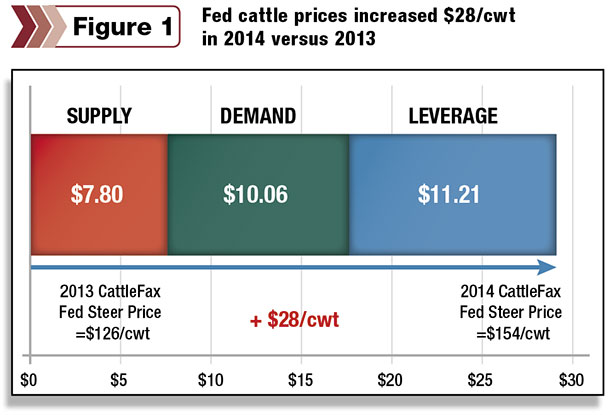

The tight supply of beef that has existed for several years, joined with strong demand from domestic and foreign buyers, was accountable for the high prices.

CattleFax CEO Randy Blach and analyst Kevin Good told producers at the 2015 NCBA Cattle Industry Convention in San Antonio the $28 per hundredweight (cwt) jump in fed cattle prices seen in 2014 was only partly due to supply and demand.

The largest portion – around $11.21 per cwt – was due to leverage the cattle seller could extract from retailers. Pork and poultry production took a big hit in 2014, and that provided a selling premium for beef.

“We got the highest percentage of retail that we’ve had since 1993,” Good said. “We had the leverage; we had tight supplies going through a system; therefore, the packer and retailer had to bid up for our product. And we got 2.1 percent more retail last year than the year prior.”

Good said by multiplying the 2.1 percent increase to the average retail price of beef at $5.50 a pound, “that’s 11 and a half dollars more per live hundredweight on steers and heifers that we gained just because of leverage.”

Historically that trend will be hard to continue. And with poultry and pork boosting production of competing meats, “we’re going to give up some of that leverage.”

“As you start giving up leverage, your fed market’s going to be an underachiever. It’s going to tend to underperform your expectations looking at supply and demand natures.”

The cattle inventory on Jan. 1, 2015, showed an increase of 600,000 female beef cows, indicating clear signs of herd expansion. Even better is that the expansion is taking place in the Southern Plains states of Texas, Oklahoma, Missouri and Kansas, which were hit hardest by drought in the past five years.

Good said CattleFax price expectations on fed steer prices will still stay around $157 per cwt. Average feeder steer prices are forecast to rise to $220 from the 2014 average of $207.

“Yes, that’s stronger than last year’s average, but we think our absolute high for this cattle cycle is behind us.

“Not that this year’s going to be a disaster. We still think prices are going to be very strong. But we need to recognize we’ve got a trend change in place because of bigger beef supplies in the future, and bigger total meat supplies today, along with exports and currency.”

Blach said producers at the front of the production cycle shouldn’t be gun-shy to expand if some prices taper off in 2015. The need to expand is vital for delivering product that meets demand, while stabilizing feeders and packers.

“A year ago, I said we can handle another 3 million beef cows in our inventory – to 32 million head, not just 29 [million] – and still be highly profitable.

“When I say highly profitable – that’s not at levels we saw in 2014, because we are at those peaks. You need to prepare for calf prices to be much more seasonal in 2015.”

If the industry still averages between $200 and $225 per cwt in calf prices, that’s a strong price point to stay ahead of production costs, which still vary widely across the country.

“Our data would suggest the difference in production costs for cow-calf producers range anywhere from $500 per head to $1,000, depending on the region you’re operating in and your management practices.”

Good said the feedyard industry will continue to face challenges with excess capacity, while the stocker backgrounder has a narrow margin window. Cow-calf producers have a robust window open to more expansion. ![]()

PHOTOS

PHOTO 1: CattleFax analyst Kevin Good speaking at the 2015 NCBA Cattle Industry Convention.

PHOTO 2: CattleFax CEO Randy Blach speaking at the 2015 NCBA Cattle Industry Convention. Photos by David Cooper.