The USDA’s monthly Crop Production report does not traditionally include updates on hay or forages in September, so we must look back to the August summary to capture dry hay acreage, yield and production estimates. According to that survey-based report, 2021 U.S. production of alfalfa and alfalfa-mixture dry hay for 2021 was forecast at 47.8 million tons, down 10% from 2020. The lower production is the result of lower average yields (2.97 tons per acre, down 0.3 ton from last year) and smaller harvested area (16.1 million acres, unchanged from June’s Acreage report but down 1% from 2020).

Production of other hay in 2021 was forecast at 70.9 million tons, down 4% from 2020. Average yields (2 tons per acre, down 0.05 ton from last year) and smaller harvested area (35.4 million acres, down 2% from 2020) contribute to the decline.

The USDA is next scheduled to update 2021 hay estimates on Oct. 12.

If you are interested in the late summer dry hay production outlook in your state or region, you can find the August USDA Crop Production report here.

Dry conditions continue

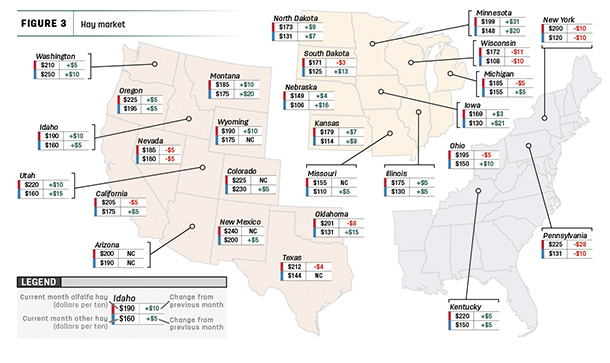

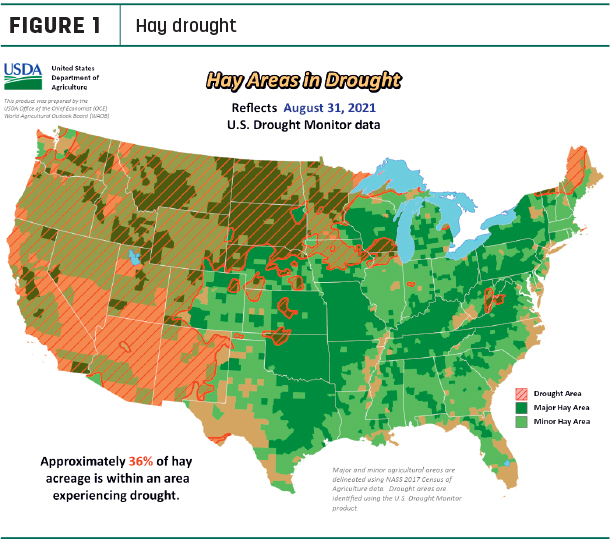

Undoubtedly, the drought is impacting hay production estimates, and moisture conditions have changed little in major forage areas, based on U.S. Drought Monitor maps. As of Aug. 31, about 36% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, unchanged from a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) improved just 1% over the past month to 63%. Rainfall in regions of Minnesota and Wisconsin were offset by expanded drought areas in Oklahoma, Kansas and Nebraska.

Prices continue to rise

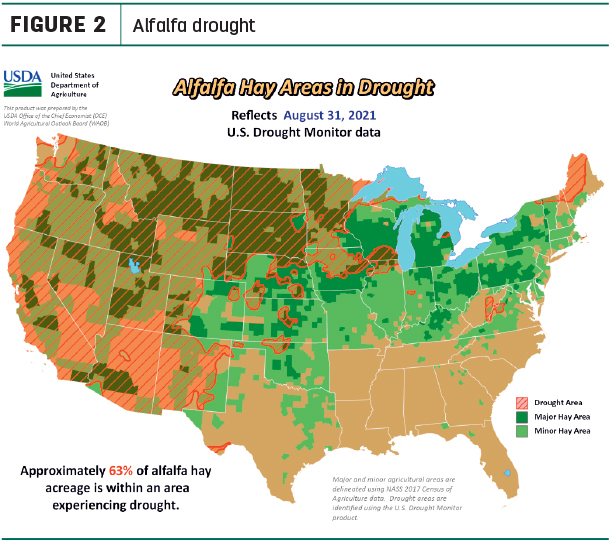

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

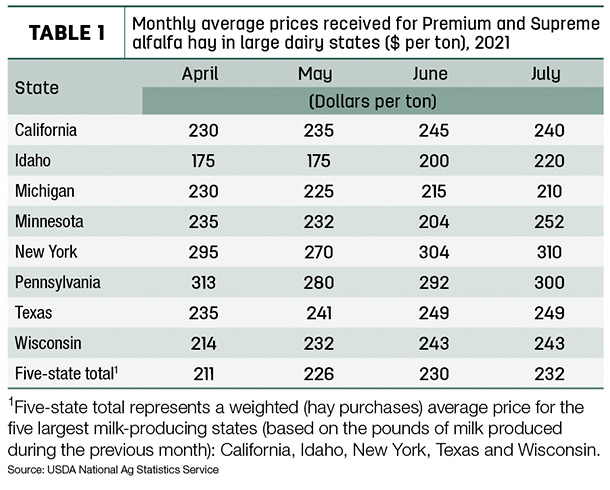

The average price for Premium and Supreme alfalfa hay in the top milk-producing states rose another $2 to $232 per ton in July (Table 1), the highest average recorded since the USDA began compiling dairy-quality hay prices in 2019. Compared to June, average prices were steady in Texas and Wisconsin and slightly lower in California and Michigan, but jumped substantially in Minnesota.

Alfalfa

The national average price for all alfalfa hay rose for an eighth consecutive month, up $2 per ton from June to $201 per ton. It’s the highest average since May 2019. Monthly average alfalfa hay prices increased in 13 of 27 major forage states, with largest increases again primarily in the Northern tier of states stretching from Minnesota to Washington; South Dakota was the lone exception, posting a small decline.

Other hay

The U.S. average price for other hay jumped in July, up $11 to $151 per ton. It’s also the highest since May 2019. Average prices moved higher in 20 of 27 major hay-producing states. Largest increases were in Iowa, Minnesota and Montana, up $20 per ton or more compared to a month earlier. Prices in New York, Pennsylvania and Wisconsin were down $10.

Hay, alfalfa product exports lower

Exports of dry hay and alfalfa cubes and meal were mostly lower in July, and in some cases, the lowest volumes of the year.

July 2021 alfalfa hay exports totaled 215,308 metric tons (MT), a five-month low. Shipments to China totaled 127,115 MT and represented about 59% of total alfalfa exports in July. Sales to Japan were down about 11,000 MT from June at 36,667 MT. Nonetheless, January-July 2021 alfalfa hay exports stand at almost 1.6 million MT, the third-highest total on record for the first seven months of the year.

At 89,005 MT, July exports of other hay were the lowest for any month dating back to at least 2005. July shipments to Japan fell to 49,352 MT, the lowest monthly total dating back to at least 2013. Sales to South Korea, at 19,129 MT, were the lowest since January.

Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, expects the marketing yo-yo to continue. Shipping delays, port closures and labor shortages are complicating export schedules.

Analysis from the U.S. Dairy Export Council provides some context in the Southwest. July total outbound shipments through the major California ports of Los Angeles, Long Beach and Oakland were lower than any point in the past year, and the quantity of full containers shipped out of those ports was the lowest in over a decade. Container companies opted to transport empty containers back to Asia to shorten turnaround times rather than pick up U.S. agricultural products – unless exporters were willing to pay extravagant prices and extra fees, as well as deal with short and rapidly moving return windows to get U.S. dairy products on a ship. An estimated 70% of shipping containers were empty in July, an all-time record.

There is concern about hay supplies available next spring, Mastin said, especially as domestic demand grows and drought, fires and storm damage cut into supplies.

Regional markets

Here’s a snapshot of local markets during the first week of September:

- Southwest: In Texas, trading activity and demand remained slow due to pasture improvements from recent rainfalls. Hay prices are mostly steady.

In Oklahoma, hay trade remained slow in most areas. Grinding-quality hay trade had slowed down with the influx of silage.

In New Mexico, alfalfa prices were steady to $20 lower. Some hay is being stored for the winter. A substantial supply of low-quality hay was reported at discount.

In California, demand remained good for all alfalfa. Retail hay trade was moderate on firm prices. Dry and windy conditions led to further expansion and intensification of the Dixie and Caldor fires in northern California.

- Northwest: In Montana, spotty rain greened up some locations over the past couple of weeks, but hay market activity picked up. Hay continued to move as ranchers were trying to secure enough hay to make it to spring. Some ranchers were opting to sell some of their cows instead of buying hay.

In Idaho, trade remained moderate as remaining unsold supplies were held in firm hands. Cattle producers were running out of feed with fall and winter approaching and the growing season coming to an end. Northern Idaho/eastern Oregon growers reported hay yields that were half of normal.

In Colorado, trade activity was moderate on good demand. Prices were steady on all classes of hay. Growers across the state were expecting sales to increase after Labor Day and were holding out for higher prices.

In the Columbia Basin, all grades of retail hay sold higher with demand exceeding supply. Domestic alfalfa sold steady. The wait time averaged more than seven days for container ships for exports.

In Wyoming, demand was good for any type of baled forage products. Calls continued to come from out-of-state buyers looking for large and small square bales. Producers should get one more cutting before putting away haying equipment, although fourth cutting could be short in the eastern part of the state.

-

East: In Pennsylvania, overall demand was light to moderate on light supplies available for auction. Forage growers were moving toward their final cuttings.

- Midwest: In Nebraska, demand slowed as harvest of silage and a little high-moisture corn was starting to come to feedlots, taking pressure off the hay market. Out-of-state buyers continued to call trying to procure hay. Harvest of “off” forages will help with the shortage of available roughages.

In Kansas, prices were steady for alfalfa and grass hay. Trade had slowed with an indication that hay was being replaced in cattle rations by chopped triticale and corn silage. Alfalfa growers were being advised to scout and treat for grasshoppers in fall seedings.

In South Dakota, the severe drought conditions have greatly reduced grazing and supplies of forage. Cow-calf operators were beginning to wean their calves and ship them to market as they try to stretch feed supplies to keep cow herds intact. Corn chopping was in full swing, especially in the northern part of the state where a large number of acres were producing very little grain and are being chopped and sold to neighbors with cattle operations.

In Iowa, alfalfa and grass hay sold lower and uneven.

In the Great Lakes region, fall armyworms showed up in numbers not seen for 30 years and were feeding primarily on forages. Producers trying to salvage fields were being urged to harvest as quickly as possible, as the larvae will continue to feed on the cut foliage in the windrows until it dries out.

Other things we’re seeing

-

Dairy: Higher alfalfa hay prices continued to contribute to higher feed costs, pressuring monthly average U.S. dairy farmer income margins over feed costs to the lowest level ($5.68 per hundredweight [cwt]) since May 2020. The USDA is taking note and will adjust hay cost calculations under the Dairy Margin Coverage (DMC) program, with more emphasis on average prices for dairy-quality alfalfa. The tight margins are having an impact: Cow numbers declined for a second consecutive month in July, and year-to-year growth in milk output per cow helped slow overall milk production growth.

-

Beef: U.S. beef production was expected to decline due to lighter than expected carcass weights as a higher proportion of non-fed cattle are slaughtered through the end of the year, pressured by higher feed costs.

-

Fuel: The U.S. Energy Information Administration noted U.S. retail gasoline prices declined during the second half of August but remained about 92 cents per gallon higher than a year earlier. U.S. average diesel prices ended August mostly steady but were about 90 cents per gallon higher than a year earlier.

-

Trucking: After decreasing for the prior seven weeks, flatbed spot rates increased slightly to end August and remained well above year-earlier levels. Approval of a federal infrastructure bill could spur demand for trucks and drivers.

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke