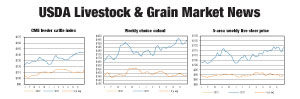

Finally, after 23 straight months of year-over-year increases, the USDA cattle-on-feed report showed that the monthly on-feed inventory was less than the previous year.

Plus, feedlot placements finally posted the disparaging percentage that cattlemen have been looking for in relation to the huge numbers of cattle that were put on feed during last year’s Southern Plains drought.

In fact, head counts of feeder cattle checking into confinement feeding facilities were nearly 15 percent less than the same time a year ago, which made placements total 500,000 head less than 2011 so far for the year.

This data should have been the proof cow/calf producers and backgrounders have been looking for in order to return feeder markets to record-breaking form and leave this spring’s media fears in the dust.

When the CME Feeder Cattle contract moved from the May to the August spot month, it left about a $6 gap between the cash index and the nearest available futures quote.

However, seasonally light sales volume and good demand for yearling feeders is allowing the index to catch up quickly, especially on Fridays when the direct sales information is entered.

Current direct sales of country feeder cattle were about the only element of the commercial cattle arena that immediately reacted appropriately to the bullish on-feed report. Futures markets and out-front contracts of cash feeders were sluggish, which was frustrating to cattle feeders – long waiting for light numbers to show up on a cattle-on-feed report.

Data from May’s feedlot inventory also suggested slightly heavier supplies of market-ready fed cattle through the first part of the summer.

Carcass weights so far this year have been especially heavy, which has partially made up for tighter numbers and a smaller harvest.

Outstanding performance and the increased use of finishing feed additives have improved late-term feed efficiency and dressing percentages to add an extra 15 to 18 pounds per carcass. Beef production is down 3 percent for 2012 but would be down well over 5 percent if carcass weights had not increased.

Pasture gains are also likely to be impressive this year as slightly dry conditions in the major grazing regions have the roughage sticking to cattle’s ribs and not washing through as it does when the grass is too wet.

Dry conditions in the southern half of the Corn Belt are taking their toll and if rainfall measurements do not increase, this year’s production will fall well short of lofty expectations.

Forecasters are looking for this year’s corn crop to be unprecedented in size and fully 20 percent larger than 2011. Besides plowing up pastures and fencerows, many farmers decided to go corn-to-corn in their favorite fields rather than alternating crops.

Weather patterns, wheat harvest and hay production through the central portions of the U.S. have run at least a month ahead of schedule in 2012. Now, early summer is feeling more like late July and Midwestern producers are worried what August will feel like.

The cattle industry needs a bumper corn crop to ease feed costs and many cattle feeders have already gambled on the expectations by purchasing feeders well beyond their hedging protection. Timely rains and high nighttime humidity are badly needed in the Corn Belt, and Western ranchers need it to happen soon.

Huge mid-summer video sales are fast approaching, which will appraise fall calves and late-summer yearlings.

Most cattle sellers have dollar signs in their eyes and hopes of once again achieving record prices. Price levels may be slightly below February’s highs, but ranchers would be well advised to accept the market, rather than passing out their consignments or putting them off until a later date, which rarely works. ![]()

Corbitt Wall is the Missouri federal-state supervisor at the USDA-Missouri Livestock and Grain Market News Service.