Whether those factors tap the brakes on momentum for FMMO and dairy policy reforms remains to be seen. Here’s Progressive Dairy’s monthly attempt to digest FMMO numbers and their impact on your milk check.

Uniform prices and PPDs

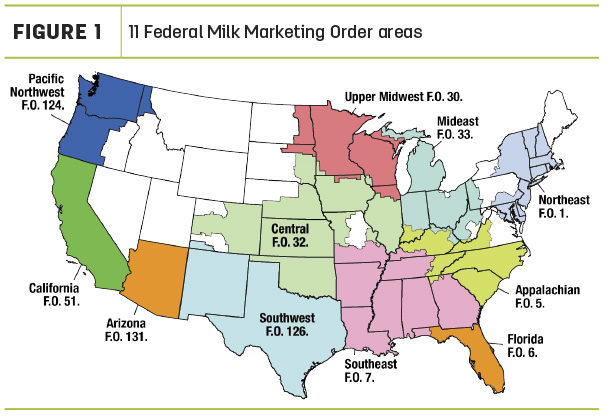

FMMO administrators reported August 2021 uniform milk prices, PPDs and milk pooling data on Sept. 10-13. As they were in June and July, August baseline PPDs in all applicable FMMOs were positive for a third straight month, while uniform or “blend” prices at standardized test declined in all 11 FMMOs, in many cases to the lowest point since April or May.

With August prices declining for all FMMO classes of milk, statistical uniform prices were down 19-87 cents per hundredweight (cwt) across all FMMOs compared to a month earlier. The high was $21.11 per cwt in Florida FMMO #6; lows of under $17 per cwt remained in five FMMOs (Table 1).

August 2021 marked the third consecutive month that baseline PPDs were positive in all FMMOs utilizing multiple component pricing, moving 2-24 cents higher from July. As we note every month, PPDs have zone differentials and vary slightly within each FMMO. Also, whether positive or negative, PPDs’ impacts on producer milk checks are based on deductions by their individual milk handlers.

Protein, butterfat values slide lower

August Class III-IV milk prices moved lower due to declines in cheese and butter prices, which drove lower values of both protein and butterfat used in monthly FMMO milk price calculations.

At about $2.46 per pound, the value of milk protein in August FMMO milk price calculations fell about 3.75 cents from July and was down $1.98 from August 2020 and is the lowest since May 2020. The value of butterfat posted a 4.9-cent decline in August to about $1.85 per pound. That’s the lowest since March 2021 but still about 22 cents more than August 2020.

At $15.95 per cwt, the August 2021 Class III price is down 54 cents from July 2021 and $3.82 less than August 2020, when USDA food box purchases helped boost cheese prices. The August 2021 Class IV price slipped lower for a second consecutive month, down 8 cents from July to $15.92 per cwt.

Class III flow continues to grow

The August Class III-Class IV price spread fell to just 3 cents per cwt. The narrower spread, combined with an August 2021 Class I base price ($16.90 per cwt) that was higher than the Class III price, reduced depooling incentives for Class III handlers, feeding the larger stream of Class III milk flowing back into FMMO pools.

By volume, total Class III milk pooled across all FMMOs in August 2021 was about 4.98 billion pounds, the most since August 2019 and moving above the 4.33-billion-pound average for January-May 2020, prior to the pandemic-related milk marketing disruptions and cheese-heavy food box purchases. By comparison, Class III pooling across all FMMOs still lags the average of 6.6 billion pounds per month during January-August 2019.

On a volume basis, Class III utilization was down slightly in the Northeast FMMO #1, Central FMMO #32 and Pacific Northwest FMMO #124.

On a percentage basis (Table 2), Class III utilization was about 38.5% of all FMMO milk marketings in August 2021, up from 33% in July and the 14.8% average during June 2020-May 2021. Class III utilization is now close to the pre-pandemic utilization rate of 41% for all of 2019.

Compared to July, August 2021 Class III utilization was lower on a percentage basis in two FMMOs: the Pacific Northwest FMMO #124 and Appalachian FMMO #5.

Most noteworthy was the jump in August 2021 Class III utilization on the California FMMO. After averaging less than 3% in 2020 and 2% through the first seven months of 2021, California FMMO Class III utilization was 32% in August. By volume, about 814.1 million pounds of milk was utilized in Class III products in August on the California FMMO, more than the total for all of 2020 and the most for any month dating back to June 2019. That was accomplished, in part, due to California FMMO’s “repooling” standards for milk handlers.

What’s ahead?

Looking down the road, factors affecting the three hot button topics – depooling, negative PPDs and the Class I mover – have been temporarily squelched, largely by FMMO milk class prices coming back in alignment.

Markets change but based on closing futures prices on the Chicago Mercantile Exchange (CME) as of Sept. 13, the third quarter 2021 average spread between Class III and Class IV milk prices will fall to just 24 cents per cwt. After a small increase to 43 cents in the fourth quarter of the year, the spread averages a mere 26 cents for all of 2022, diminishing any Class III depooling incentives. The last time the annual average Class III-Class IV price spread was that narrow was in 2018 at 39 cents per cwt.

Near term, the September 2021 advanced Class I base price is $16.59 per cwt, down 31 cents from August 2021 and $1.85 less than September 2020. That decline will be somewhat offset by strengthening Class III-IV milk prices. Actual September Class III and Class IV milk prices won’t be announced until Sept. 29, covering component prices for Sept. 4, 11, 18 and 25. As of the close of CME trading on Sept. 13, Class III and Class IV milk futures prices closed at $16.59 and $16.40 per cwt, respectively.

The closer Class III-IV price relationship likely ensures that monthly Class I prices should maintain the highest position when using the “average of plus 74 cents” Class I mover pricing formula compared to the previous “higher of” formula.

Policy discussions

All of that provides a backdrop for ongoing federal dairy policy and potential FMMO reform discussions. A U.S. Senate Ag Committee subcommittee with oversight on dairy pricing and policy was scheduled to hold a hearing Sept. 15.

And despite the USDA creation of the $350 million Pandemic Market Volatility Assistance Program (PMVAP), designed to reimburse dairy producers for financial losses due to the change in the Class I mover price formula, Jim Mulhern, president and CEO of the National Milk Producers Federation (NMPF), said his organization would continue to explore potential long-term policy solutions.

At Progressive Dairy’s deadline, no formal FMMO hearing has been requested or scheduled several months after the NMPF board approved moving forward on a hearing request. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke