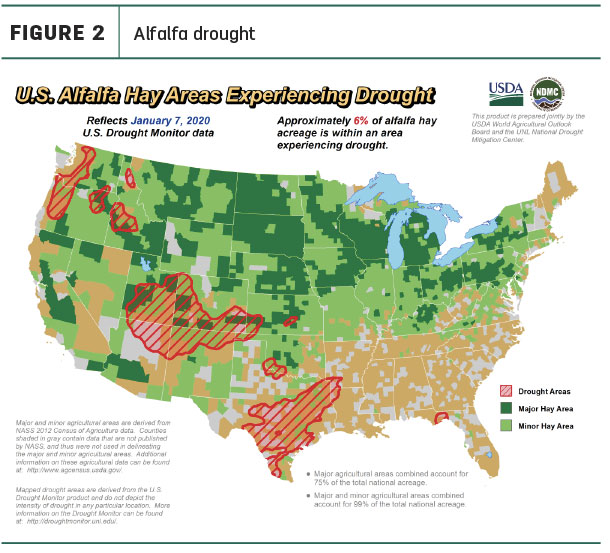

Drought areas

Entering the new year, hay-producing areas impacted by drought were little changed. As of the first week of January, about 9% of U.S. hay-producing acreage (Figure 1) was considered under a drought, a 2% increase from the previous month. At 6%, alfalfa-producing areas under drought conditions saw no change (Figure 2). While percentages didn’t change much, previous drought areas all but disappeared in the Southeast but remained prominent in Utah, Colorado and Texas. New drought areas also emerged in Idaho, Oregon and Washington.

Early snowpack surveys are underway in the West. A summary of 130 electronic reading stations scattered throughout California indicated the snowpack’s snow water equivalent (SWE) was 9.3 inches as of Jan. 10, or 90% of the 30-year average.

Elsewhere, SWE estimates were above historical averages in Arizona, Colorado, New Mexico and Utah; about average in Montana, Nevada and Missouri; and below average in Idaho, Oregon, Washington and the Columbia River Basin.

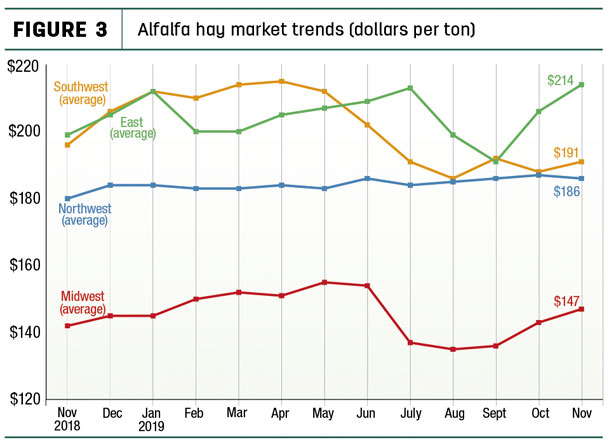

November prices summarized

Alfalfa

The U.S. average alfalfa hay price declined $6 per ton in November 2019, to $173 per ton. That’s the lowest average of the year and equal to one year earlier. The overall decline came even though prices rose in three of four regions tracked by Progressive Forage (Figure 3).

Compared to a month earlier, alfalfa prices fell $28 per ton in Oklahoma and were down $5-$7 per ton in Kentucky, Michigan, Montana, Nevada, Oregon, South Dakota and Kansas. Monthly prices were unchanged in nine hay states but jumped $45 in Texas and $26 in Minnesota.

High monthly alfalfa hay prices were in Colorado and Pennsylvania (both $235) and Wisconsin ($226); seven other states averaged more than $200 per ton. Lows were in North Dakota ($88) and Nebraska ($106).

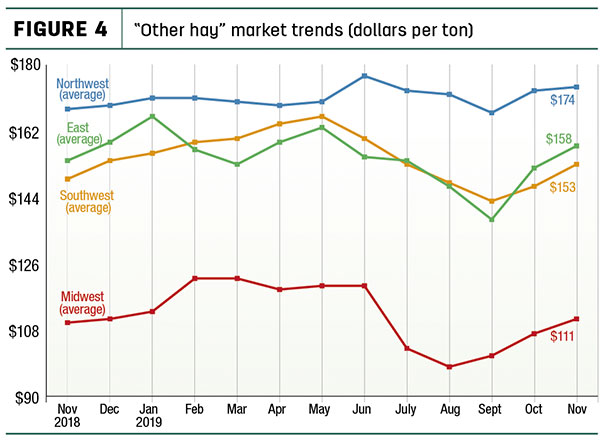

Other hay

The U.S. average price for other hay continued to rebound in November; at $137 per ton, it was up $11 from October and the highest since June. Month-to-month price increases occurred in all four regions of the country, led by the East and Southwest (Figure 4).

Highest average prices in November were in Colorado ($230 per ton), with Oregon and Arizona also at or above $200 per ton. Prices averaged under $100 per ton in six states, including Iowa, Kansas, Nebraska, North Dakota, Oklahoma and South Dakota.

Dairy hay

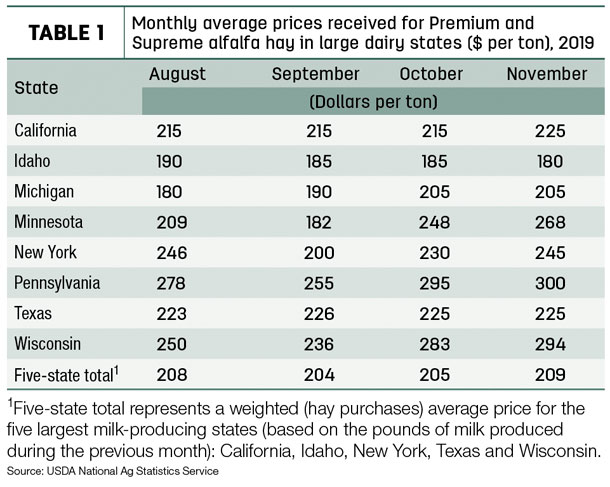

November prices for Premium and Supreme hay in the top milk-producing states averaged $209 per ton, up $4 from October (Table 1).

Organic hay

According to the USDA’s organic hay report released in late December, FOB farm gate prices paid for Supreme alfalfa large square bales averaged $261 per ton. A mix of Premium/Supreme alfalfa large square bales averaged $240 per ton, with Premium large squares at $215 per ton. Good/Premium alfalfa in small square bales averaged $220 per ton.

Regional markets

Here’s a regional summary of early January conditions and markets:

• Midwest: In Iowa, alfalfa and grass hay sold steadily, with less buyer interest on lower-quality hay.

In Nebraska, muddy ground conditions made delivery of contracted hay a challenge. Some producers may have to start buying hay at calving time. Forage availability is spotty, and some buyers are turning to South Dakota, seeking hay at a cheaper price delivered than local hay producers are asking.

In Kansas, trade and demand remained slow to start the year, with prices steady on limited test. Most areas saw dairy hay selling at about $1.00-$1.05 per point of relative feed value (RFV).

In Missouri, producers were eager to move inventories prior to spring, but mild winter weather thus far in the feeding season was slowing the hay market.

In South Dakota, prices for alfalfa hay and grass hay remain firm on good demand, especially from out-of-state buyers. Early January blizzard conditions made it difficult to get hay loaded.

Updates from Wisconsin and Minnesota were not available at Progressive Forage’s deadline.

• Southwest: In Oklahoma, alfalfa and hay trade movement was light to moderate due to the warmer winter.

In Utah, prices were mostly steady, with trading slow on all qualities of hay.

In Texas, supplemental feeding moved into full swing in most regions. Quality continues to set the price. A large portion of the dairy/horse quality alfalfa hay was being brought down from Colorado.

In California, almond acres are steadily increasing at roughly the same rate that alfalfa acres are decreasing, as tree nut growers are reportedly purchasing extra ground for the water rights.

• Northwest: Hampered by late-season rainfall, inventories of high-quality hay were down throughout the Northwest, according to Northwest Farm Credit Services.

In Montana, cold temperatures caused cattle operators to start feeding hay earlier than normal, and any surplus hay is being held in case of a long winter and spring. The fall rains and early winter snows fostered optimism for sufficient water supply in the 2020 growing season.

In Idaho, improved dairy margins increased demand for higher quality hay, although inventories remained tight.

In the Washington-Oregon Columbia Basin, a surplus of feeder hay shrank the price gap between high- and low-quality hay. Producers are timid about planting timothy in 2020, favoring alfalfa. Oregon prices trended generally steady.

In Colorado, trade activity and demand were light. Moderate and severe short-term droughts continued across the southern portion of the high plains.

In Wyoming, hay prices were steady to firm. Most contacts in eastern part of the state were sold out. Anticipation of an arctic blast heightened the likelihood livestock owners would have to increase feeding, depleting hay piles elsewhere. Some producers continued to wait on trucks to haul hay to out-of-state buyers.

• East: In Pennsylvania, demand was picking up at post-holiday hay auctions, with supplies light to moderate depending on location.

In Alabama, hay prices were fully steady on moderate supply and good demand.

Dairy outlook

In November, U.S. average milk prices and dairy income margins likely peaked for the foreseeable future as year-over-year milk production growth slowed. The restrained growth was due to weaker milk production per cow as dairy producers struggled with forage quality in many regions.

While cow numbers were unchanged from a month earlier, that came with a caveat: the USDA revised October 2019’s preliminary cow numbers higher by 4,000 head.

Compared to a year earlier, November’s cow numbers were down 27,000 nationally, but up 8,000 in the 24 major dairy states. Since June, cow numbers in those major states are up 33,000 head, with strongest growth in Texas, Idaho and Colorado and more moderate increases in Michigan, New Mexico, South Dakota and Kansas.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke