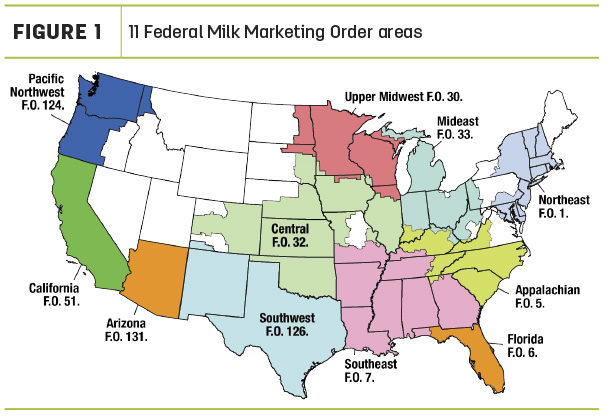

Federal Milk Marketing Order (FMMO) April 2022 uniform milk prices were up as more high-valued Class IV milk started coming back to the pools. Prices paid to producers are at record highs but are likely nearing their peaks. Administrators of the 11 FMMOs (see Figure 1) reported April 2022 uniform milk prices, producer price differentials (PPDs) and milk pooling data, May 10-13. Here’s Progressive Dairy’s monthly review of the numbers to shed some additional transparency on your milk check.

Class, uniform prices higher

Supported by higher prices for all classes of milk, FMMO statistically uniform milk prices were up in April and close to September 2014 record highs:

- At $24.38 per hundredweight (cwt), the April advanced Class I base price was up $1.50 from March 2022 and $8.87 more than April 2021. It’s just 9 cents below the record high of $24.47 per cwt in May 2014.

Adding zone differentials for each order's principle pricing point, April 2022 Class I prices averaged $27.20 per cwt, with a high of $29.78 per cwt in the Florida FMMO #6 to a low of $26.18 per cwt in the Upper Midwest FMMO #30.

Based on Progressive Dairy calculations, the Class I mover calculated under the “higher-of” formula would have resulted in a Class I base price of $24.89 per cwt, 51 cents more than the price determined using the “average-of plus 74 cents” formula. The effect within individual FMMOs depends on Class I utilization, with the largest impact on Appalachian, Florida and Southeast orders.

- At $25.71 per cwt, April’s Class II milk price surpassed both Class III and Class IV prices, up 95 cents from March and $10.15 more than April 2021.

- The April 2022 Class III milk price rose $1.97 from March to $24.42 per cwt, the highest since September 2014. The Class III price is up $6.75 from April 2021.

- At $25.31 per cwt, the April 2022 Class IV milk price hit a new record high, up 49 cents from March and $9.89 more than April 2021.

Component values, tests

April Class III-IV milk prices again moved higher due to increases in values of butterfat, protein and nonfat solids used in monthly milk price calculations.

The value of butterfat rose more than 5 cents from March to almost $3.15 per pound. The value of milk protein jumped more than 70 cents to $3.42 per pound. The value of nonfat solids rose more than 3.5 cents to $1.65 per pound. The value of other solids decreased about 5.5 cents to 55.7 cents per pound.

Offsetting the higher values, average butterfat, protein and nonfat solids tests in pooled milk were down slightly from March in a handful of FMMOs providing preliminary data.

Uniform prices near 2014 records

With higher individual milk class prices, April blend or uniform prices at standardized test were the highest in nearly eight years (Table 1), increasing in a range of 86 cents to $1.89 per cwt across all 11 FMMOs compared to March.

The high uniform price for April was $29.13 per cwt in the Florida FMMO #6; the low was $24.55 per cwt in the Upper Midwest FMMO #30. Florida FMMO uniform prices have only topped $29 per cwt twice before, in May and September 2014, with a record high of $29.29 per cwt in September of that year.

April baseline PPDs were positive but slightly lower than March, down in a range of 8-67 cents (Table 1). As we remind you each month, PPDs have zone differentials within each FMMO. Also, whether positive or negative, individual milk handlers apply PPDs and other deductions to milk checks differently.

Impact on pooling

The April Class III-IV price spread slipped to just 89 cents per cwt, a five-month low and cutting into incentives for Class IV depooling.

In some individual orders, that brought a lot more Class IV milk back to the pool. In the California FMMO #51, more than 208.8 million pounds of Class IV milk came to the April pool, far more than January-March combined. In the Mideast FMMO #33, 141.2 million pounds of Class IV milk was pooled, up more than 100 million pounds from March. While on a smaller scale, April Class IV pooling was up 40 million pounds compared to March in the Southwest FMMO #126.

You can get a general picture of FMMO pooling-depooling in a couple of ways: on a volume basis, comparing monthly pooling totals to previous months; and on a percentage basis, comparing the percent utilization of a specific class of milk relative to all milk pooled that month.

Looking at April data, about 12.8 billion pounds of milk were pooled on all federal orders, down about 290 million pounds from March (there was one less day of milk production and marketing in April).

Class IV milk pooled across all FMMOs increased to about 1.406 billion pounds (Table 2) in April, representing about 11% of total FMMO milk marketings, up 3% from March and the largest volume since November 2021. It’s still less than half the average Class IV milk pooled monthly in 2021.

At 6.683 billion pounds, April Class III pooling fell about 500 million pounds from March. As a percentage of utilization, Class III milk represented about 52.1% of the total FMMO pool, on par with recent months.

Read also: Erick Metzger, general manager of National All-Jersey Inc., analyzed Class IV depooling and its impact on FMMO revenues from November 2021 through March 2022. Read: Depooling is back: Now it’s Class IV.

Looking ahead

The outlook for prices is strong but mixed for May milk marketings. The advanced Class I base price is up, but a slightly lower Class IV price is likely to offset a price gain in Class III.

Already announced, the May 2022 advanced Class I base price is a record-high $25.45 per cwt, up $1.07 from April 2022 and $8.35 more than May 2021. It’s 98 cents higher than the previous high of $24.47 per cwt in May 2014.

With Class I zone differentials added to the base price of each FMMO principle pricing point, the actual Class I price will average approximately $28.27 per cwt across all FMMOs, ranging from a high of $30.85 per cwt in the Florida FMMO #6 to a low of $27.25 per cwt in the Upper Midwest FMMO #30.

In May, the newer Class I mover average-of plus 74 cents formula will help boost Class I prices paid to producers compared to the previous higher-of formula. Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $24.28 per cwt, 17 cents less than the price determined using the average-of plus 74 cents formula.

May Class II, III and IV milk prices won’t be announced until June 2. At the close of Chicago Mercantile Exchange (CME) trading on May 12, the May Class III futures price was $24.95 per cwt, up 53 cents from April. The May Class IV futures price settled at $24.80 per cwt, down 51 cents per cwt. If those prices hold, it would mark the first month the Class III price moved above the Class IV price since last October. And the Class III-IV price spread would shrink to just 15 cents per cwt, eliminating most depooling incentives.

Longer term as of May 12, Class III futures prices averaged $22.94 per cwt for all of 2022, with Class IV futures averaging $23.86 per cwt.

Read also: Economic outlook: Higher 2022 milk production forecast has small impact on projected prices.