When you hear the words “We’re from the government, and we’re here to help,” it may not seem very comforting. However, at the USDA Farm Service Agency (FSA), there are truly programs to help cattle producers, but it is important to remain informed of what is available for you and your particular operation. Each county is represented by an FSA office, even if there is not an office physically located in that county. For questions or to sign up, contact the FSA office where your property is located. If you have land in multiple counties, you may need to contact each county.

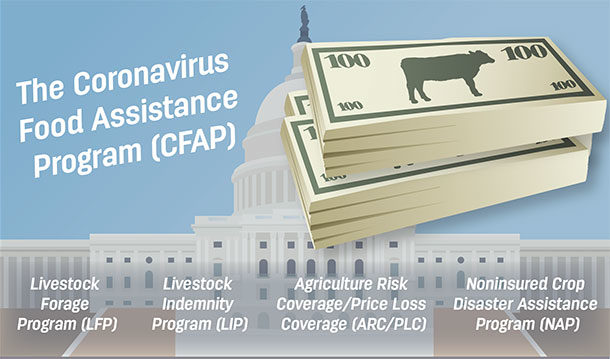

FSA programs can be sorted into those made available explicitly through the farm bill and others that are put in place in response to certain situations. Some notable programs created in the farm bill available for cattle producers include the Agriculture Risk Coverage/Price Loss Coverage (ARC/PLC), Livestock Forage Program (LFP), Livestock Indemnity Program (LIP) and Noninsured Crop Disaster Assistance Program (NAP). Each of these programs has certain requirements for eligibility. ARC/PLC and NAP are available for sign-up each year, while LFP and LIP only hold sign-ups due to certain triggering events. For example, LFP is triggered by drought, and LIP is triggered by eligible livestock deaths due to some natural disaster.

As we saw in 2020, FSA may have certain “ad hoc” programs available to producers in response to unusual conditions. The Coronavirus Food Assistance Program (CFAP) was an “ad hoc” program that was implemented because of market issues caused by the COVID-19 pandemic. These types of programs require the producer to stay connected to their local FSA office so they are aware and can sign up. FSA provides newsletters by email and also can alert producers by text message in these situations. It is up to the individual producer to sign up for these notifications.

In addition to program sign-ups, it is also important to inform the FSA office if you have sold or picked up new land whether by lease or purchase, or if you have changed the management or operation of your business in any way. For example, if you previously operated as a general partnership with your brother but this year created a limited liability company that operates or owns your farms, the FSA will need to update their farm records accordingly. The FSA will ask that you provide documentation, such as your federal tax identification number and other business documentation, depending on the type of entity you have. If you have purchased or leased new land, the FSA will need a copy of the deed or lease agreement to make sure those acres are counted on your roster.

Similarly, the FSA must update its records upon the passing of a producer. In this event, someone, usually the executor of the will or an heir, will provide a death certificate, any documents from the court that indicate who may do business on behalf of the deceased and/or other documents, such as a trust agreement, indicating who will inherit the property. Eventually, the FSA will need copies of deeds in this situation as well. It is also important to provide names and contact information for the new owners, particularly if these owners have never participated in FSA programs previously.

The bottom line is: FSA programs really are designed to help producers. However, as stated previously, it is up to the producer to stay informed by speaking with their local office and taking advantage of email and text notifications to remain in the know about all available programs.