“Last year I said you just have to try and hold on for another year while grain farmers maximize revenue,” the Chicago-based market analyst said at the eighth annual Feeding Quality Forum.

“Now the picture is reversed. We’re just trying to keep corn farmers in business as livestock producers have their turn.”

Big changes are rocking the agricultural markets. Why?

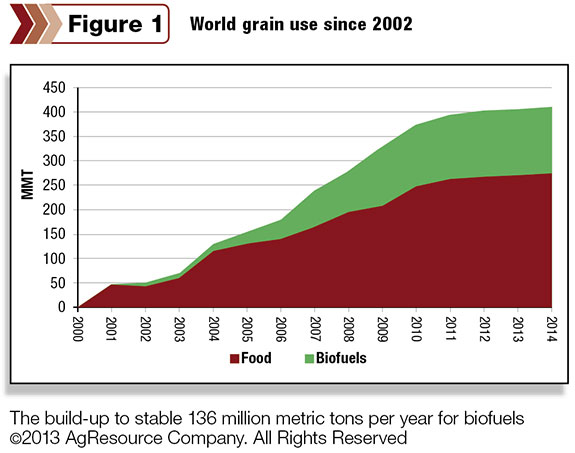

“You have been fighting ethanol for corn these past six or seven years, but the biofuel rush is over, and the aftereffects have reshaped the market,” Basse said. With no plants under construction, ethanol demand will be “flat-lining” into 2022.

An ethanol boom (see Figure 1) that started a decade ago needed five to nine million more acres for corn each year and drove world prices higher, but it kept more and more U.S. corn home while competitors led by Brazil reacted to fill those international orders.

Industrial demand is stable at 4.6 to five million bushels of corn each year in the U.S., but production has adjusted now. Normal weather will only build ending stocks since Brazil, Argentina, the Ukraine and the rest of the world have stepped up to supply global needs, Basse said.

The U.S. share of world corn trade has fallen to a record-low 28 percent compared to 65 percent in 1979. Last year, for the first time, U.S. soybean exports exceeded corn.

Even that stands to fade this year with record increases in South American soybean yields, he said, noting U.S. prices could be less than $10 per bushel early next year and down from there as more South American acres switch away from corn.

“Investor money has been leaving the grain market and going into stocks on Wall Street,” Basse added. “There’s no export story in grains; there’s no biofuels story; there’s no consumption story.”

Showing a corn price chart dating to 1866, he said the fall from last year’s peak could reach $4 per bushel this fall and should range from $3.25 to $6 for the next 10 years.

“I can’t really tell you how important that is for you in the feeding business to have ending stocks of corn built up,” the economist said. “The new stocks-to-use ratio means a short crop in the future won’t bring worries about $8 corn – that tremendously reduces your risk.”

One cure for falling prices is to take land out of production, but without political intervention, U.S. farmers react to lower prices by planting more as long as they can, Basse noted.

China won’t buy much of the cheaper corn because it must keep its own 570 million farmers on course to produce, and they will ramp up to export more.

Don’t expect to see a farm bill passed this year but even without such structure, Basse said, “We may see three to five million acres go back into pasture in this country,” as farmland prices undergo a 5 to 35 percent downward price correction.

“When it costs $5 to grow corn, and the market is offering you $4, that brings up a new kind of farm crisis like back in the mid-1980s,” he said. “This won’t be about interest rates but rather the cost of operation versus price.”

The livestock producer advantage – “the outlook for cattle is pretty damn robust” – will come with greater volatility starting this fall, Basse said.

Record low beef production in the U.S. and the lowest year-end beef stocks in 10 years should push cash fed-cattle to a range of $134 to $138 per hundredweight for the 2013 fourth quarter, he said. “Under the right circumstances, $140 cattle do not seem unreasonable,” he added.

Feeding cattle should be profitable in 2014, “but it’s not as good as it should be, because feeder cattle prices are likely to be at record highs in the initial part of an expansionary phase,” Basse said.

Still, the outlook is solid enough that “feedlots are an investment option again,” he said, citing one more reason for optimism.

Over the next five or six years, the U.S. will make dramatic strides in oil and gas production, along with Canada, both exporting crude oil to Mexican refineries.

“We will move from the largest net importer of energy to the world’s leading exporter by 2018 to 2020, and oil prices will fall to $65 or $70 per barrel,” Basse said. “That will put more discretionary income in consumer pockets, and they will buy more beef.”

How fast will bankers open their doors for cattle expansion?

Interest rates are starting to rise, but Basse does not see interest or inflation making much of a move in the near term because too much money is just sitting in banks for lack of confidence in the economy and the government.

“This is a very, very important tipping point for U.S. livestock,” he said. “I imagine bankers will be on your side in the next year or two, but it takes a few years for everybody to get on board.” ![]()

—From Certified Angus Beef press release

PHOTO

Dan Basse of AgResource Company