According to the USDA-NASS Livestock Slaughter report released in May 2017, dressed weights for steers and heifers slaughtered under federal inspection declined 25 and 22 pounds, respectively, year-over-year. The decrease in the average carcass weight more than offset the increase in the number of cattle slaughtered and kept production from increasing.

The USDA report on beef production under federal inspection for the week ending May 27 indicates average dressed weights for steers and heifers continue to decline, falling another 9 and 13 pounds, respectively, from the week ending April 29.

Weights are expected to move higher seasonally, but gains will likely be limited while there are incentives to market cattle as rapidly as possible.

Loads sold for delivery in 22 to 60 days averaged above year-earlier levels through mid-April. For meatpackers to meet their commitments as dressed weights decreased, they likely increased slaughter late in the month and into early May.

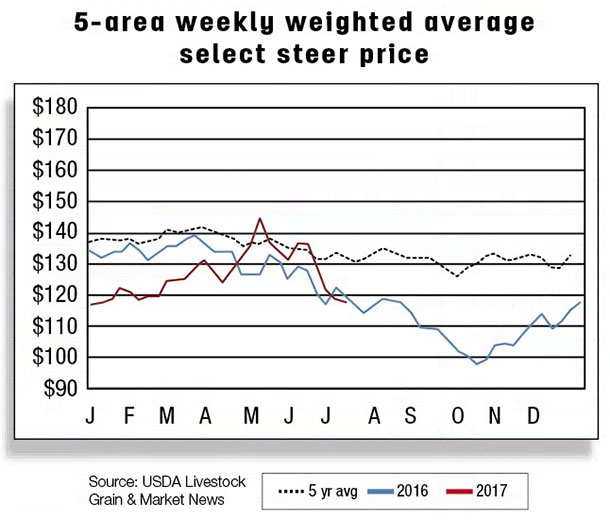

According to the USDA weekly recap of the 5-Area weighted average fed steer price, the price experienced a spike in the first week of May to $144.60 per hundredweight. The demand by meatpackers likely contributed to that price surge. Relative price strength is likely to persist as demand for beef remains strong.

However, as summer demand winds down, packer margins will likely decline, and cattle prices will be pressured. Third-quarter fed prices are expected to decline seasonally, averaging $118 to $124 per hundredweight, up from $113.26 in third-quarter 2016.

Retailer demand for featuring Choice beef at the start of the summer holidays widened the spread between wholesale prices for Choice and Select beef to historic levels at $30.38 per hundredweight in the week ending June 9 (See Figure 1).

However, the spread typically reaches its seasonal peak around mid-June, as indicated in the chart. As demand for grilling-type cuts diminishes and supplies of Choice beef increase seasonally, the spread is expected to decline through late summer.

Third-quarter production is forecast at 6.8 billion pounds, and the USDA revised its 2017 commercial beef production down slightly to 26.2 billion pounds. For 2018, beef production was adjusted upward to 27.1 billion pounds on the expectation more steers and heifers would be available for slaughter next year due to the higher-forecast 2017 calf crop.

Feeder cattle supply outside feedlots tightens

According to the May 2017 USDA-NASS Cattle on Feed report, year-over-year net placements increased by 12 percent to 1.78 million head during April, surpassing marketings that totaled 1.7 million head (See Figure 2).

The large placement number would imply proportionately greater steer and heifer marketings late in the third quarter or early in the fourth. The sharp increase in placements can be attributed to a few factors.

First, producers reacted to the unexpected price increase for feeder calves by marketing their calves. Second, higher-than-normal wheat graze-out likely occurred in the Southern Plains as a result of very low wheat prices.

Then those calves on wheat pastures were likely marketed in April, allowing for wheat producers to plant a summer crop. However, according to the ERS estimate of feeder cattle supplies outside feedlots, on April 1 there was only a 0.42 percent year-over-year increase in the supply of feeder cattle to be placed in feedlots.

Large placements of calves during April would likely have further tightened the number of feeder calves available outside the feedlots.

Returns to feedlot operators improved during 2017 as bids for fed cattle moved higher through much of the year, and feedlots were marketing calves bought at relatively low prices during the second half of 2016. With expectations of moderate feed prices, feedlots have shown a willingness to bid higher for feeder calves.

Although feeder calf prices are expected to decline from their second-quarter peak, they will remain above year-earlier levels into early 2018.

Beef exports up, imports down through April 2017

U.S. beef exports for April 2017 increased by 15 percent to 218 million pounds over the same month a year ago, which was supported by growth in four major destinations: Japan (+18 percent), South Korea (+8 percent), Hong Kong (+7 percent) and Canada (+4 percent).

Increases in exports are likely fueled by higher domestic production and lower beef prices. The U.S. dollar has weakened slightly over the past two months relative to most of its trading partners, making it less expensive to buy U.S. beef. Exports for the first four months of 2017 are also 20 percent higher than the same period last year, totaling 869 million pounds. Japan remained the No. 1 export destination throughout this period.

In April 2017, U.S. beef imports totaled 250 million pounds, down 8 percent from the same month a year ago (See Figure 3). U.S. beef imports from January through April 2017 totaled 950 million pounds, 11 percent lower than the same period last year.

Increased imports from Canada and Mexico were outweighed by the heavier-than-expected decline in imports from Oceania through April 2017. Beef supplies remain tight in Australia as herd rebuilding appears to be continuing. As a result, the second-quarter 2017 import forecast was left unchanged at 775 million pounds.

Cattle imports declined and exports increased through April 2017

First-quarter 2017 cattle imports were 5 percent above the same period a year ago. April 2017 cattle imports were 153,900 head, a 28 percent decline from the same month a year ago. Declines were seen in both Mexico (-20 percent) and Canada (-37 percent).

These were the lowest April numbers since 2005. Lower imports during March and April have contributed to 4.5 percent lower cattle import numbers for the first four months of 2017 compared to the same period a year ago. Cattle imports so far this year have totaled 672,000 head. At the same time, cattle exports increased to 44,000 head for the first four months of 2017, 60 percent more than the same period a year ago. Higher shipments were made to both Canada and Mexico. ![]()

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.

Analyst Lekhnath Chalise contributed to this report.